How to trade options

Here are some of the fundamental steps involved in the options trading process.

1. Determine your objective.

Income generation

You want to potentially generate income on stocks you own or would like to own.

Hedging

You want to potentially reduce the downside risk on an existing stock position.

Speculation

You want to potentially profit based on the direction you think the market will move.

Learn about the options trading strategies that align to these objectives.

Regardless of your trading objective, you'll need a brokerage account that's approved to trade options in order to proceed with any strategy involving options. The types of options you can place also depend on your specific options approval level. Talk to a Schwab specialist at 888-245-6864 to learn more.

Current Schwab clients can log in and apply online for options approval.

2. Search for options trade ideas.

Whether you already have an underlying security selected or want to find one that fits your needs, there is a wide range of criteria to help you evaluate potential trade ideas that match your strategy, such as price, volume, implied volatility, sector, and more.

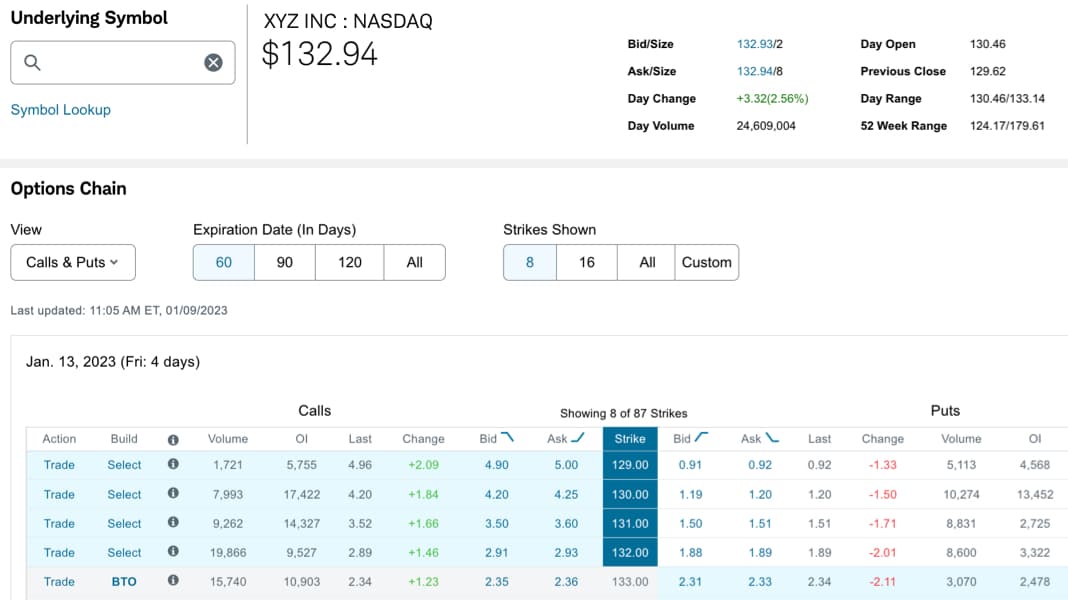

Options chains on Schwab.com

The options chain gives you a quick overview of the market for options on the underlying stock. You can see trading volume, price changes, and shaded areas that indicate in-the-money options.

