Options contracts

Explore the basic options contract types and considerations for trading them.

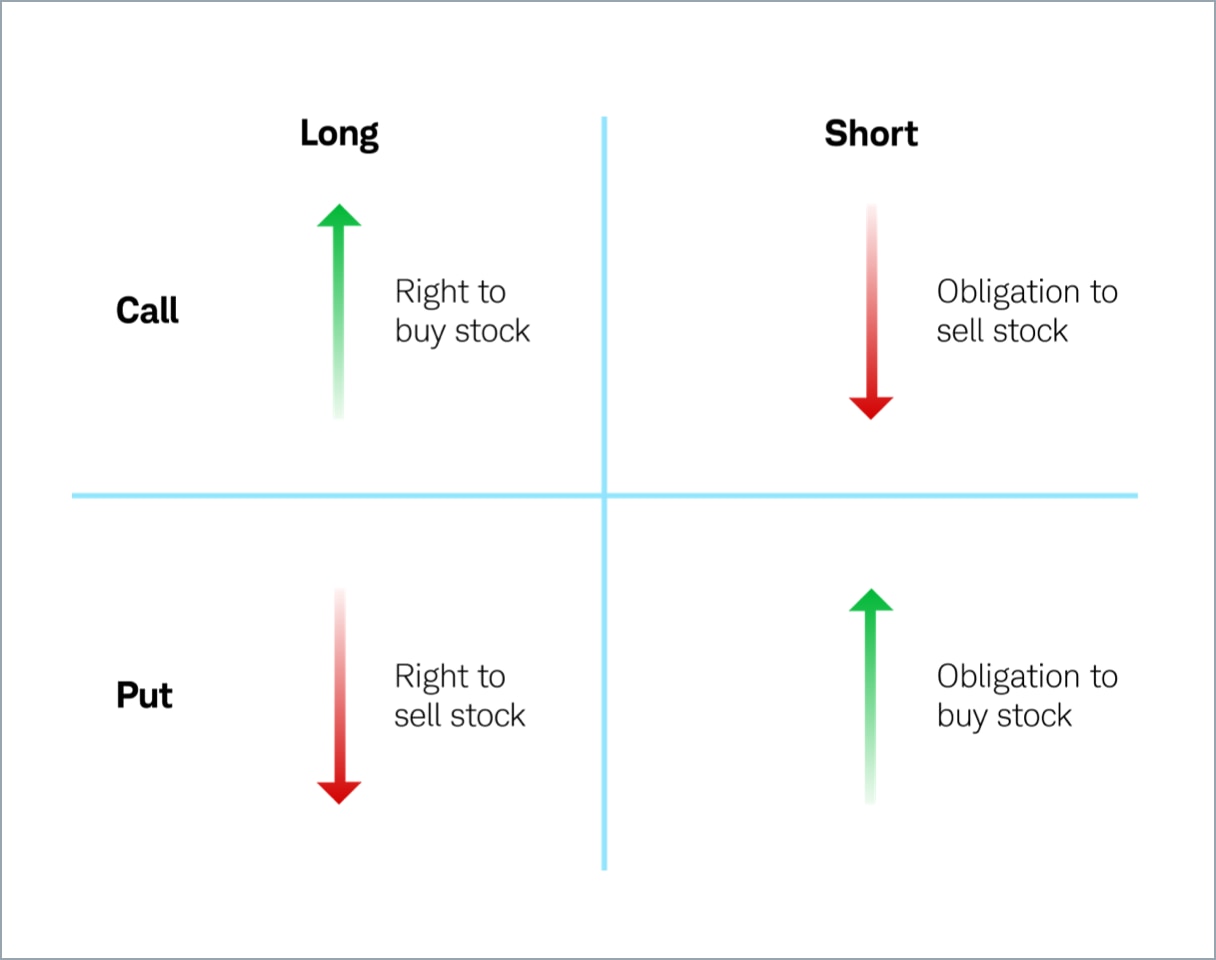

What are call options and put options contracts?

Call options

A call option gives the contract owner/holder (the buyer of the call option) the right to buy the underlying stock at a specified strike price by the

Tooltip

. Calls are typically purchased when you expect that the price of the underlying stock may go up.

Put options

A put option gives the contract owner/holder (the buyer of the put option) the right to sell the underlying stock at a specified strike price by the expiration date. Puts are typically bought when you expect that the price of the underlying stock may go down.

Learn more about the basics of call and put strategies.

Potential benefits and risks to consider with calls and puts

Let's look at why someone might consider buying or selling a call option.

Risks and benefits

-

Potential benefitsPotential benefitsPotential risksPotential risks

-

Buyer of a call optionPotential benefitsIf your call option goes up in price, it enables you to sell the option for more than you paid. Buying a call option requires less capital than buying the stock outright.Potential risksIf the stock price doesn't go up and you don't exercise the option, you lose what you paid for the call; if the stock price goes over the strike price by as little as a penny, you could be required to purchase the stock at expiration.

-

Seller of a call optionPotential benefitsEarn a Tooltip for the contract, and if it expires because the stock price didn't go up, you won't be obligated to sell the stock.Potential risksIf assigned, you have to sell the stock, likely at a price below market value; the risk may be unlimited if you don't already own the stock.

Now, let's look at why someone might consider buying or selling a put option.

put options risks and benefits

-

Potential benefitsPotential benefitsPotential risksPotential risks

-

Buyer of a put optionPotential benefitsIf the stock price goes below the strike price, you can exercise the contract and sell the shares for a price above the market price.Potential risksIf the stock price expires at or above the strike price(s), the option expires worthless, and you can lose the money you paid for the options contract.

-

Seller of a put optionPotential benefitsEarn a premium for the contract, and if it expires because the stock price stayed the same or went up, you won't have to buy the stock, and you still keep the premium.Potential risksYou may have to buy the stock at a price above market value, and the stock price could continue to fall. If you do not close the position, you may be assigned and have to buy the stock.

Understanding options contract quotes

These components appear in an options contract symbol, though different brokers may order them differently.

Underlying asset – This is the security/asset the option allows you to purchase or sell.

Expiration date – If an option is not closed out by the expiration date, it expires.

Strike price – This is the price at which you can buy or sell the shares.

Option type – This letter, either a "C" or "P", indicates whether it is a call or a put.

Get more details on how to trade options.

Have questions about options? We're here to help.

Call