Onward

Insights for clients invested in their financial futures

Features

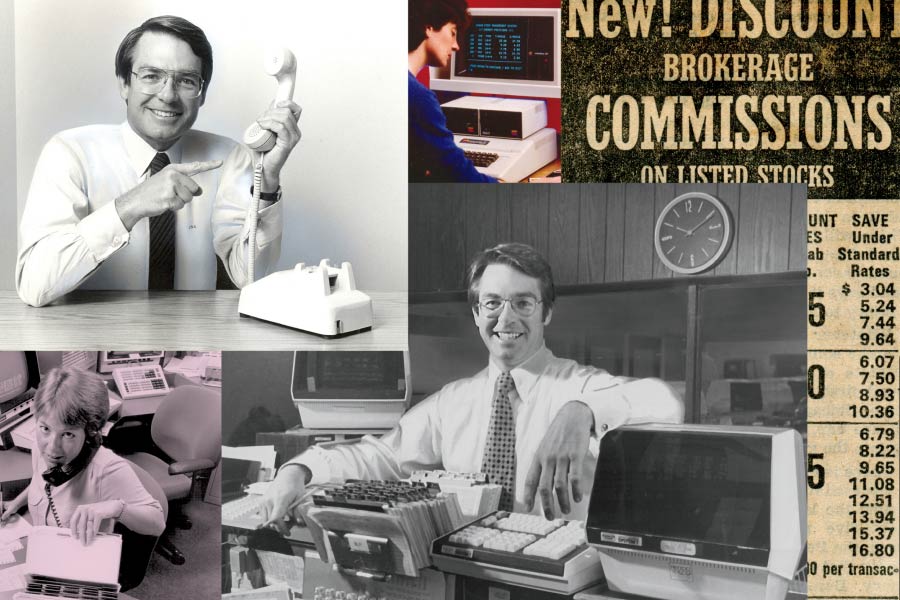

50 Years of Innovation

Since its founding in 1973, Charles Schwab has helped pioneer market access, lower fees, financial literacy, and more. Here's an up-to-the-minute guide to our initiatives and offerings.

4 Weak Spots in the Market

Today's uncertain economic climate is putting particular pressure on four market segments. Here's what to watch out for in the months ahead.

Lessons on Charitable Giving

How one woman's generous gift could help save lives—and what you can learn from her unique approach to philanthropy.

Explore more topics

Perspectives

Trading Bearish Patterns

Bearish trends can become a concern during a slower economy. Learn how to spot patterns and potentially profit from them.

Annuities in Your Estate Plan

If you have an annuity you no longer need, consider these five ways to deploy the extra income in your estate plan.

Tactical Allocation Tilts

How to implement tactical allocation tilts based on short-term market expectations.

Word of mouth

The Future of Social Security and Medicare?

Medicare and Social Security are projected to run out of money in less than a decade. Mike Townsend discusses possible solutions to the shortfalls and the likelihood of each.

4 Common Investor Concerns

Schwab experts answer questions about locking in higher interest rates, the likelihood of a "soft landing" for the economy, and more.

Should I Join a Nonprofit Board?

What should you consider before serving on the board of a nonprofit? Schwab wealth expert Susan Hirshman breaks it down.

Quick takes

Reducing Estate-Attorney Fees

Working with an estate attorney can be costly. These three tips can help keep legal expenses to a minimum.

Are Earnings Estimates Useful?

Companies often beat their stock earnings estimates. What gives—and how are traders to respond?

Saving and Investment Gifts

Looking for a gift with the potential to keep on giving? Learn more about saving and investment gifts like stock shares and tuition contributions.

Beware AI Voice Cloning Scams

Fraudsters can use artificial intelligence to impersonate nearly anyone. Here's how to help protect yourself from AI voice-cloning scams.

Small Business Reporting Rules

What small-business owners need to know about the new Corporate Transparency Act.

From our leaders

From the archives

SLAT Trusts for Couples

A spousal lifetime access trust (SLAT) allows access to assets while helping to keep them out of your taxable estate.

BDCs: High Yields, Big Risks?

Business development companies are known for attractive yields—but are they worth the risks?

Life Insurance and Your Estate

Adding life insurance to your estate plan can help give your heirs flexibility in the future.

Risk Tolerance vs. Capacity

It's not how much risk you can stomach that counts—it's how much time you have left to save.

How Discounted Munis Are Taxed

Discounted municipal bonds could expose you to unexpected taxes. Here's what to know before you buy.