Individual Bonds

Take ownership of your bond investing strategy by choosing from a wide selection of different types of individual bonds.

What is a bond?

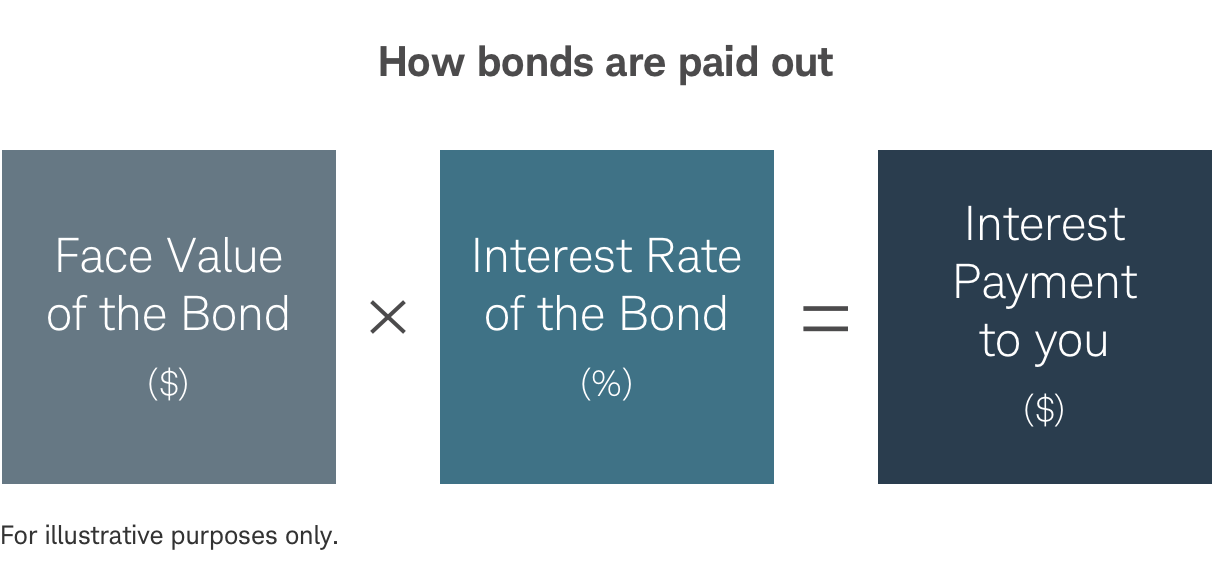

When you invest in a bond, you are a company's lender and the bond is like an IOU-a promise to pay back the money you've loaned, with interest.

The amount of income a bond pays is largely determined by the prevailing interest rate at the time of issuance and other factors specific to that bond.

Get to know the different types of bonds.

-

Treasury bonds

Treasuries are issued through the U.S. Department of the Treasury and are backed by the full faith and credit of the U.S. government.

View our "How to Trade Treasury Bonds" video to learn more.

Benefits and Risks

-

Treasury Bonds benefits and risks Benefits Risks Guaranteed payment – Tooltip and interest is guaranteed by the full faith and credit of the U.S. government. Predictable income – Most Treasuries pay a fixed interest rate on a regular schedule (usually semiannual), so investors know exactly what interest payment they will receive and when they will receive it.Range of maturities – Treasury securities are issued with a broad range of Tooltip , making it easy to find Treasuries that can help you meet your goalsLiquidity – Treasuries are generally the most liquid types of fixed income investment, often providing ample opportunities to sell your Treasuries before maturity.Tax breaks – Although federally taxable, the interest on Treasuries is exempt from both state and local taxes.Interest rate – The value of a fixed income security could fall as a result of a change in interest rates. Reinvestment – If interest rates are low when a bond reaches its maturity date or the issuer calls the bond, the investor could be left with lower yielding reinvestment options and a possible reduction in cash flow.Inflation – If prices rise at a higher rate than investment returns, your money buys less in the future. The risk is greatest if the bond has a long time until maturity.Market and event – Outside situations that influence the market could have a negative impact on the price or value of your investment.NOTE: These risks may apply across all bond types listed below.

Municipal bonds

-

Municipal bonds

States, cities, counties, and other local governments, as well as enterprises that serve a public purpose, such as universities, hospitals, and utilities, issue municipal bonds that generally pay interest income that is exempt from Federal and potentially state income taxes.

Benefits and Risks

-

Municipal Bonds benefits and risks Benefits Risks Tax-free interest – Interest income from most municipal bonds is often exempt from federal income tax—and if the bond is issued in the state where you live, interest may also be exempt from state income taxes. Predictable income – Most municipal bonds pay interest twice a year, so barring default you know exactly how much to expect and when you'll receive it.Historically low chance of default – Generally speaking, municipal bond payments are typically backed by taxes or user fees from services that are often essential.Opportunity to invest your money locally – You may be knowledgeable about the issuing municipality, or the projects being funded, potentially helping you make better decisions about which bonds you're comfortable buying.Material events – Municipal issuers provide regular ongoing disclosure about certain events that might affect the value of the securities they have issued. Extraordinary redemption (aka catastrophic call) – An extraordinary redemption is a provision that gives issuers the right to call bonds due to unforeseen or unusual circumstances.Alternative Minimum Tax (AMT) – Some types of municipal bonds are subject to the AMT, which is an alternative way of computing taxes that is mandated by the IRS for income over certain levels.Credit risk – This is the risk of default, credit downgrade, or change in credit spread.Liquidity – The harder it is to sell a security or the greater the loss in value resulting from a sale, the greater the liquidity risk.