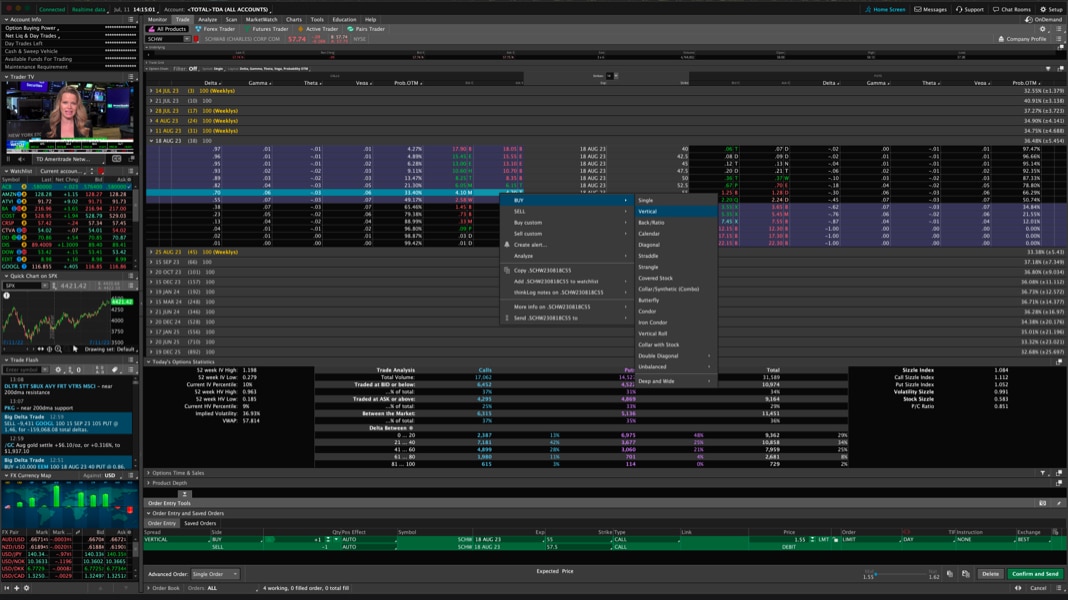

Options chains and statistics on thinkorswim® desktop

View statistics like the put-call ratio and IV% to determine your strategy, and use the Sizzle Index™ to help identify if options activity is unusually high or low. Learn more about options statistics on thinkorswim.

3. Analyze ideas.

Once you've identified some potential options trades, it's time to analyze them further. You can start with perspectives and ratings from third-party sources. You can also analyze each option's potential risk or reward, as well as how an option's price may be impacted by factors like changes in the underlying stock price, days to expiration, different strike prices, expiration dates, and implied volatility.

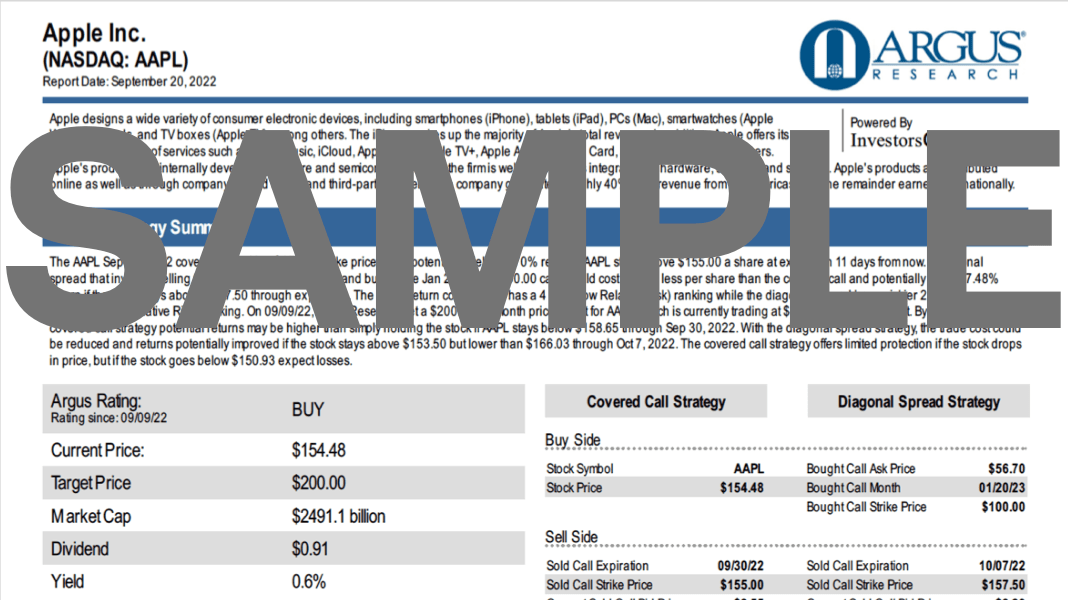

Argus Options Reports on Schwab.com

Argus Options Reports provide covered call and diagonal spread strategies on over 400 stocks that Argus Research rates as Buy or Hold.

