For 50 years, Charles Schwab has had a singular mission: to help individual investors take ownership of their financial lives. Through actions big and small, the company has disrupted the industry and leveled the playing field for people from all walks of life, giving them the tools and resources they need to make informed decisions about their money and their futures.

"At Schwab, the occasion of our 50th anniversary is a time to celebrate our clients," says Walt Bettinger, Schwab's CEO and co-chairman. "Your needs, wants, and wishes have always been our North Star. We try to see every decision, every new product, through our clients' eyes, and we're grateful that so many people have entrusted their hard-earned money—and their futures—to us."

Here's a brief history of the many ways Schwab has challenged the status quo, expanded market access, and advocated on behalf of investors.

1973–1982 | Humble beginnings

What started in 1963 as a subscription-based investment newsletter grows into a fully-fledged investment broker by 1973—one that challenges industry norms and uses technology to revolutionize service.

- 1973 | Service over sales: At a time when other firms pay brokers a commission based on their total sales, Schwab introduces a new model that ties brokers' compensation to client service—the spirit of which is still prevalent today. "I wanted to remove the conflicts that put the interests of brokers at odds with those of the clients they served," says Chuck Schwab, founder and co-chairman. (For more on how Schwab compensates its investment professionals, see schwab.com/compensationdisclosure.)

- 1975 | The turning point: On May 1, the Securities and Exchange Commission mandates negotiated commission rates for all securities transactions. While many brokerages use the opportunity to raise commissions, Chuck takes the opposite tack by creating a discount brokerage.

- 1979 | Big bet on computers: Schwab makes a game-changing move by risking half a million dollars on a computer mainframe, enabling the company to handle twice the transactions with greater accuracy and at reduced cost to clients—making Schwab the first brokerage firm to bring such automation in-house.

- Early '80s | 24/7 access: Backed by sophisticated technology, Schwab establishes industry-first services that give investors around-the-clock access to stock quotes (1980) and order entries for stocks, bonds, and options (1982). "This is another great example of how Chuck believed in doing things differently and doing right by investors," says Jonathan Craig, head of investor services at Schwab. "Before this change, investors could only manage their investments during bankers' hours—and offering 24/7 access really helped set us apart."

1983–1992 | A glimpse of the future

Despite its stellar growth—reaching 1 million client accounts by 1985 and going public in 1987—the company stays true to its mission of serving clients with integrity, innovating on their behalf, and expanding access to investing through the strategic use of technology.

- 1984 | DIY: The company introduces The Equalizer®, a DOS-based platform that allows clients to connect their personal computers to Schwab via phone lines to track their portfolios, receive alerts when limits are hit, and produce tax reports. "The idea was to put the capabilities of a Schwab branch in every client's home, allowing them to accomplish things that would have previously required a phone call or even a visit," says Tim Heier, Schwab's chief technology officer.

- 1986 | 24/7 mutual funds: Schwab becomes the first broker to allow clients to place mutual fund buy or sell orders 24/7.

- 1989 | Touch-tone trades: Schwab introduces TeleBroker®, the industry's first 24-hour automated telephone brokerage service.

- 1992 | No-transaction-fee mutual funds: With the introduction of Mutual Fund OneSource, Schwab revolutionizes mutual fund investing by giving investors no-fee access to funds from dozens of fund families, all in one place.

1993–2001 | The internet changes everything

Recognizing the revolutionary power of the internet, Schwab takes another calculated risk by doubling down on web trading while simultaneously slashing commissions.

- 1994 | Servicio en español: Schwab launches Spanish-language TeleBroker®.

- 1996 | Online trading: A year after launching Schwab.com, Schwab fuels the internet trading revolution with web trading. Customers can trade over-the-counter stocks, monitor the status of orders, and verify account balances. The rise of online trading furthers Schwab's efforts to make investing as affordable as possible (see "The path to $0"). "It cost the firm considerable revenue to give all clients access to online trading for what was then the very low price of $39 per trade, but it was the right thing to do—for investors, for the future of market access, and, in the long run, for Schwab as a company," Walt says.

- 1999 | Trading after dark: Schwab launches after-hours trading for Nasdaq and select listed stocks, with orders accepted online or by phone from 4:30 p.m. to 7 p.m. ET, Monday through Friday.