Corporate bonds

-

Corporate bonds

Companies issue corporate bonds to raise capital for activities such as expanding operations, purchasing new equipment, or building new facilities. The issuing company is responsible for making interest payments and repaying the principal at maturity.

Benefits and Risks

-

Corporate Bonds benefits and risks Benefits Risks Potential for higher returns – Corporate bonds can offer higher yields than those offered by other fixed income securities with similar maturities, but with more risks. Liquidity – Many corporate bonds are actively traded in Tooltip , which allows access to principal prior to maturity.Diversification – Corporate bond prices generally behave differently from stocks, so they can offer diversification benefits to a portfolio. The wide selection of corporate bonds also makes it possible to diversify by issuer, industry, maturity, Tooltip , and interest payment schedule.Credit quality – Corporate bonds generally have lower credit ratings—and higher credit risk—than those of U.S. government bonds. If the issuing company is financially unable to make interest and principal payments, the investor’s investment may be at risk. Subordinated vs. unsubordinated bonds – Bonds from a single issuer are ranked in order of priority of payment in the event of a bankruptcy. Senior debt, which is paid first, may have a higher credit rating and higher credit quality than junior, or subordinated, debt.Secured vs. unsecured bonds – Corporate bonds can be secured or unsecured obligations of the issuing company. Secured bonds generally have lower credit risk and lower coupon payments compared to unsecured bonds issued by the same corporate issuer.

Mortgage-backed securities

-

Mortgage-backed securities

Mortgage-backed securities are created by pooling mortgages purchased from the original lenders. Investors receive monthly interest and principal payments from the underlying mortgages. These securities differ from traditional bonds in that there isn't necessarily a predetermined amount that gets redeemed at a scheduled maturity date.

Benefits and Risks

-

Mortgage-backed securities benefits and risks Benefits Risks Monthly cash flow – Investors receive a monthly payment, but the amount received each month consists of both interest and principal and may vary from month to month. Geographic diversification – These securities may be Tooltip by mortgages from different parts of the country, so weakness experienced in the housing industry in one part of the U.S. may potentially be offset within the pool of mortgages.Higher yields – Historically, mortgage-backed securities have provided yields that are higher than those for Treasuries of comparable maturities.Prepayment – When mortgage rates fall, homeowners typically refinance more frequently and mortgage-backed securities tend to repay principal more quickly than originally anticipated. Extension – When mortgage rates rise, homeowners typically refinance less frequently and mortgage-backed securities tend to repay principal more slowly than originally anticipated.

Agency bonds

-

Agency bonds

Agency bonds are issued by either a government-sponsored enterprise (GSE) or a government-owned corporation and are debt obligations solely of the issuing agency.

Benefits and Risks

-

Agency bonds benefits and risks Benefits Risks High credit quality – Agency bonds involve some level of federal sponsorship and generally have high credit quality. Liquidity – Agency bonds enjoy an active secondary market, so there is usually opportunity to sell before the bonds mature.Tax-free income – The payments from agency bonds are generally exempt from state and local taxes and are only taxable at the federal level.Credit risk – The risk of default, credit downgrade, or change in credit spread. Liquidity – The harder it is to sell a security or the greater the loss in value resulting from a sale, the greater the liquidity risk.Inflation – This occurs when prices rise at a higher rate than investment returns and, as a result, money buys less in the future.

Ready to start investing?

-

Ready to start investing?

Already a Schwab client? Get started

Need some help in choosing what fixed income product best fits your needs?

Common questions

-

The yield you're quoted when you buy a bond is often different from the interest it pays. Why? Because in addition to the annual interest rate, the bond's return reflects any difference between its purchase price and its face value—the amount you're expected to receive when the bond matures.

If you buy the bond at a price higher than the face value (at a premium), you'll receive less than you paid when the bond matures.

If you buy the bond at a price lower than the face value (at a discount), you'll receive more than you paid when the bond matures.

If you sell the bond before it matures, you get its current price, which may be higher or lower than the amount you originally paid.

-

Bonds are issued by both public and private entities. Cities, states, the federal government, government agencies, and corporations issue bonds to raise capital for a variety of purposes, such as building roads, improving schools, opening new factories, and buying the latest technology.

-

Two key factors that determine a bond's yield are credit risk and the time to maturity.

Credit risk: A bond's yield generally reflects the risk that the issuer will not make full and timely interest or principal payments. Rating agencies provide opinions on this risk in the form of a credit rating. Bonds with lower (higher) credit ratings generally pay higher (lower) yields because investors expect extra compensation for greater risk.

Maturity: Generally, the longer the maturity, the higher the yield. Investors expect to earn more on long-term investments because their money is committed for a longer period of time.

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

Visit

Visit