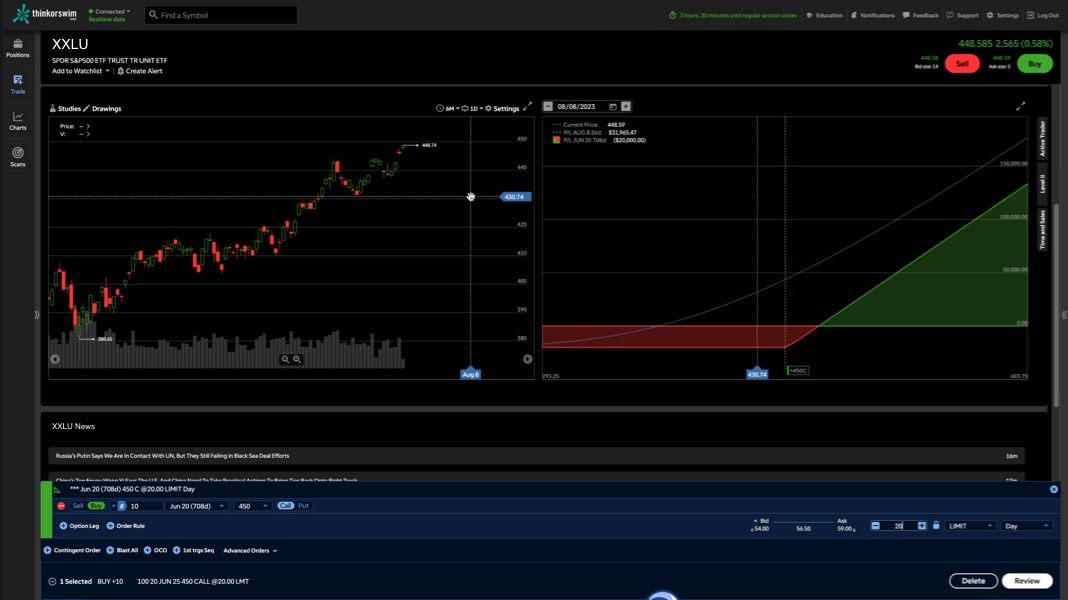

Analyze tab on thinkorswim web

On thinkorswim web, desktop, and mobile, see risk/reward graphs showing potential profit and loss based on "what if" scenarios and probabilities so you can craft your options strategy with confidence.

4. Place your options trade.

Settled on a specific option to trade? The next step is to establish your option position by submitting an order for execution. Enter the underlying symbol, then the specific option order details (type, expiration, strike price, number of contracts, etc.). Once your order is submitted, it will be routed to the market.

.png)

Options Trade Builder on Schwab.com

Create basic to complex options trades with the click of button. Choose from a menu of single and multi-leg strategies, and options for your selected strategy will populate with the most recent expiration date and strike price. From there, press "Continue" to quickly build the order for review prior to sending.