- 2000 | Mobile trading takes shape: Schwab introduces PocketBroker™, a wireless investing service available via Palm devices that offers real-time quotes, equities trading and confirmation, account balances, email alerts, news stories, and watch lists.

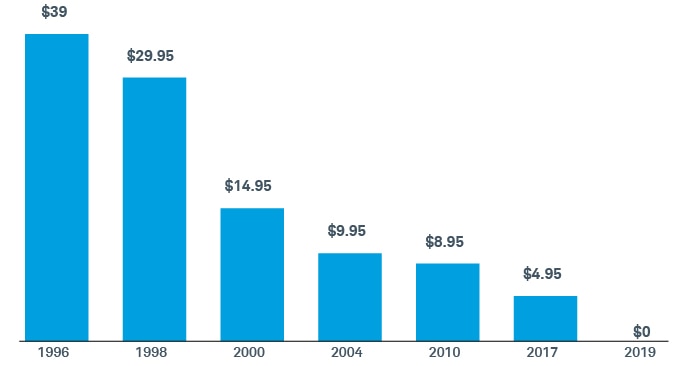

The path to $0

The advent of online trading in the mid-1990s further fueled Schwab's efforts to make investing as affordable as possible—a trajectory that reached its zenith in 2019 when the firm did away with online trading commissions altogether.

Source: Charles Schwab.

2002–2012 | Steady amid uncertainty

In a decade bookended by two market crises, the company focuses on what it does best: innovating on behalf of investors.

- 2002 | Advice, the Schwab way: Schwab introduces Schwab Equity Ratings® (schwab.com/resource/schwab-equity-ratings), Schwab Private Client (now Schwab Wealth Advisory™; schwab.com/wealth-advisory), and Schwab Advisor Network® (schwab.com/advisor-network) as part of the firm's commitment to advisory solutions. "From proprietary research to in-house and trusted third-party advice offerings, our goal was to meet a client's every need—free of the commission-based conflicts of interest that constrained much of Wall Street," Chuck says.

- 2003 | The bank for investors: Charles Schwab Bank—an online bank offering checking and savings accounts as well as home mortgages—launches, allowing clients to seamlessly manage banking and investing transactions (schwab.com/bank).

- 2006 | Account security, guaranteed: Schwab announces its Security Guarantee, covering losses in any Schwab account arising from unauthorized activity (schwab.com/securityguarantee).

- 2011 | Mobile evolution: Schwab becomes one of the first brokerages to launch a smartphone trading app, through which clients can deposit checks, monitor the markets, and place trades.

- 2012 | Trading 2.0: The acquisition of OptionsXpress brings an innovative brokerage platform to Schwab's active investors and traders with trading tools, analytics, and education to execute a wide variety of sophisticated strategies.

2013–2023 . . . | Expanding what's possible

From automated portfolio management to direct investing, Schwab continues to leverage technology to remove barriers and offer sophisticated investment strategies to a wider group of investors.

- 2015 | Advice meets automation: Schwab launches Schwab Intelligent Portfolios®, an investment advisory service that uses computer algorithms to build, monitor, and rebalance a diversified portfolio of exchange-traded funds based on an investor's goals, risk tolerance, and time horizon (schwab.com/intelligent).

- 2016 | Automated advice 2.0: The company introduces Schwab Intelligent Portfolios Premium®, an advisory service that combines live credentialed professionals and algorithm-driven technology to make financial and investment planning more accessible (schwab.com/intelligent-portfolios-premium).

- 2017 | Satisfaction, guaranteed: Schwab announces its Satisfaction Guarantee, which grants clients enrolled in participating investment advisory services a complete refund of their program fees from the previous quarter if, for any reason, they're not completely satisfied with the service they've received (schwab.com/satisfaction-guarantee).

- 2020 | Schwab Stock Slices™: Clients can purchase partial shares of up to 30 stocks in the S&P 500® Index for as little as $5 per stock (schwab.com/stockslices).

