In the retirement income game, nothing says flexibility quite like a Roth Individual Retirement Account (IRA). Consider the following: Assets in a Roth IRA accumulate tax-free. You pay no taxes on qualified distributions. You'll never have to take required minimum distributions (RMDs) from a Roth IRA, unlike with traditional IRAs and 401(k) accounts. And Roth assets can pass tax-free to heirs.

That's why some investors nearing retirement—and even those in it—choose to convert some of the savings in their tax-deferred traditional IRAs and 401(k) accounts into Roth assets. (Plus, having money diversified by tax treatment across tax-deferred, tax-free, and regular taxable brokerage accounts can actually help lower your tax liability over time.)

One challenge is that taxes are due on any sums you convert—but that's less an argument against conversions and more of one in favor of careful planning. In fact, planning to make a series of conversions could help lower the total amount of taxes you pay over time. And conversions can be especially appealing in a down market, as converting assets at depressed prices could lower the resulting taxes.

Who should consider a Roth conversion?

Roth conversions generally make the most sense for people who expect to be in a higher tax bracket when they start taking withdrawals than they are at the time they convert the assets. In other words, it's better to pay a lower tax rate on a conversion today than a higher rate on a withdrawal tomorrow. It's also worth noting that tax rates are at historically low levels compared to rates over the past few decades, so conversions can also make sense if you think rates will be higher in the future.

People with large sums saved in tax-deferred accounts who expect to get hit with large RMDs later in life could also consider converting.

Finally, the longer your time horizon before you expect to make withdrawals from the Roth account, the greater the potential tax advantage. At a minimum, you shouldn't need to touch those assets for at least five years—the length of time the IRS generally requires assets to be held in a Roth before tax- and penalty-free distributions can be made after age 59 1/2—but it's best to have an even longer time frame so you can benefit more from tax-free growth.1

What are the tradeoffs?

- Taxes are due in the year of conversion. You'll need to weigh the opportunity cost of using funds now to pay taxes on a Roth conversion versus paying taxes later. (For that matter, it's also a good idea to have funds available in a bank or brokerage account to pay the taxes on the conversion.) A Roth conversion could also impact the potential tax deductions and credits available to you, since you'll be counting the converted amount as income. In addition, a conversion can increase taxes on Social Security benefits and how much you pay for Medicare premiums. So, it's important to meet with a tax professional to ensure that a conversion won't hurt you unexpectedly.

- You can't undo a Roth conversion. Prior to passage of the Tax Cuts and Jobs Act (TCJA) in 2017, investors could reverse—or recharacterize—a Roth conversion. The TCJA put an end to that. Once the transaction is complete, you can't reverse it.

- You can't cherry pick the after-tax contributions for conversion. If you have both pre- and after-tax contributions in your account, you can't choose to convert just the after-tax portion to avoid taxes. The IRS' pro rata rules will treat the conversion as a mix of pre- and after-tax assets, according to their proportion in your account. So, if 5% of your account is in after-tax dollars, 5% of your conversion will be tax-free.

Lump conversion or installments?

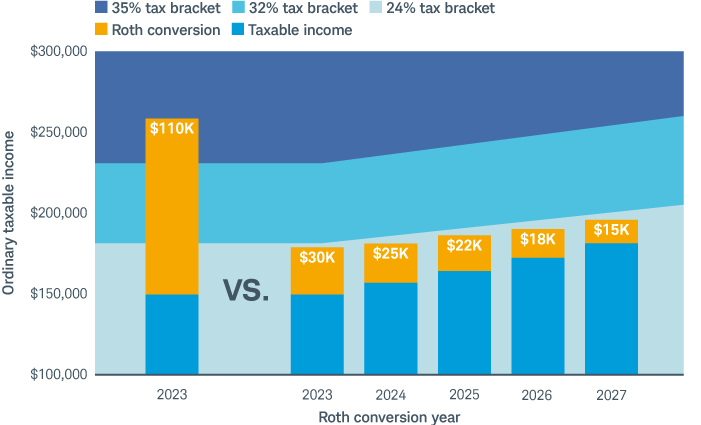

As noted, a Roth conversion will increase your taxable income, so think carefully about how much you convert in any single year. One approach, called tax bracket management, involves planning out how much income you recognize each year—for example, from asset sales and Roth conversions, as well as taxable income-reducing moves like tax-loss harvesting and charitable giving—to help ensure you stay in the lowest-possible tax bracket.

As you might imagine, converting a huge chunk of assets in one year could push into a higher bracket and expose you to higher taxes overall than if you'd converted in smaller batches over several years. The chart below illustrates the concept. In this hypothetical case, we see that doing a single Roth conversion of $110,000 in 2023 pushes an investor into the 35% tax bracket, meaning every extra dollar of income will be taxed at that rate. But converting that same amount over 5 years could keep the investor in the 24% tax bracket.

Source: Schwab Center for Financial Research.

The example is hypothetical and shown for illustrative purposes only. Tax brackets are representative of 2023 ordinary income tax brackets with future years assuming tax-bracket growth of 2.5% and wage growth of 5%.