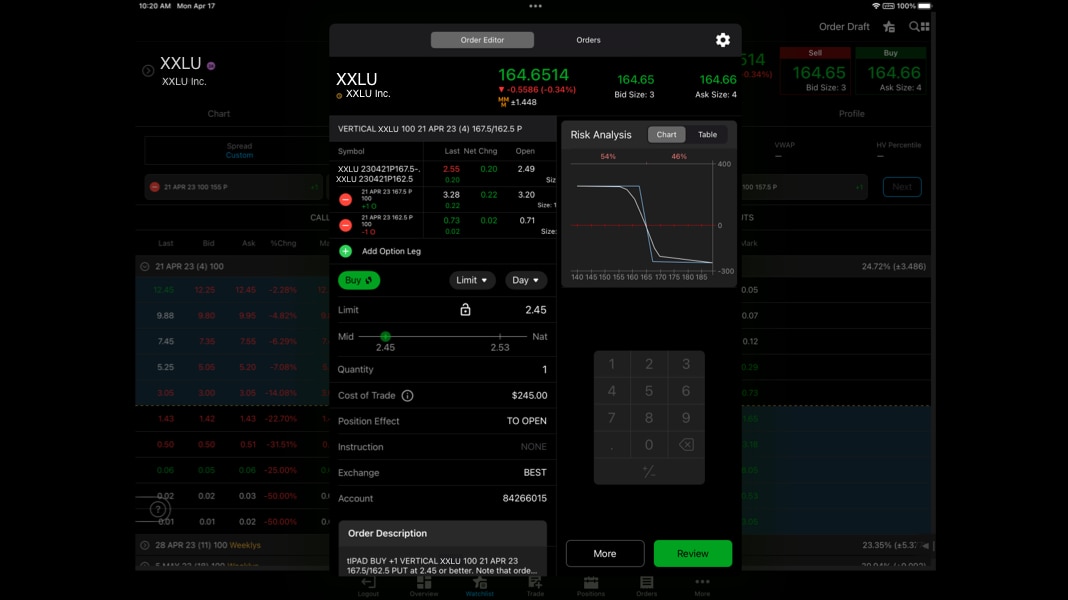

Trade ticket on thinkorswim mobile

On thinkorswim mobile, web, and desktop, quickly create a buy or sell order ticket for any option strategy by clicking on any Bid or Ask. From there, you can adjust your price, quantity, and type of order. Press "Confirm and Send," review your trade, and send the order.

5. Manage your position.

If you bought an option, depending on what the price of the underlying asset is, you may decide to sell the option before it expires or exercise the option and buy or sell the underlying security. You might also decide to let the option expire worthless.

If you sold an option, you could choose to close the position (by buying the option back) or do nothing and let the option expire worthless. The option may also be exercised by the buyer, requiring you to buy or sell the underlying security.

To help you make decisions on how to best manage your position, it's wise to keep an eye on key information such as market events, company news, price changes, dividends, unrealized profit/loss, and days to expiration.

.png)

Alerts on Schwab platforms

Setting alerts is a helpful way to stay on top of your positions while you are away. There are several alert types to choose from on Schwab.com, including price activity, volume, dividends, earnings, news, and more.

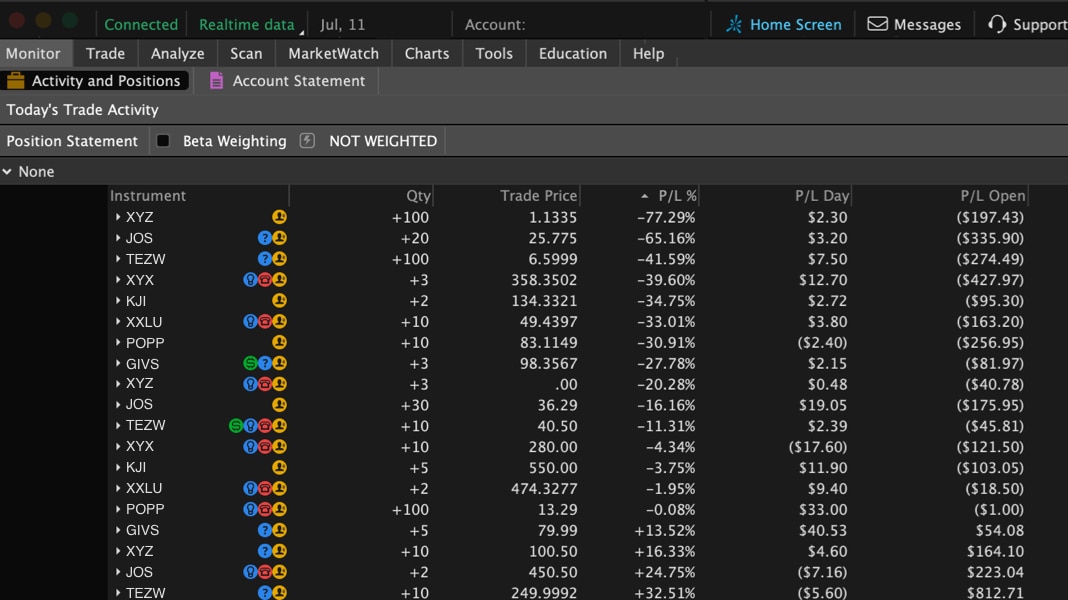

Monitor tab on thinkorswim desktop

On thinkorswim desktop, web, and mobile, simplify the task of monitoring your positions by customizing the critical information you want to see, including option Greeks, profit and loss, buying power, and more.