- 2020 | Two industry leaders become one: Charles Schwab acquires TD Ameritrade Inc. to form a single company dedicated to serving investors in every phase of their financial journey. Once complete, the integration will include the award-winning thinkorswim® and thinkpipes® trading platforms, tools for trading clients, and more. "Especially noteworthy is thinkorswim's customizable 'cockpit' view," Tim says. "It can display dozens of charts and data points in whatever configuration you see fit."

- 2022 | Indexing, personalized: Schwab launches Schwab Personalized Indexing™ (schwab.com/direct-indexing). "Schwab Personalized Indexing is still in its infancy, but the ability to customize an index according to a client's needs and preferences is revolutionary—and artificial intelligence, used judiciously, is sure to play a central role in this next frontier of investing," Walt says.

- 2023 | Leading the industry in client satisfaction: Schwab earns the highest ranking for Investor Satisfaction with Full-Service Wealth Management Firms in the J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study, ranking first for products and services, value for fees, ability for clients to manage wealth, and problem resolution.

. . . and beyond | Focused on the future

"As important as it is to celebrate a milestone like this one, I'm even more excited about what the next 50 years will bring," Walt says. "Technology has removed nearly all barriers to investing, and the next logical step is to provide true personalization to every single investor. That said, technology will never eclipse the human touch. For half a century, our dedicated Schwab professionals have put the interests of our clients first and foremost, and I'm confident our culture of service will continue to set us apart over the next 50 years."

The inside view

A Q&A with longtime Schwab employee Denise Patridge.

Denise Patridge, a Schwab financial consultant based in Oregon, joined the company in 1983. Forty years later, she reflects on how the firm has evolved while staying true to its roots.

Q: You joined Schwab in the early 1980s, a time of exponential growth for the company. How has it changed over the years?

Denise: In the early years we were strictly a trading firm, but as we worked with clients, we realized they needed more help. We couldn't give advice yet, but we had other tools, such as the Mutual Fund OneSource Select List and, later, Schwab Equity Ratings, which helped clients narrow their research based on our proprietary analyses.

That said, the launch of our wealth advisory services in the early 2000s was the real game changer. We were finally able to help investors with their complete financial pictures and begin to fulfill Chuck's vision of being clients' go-to firm for comprehensive wealth management.

Despite all that growth, however, the company hasn't changed as much as you might expect. Chuck founded a firm centered around investors, which was revolutionary at a time when firms were centered around themselves. We've broadened our offerings, of course, but that mission of service is still at the heart of everything we do.

Q: How has your role evolved over the years?

Denise: I started as a registered representative in the Sunnyvale, California, branch. I'd spend my days at the front desk taking in physical check and stock deposits from clients. I also worked in the marketing department at headquarters for a while, but what I really wanted was to work with clients. Once we started offering advice, I applied to be a financial consultant in Oregon, where I grew up. Working in other areas of the company allowed me to really understand the business and bring that knowledge to bear for my clients.

Q: Forty years is a long time to work for the same company. What kept you here?

Denise: When I first started out, I thought I would work here long enough to get my broker's license and then move on, maybe to a full-commission broker. But I recognized early on that I liked the culture and what I was doing. Schwab has always been a company that cares about employees and individuals.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Individual situations will vary.

Investing involves risk, including loss of principal.

Supporting documentation for any claims or statistical information is available upon request.

Charles Schwab received the highest score in the J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study℠, which measures investor satisfaction with full-service investment firms. The study was conducted between October 2022 to January 2023 and is based on responses from 6,168 investors. Twenty firms receiving 100 or more completed surveys were eligible to be included in the ranking. The ranking or ratings shown here may not be representative of all client experiences because they reflect an average or sampling of the client experiences. Each individual client's experience may vary. Visit jdpower.com/awards for more details. Study is independently conducted, and the participating firms do not pay to participate; however, use of study results in promotional materials is subject to a license fee.

Charles Schwab & Co., Inc. (member SIPC) receives remuneration from fund companies in the Mutual Fund OneSource service for recordkeeping and shareholder services, and other administrative services. Schwab also may receive remuneration from transaction fee fund companies for certain administrative services.

Schwab Equity Ratings and the general buy/hold/sell guidance are not personal recommendations for any particular investor or client and do not take into account the financial, investment, or other objectives or needs of, and may not be suitable for, any particular investor or client. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment.