Conversions in action

To delve into the specifics, let's look at an example of how someone focused on tax bracket management could execute multiple conversions and save on taxes.

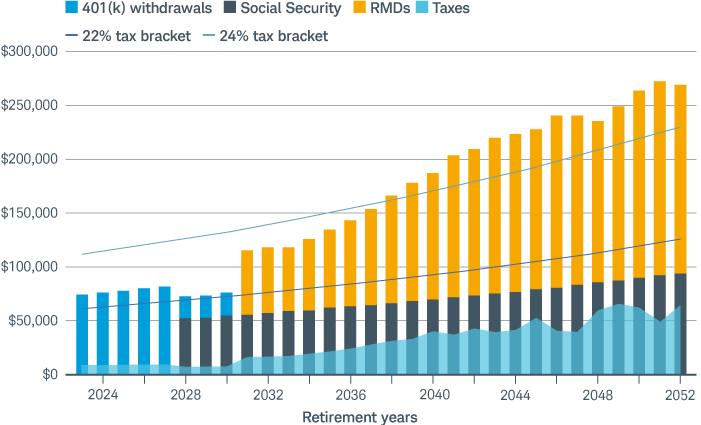

Emmeline is a 65-year-old single investor who just retired. To maximize her Social Security benefits, Emmeline wants to delay filing until age 70. She has $1.6 million of retirement assets in a tax-deferred 401(k), but she would like more flexibility in retirement by having some assets in a Roth account. Before any Roth conversion, a comprehensive financial plan projected that her withdrawals would look like the illustration below.

Retirement cashflows without a Roth conversion

Source: Schwab Center for Financial Research.

This example is hypothetical and provided for illustrative purposes only. Assumes a single, 65-year-old investor with a planned 30-year retirement. Retirement expenses assumed to be $66,000 inflated at 2.5% and an initial $1.6 million 401(k) portfolio with no other assets, allocated to a 60% equities/40% bonds and assumed portfolio return of 5.34%. Individual situations will vary.

For the next 8 years, Emmeline's planned withdrawals from her 401(k)—which would be used typically to support her retirement spending—will place her within the 22% tax bracket. But with the combined income of Social Security and the RMDs she must take at age 73, she will be required to withdraw more than she needs from her 401(k) account which will push her into a higher, 24% tax bracket in future years.

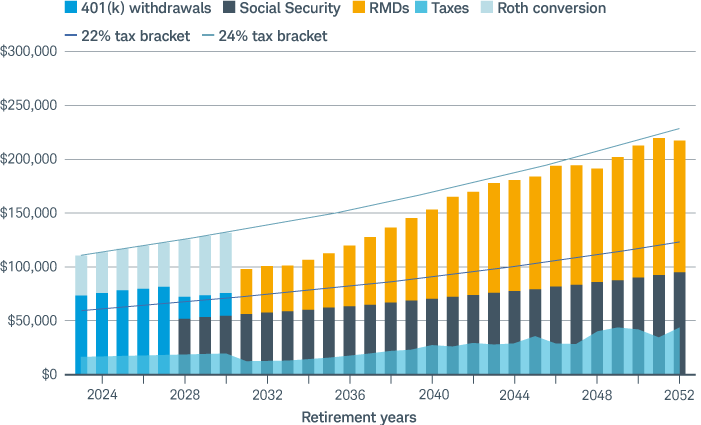

To avoid this, Emmeline could calculate how much she needs to support her spending each year and then convert just enough 401(k) assets to keep her in the lower tax bracket until RMDs kick in at age 73. As a result, she'd gain all the previously mentioned benefits that Roth accounts offer, lower her future RMDs, and potentially stay out of the 24% tax bracket all together, saving her more than $73,358 in tax liabilities in retirement.

Retirement cashflows with multiple Roth conversions

Source: Schwab Center for Financial Research.

This example is hypothetical and provided for illustrative purposes only. Assumes a single, 65-year-old investor with a planned 30-year retirement. Retirement expenses assumed to be $66,000 inflated at 2.5% and an initial $1.6 million 401(k) portfolio with no other assets, allocated to a 60% equities/40% bonds and assumed portfolio return of 5.34%. Individual situations will vary.

Get help if you need it

Everyone's situation is different, and this sort of planning can be difficult without help from a professional. That's why it makes sense to work with a tax advisor who can help project your taxable income, your tax bracket, and the potential impact on your tax bill before committing to any major changes to your retirement savings.

1 See IRS publication 590-B for details about the Roth IRA 5-year rule for contributions and the Roth conversion 5-year rule. See also IRC §408A(d)(2), §72(t), Treas. Reg. §1.408A-6.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

Investing involves risk, including loss of principal.

This information provided here is for general informational purposes only, and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, you should consult with a qualified tax advisor, CPA, Financial Planner, or Investment Manager.

Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax free and subsequent conversions will require their own 5-year holding period. In addition, earnings distributions prior to age 59 1/2 are subject to an early withdrawal penalty.

IMPORTANT: The projections or other information generated by an investment analysis tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results.

The Schwab Center for Financial Research (SCFR) is a division of Charles Schwab & Co., Inc.

1123-342F