Portfolio Management provided by Schwab Wealth Advisory, Inc., a Registered Investment Adviser and affiliate of Charles Schwab & Co., Inc. (Schwab). Please read the Schwab Wealth Advisory and the Schwab Wealth Advisory, Inc. Disclosure Brochures for information and disclosures about this program. The Wealth Advisor, Associate Wealth Advisor, and other representatives making investment recommendations in your Schwab Wealth Advisory accounts are employees of Schwab Wealth Advisory, Inc.

Schwab Advisor Network ("SAN") advisors are independent and are not employees or agents of Charles Schwab & Co., Inc. ("Schwab"). Schwab prescreens advisors and checks their experience and credentials against criteria Schwab sets, such as years of experience managing investments, amount of assets managed, professional education, regulatory licensing and business relationship as a client of Schwab. Advisors pay fees to Schwab in connection with referrals. Schwab does not supervise advisors and does not prepare, verify or endorse information distributed by advisors. Investors must decide whether to hire an advisor and what authority to give the advisor. Investors, not Schwab, are responsible for monitoring and evaluating an advisor's service, performance and account transactions. Services may vary depending on which advisor an investor chooses.

Please read the Schwab Intelligent Portfolios Solutions™ disclosure brochures for important information, pricing, and disclosures relating to Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium programs.

Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium® are made available through Charles Schwab & Co., Inc. ("Schwab"), a dually registered investment advisor and broker-dealer. Portfolio management services are provided by Charles Schwab Investment Advisory, Inc. ("CSIA"). Schwab and CSIA are subsidiaries of The Charles Schwab Corporation.

Schwab Intelligent Portfolios, which has no advisory fee and doesn't charge commissions, and Schwab Intelligent Portfolios Premium, which offers financial planning for an initial fee of $300 and a $30 per month advisory fee charged quarterly after that. Schwab does not charge an advisory fee for the SIP Program in part because of the revenue Schwab Bank generates from the Cash Allocation (an indirect cost of the Program).

Standard online $0 commission does not apply to over-the-counter (OTC) equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Schwab Satisfaction Guarantee: If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. ("Schwab"), Charles Schwab Bank, SSB ("Schwab Bank"), or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. Refund requests must be received within 90 days of the date the fee was charged. Two kinds of "Fees" are eligible for this guarantee: (1) "Program Fees" for the Schwab Wealth Advisory ("SWA"), Schwab Managed Portfolios™ ("SMP"), Schwab Intelligent Portfolios Premium® ("SIP Premium"), and ManagedAccountConnection® ("Connection")investment advisory services sponsored by Schwab (together, the "Participating Services"); and (2) commissions and fees listed in the Charles Schwab Pricing Guide for Individual Investors or the Charles Schwab Bank Pricing Guide.

For more information about Program Fees, please see the disclosure brochure for the Participating Service, made available at enrollment or any time at your request. The Connection service includes only accounts managed by Charles Schwab Investment Management, Inc., an affiliate of Schwab. The guarantee does not cover Program Fees for accounts managed by investment advisors who are not affiliated with Schwab or managed by Schwab‐affiliated advisors outside of the SWA, SMP, SIP Premium, and Connection services.

The guarantee is only available to current clients. Refunds will only be applied to the account charged and will be credited within approximately four weeks of a valid request. No other charges or expenses, and no market losses will be refunded. Other restrictions may apply. Schwab reserves the right to change or terminate the guarantee at any time.

Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Schwab Personalized Indexing is available through Schwab's Managed Account Connection® program ("Connection"). Please read Schwab's disclosure brochure for important information and disclosures relating to Connection and Schwab Managed Account Services.

Requires a wireless signal or mobile connection. System availability and response times are subject to market conditions and your mobile connection limitations. Functionality may vary by operating system and/or device.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc., members FINRA/SIPC, are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (Member SIPC), offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB (Member FDIC and an Equal Housing Lender), provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

Home lending is offered and provided by Rocket Mortgage, LLC, Equal Housing Lender. NMLS# 3030. Rocket Mortgage LLC., is not affiliated with The Charles Schwab Corporation, Charles Schwab & Co., Inc. or Charles Schwab Bank, SSB.

1123-33RF