As the markets head into the Thanksgiving holiday, oil traders are closely watching inventories and OPEC's meeting outcome. West Texas Intermediate for January settled at $77.77 per barrel, down $0.06.

OPEC+ is meeting on November 26th and analysts are expecting they will extend production cuts into 2024. "We see some scope for the group to do a deeper reduction, but we would anticipate that Saudi Arabia would seek additional barrels from other members to share the burden of the adjustment," said RBC Capital analyst Helima Croft.

The head of the International Energy Agency's oil markets and industry division addressed OPEC+ expected cuts by stating the global oil market will see a slight supply surplus in 2024.

U.S. oil inventories increased nearly 9.1 million barrels for the week of November 17th, with the consensus that EIA crude inventories will increase by 1.75 million barrels this week. The head of economics and strategy at Mizuho Bank Ltd., Vishnu Varathan said, " With US output ramping up for the fourth quarter, and Venezuelan sanctions eased, the increased supply will not sit well [with OPEC]."

The easing of sanctions on Venezuela's oil exports is bearish on the global crude markets. On October 18th, the US stated it would ease sanctions for six months provided Venezuela hold fair presidential elections. Analysts have estimated 200,000 barrels per day will be added to the global market.

Heading into the Thanksgiving holiday, travel demand has been increasing which is bullish for oil prices. The American Automobile Association anticipates 55.4 million Americans will be traveling more than 50 miles. "Going into the long weekend the market would rather be a little bit long than short," said Andrew Lipow, president of Lipow Oil Associates.

In an insignificant impact to the price of oil, there is another oil spill in the Gulf of Mexico. The US Coast Guard estimates 1.1 million gallons of oil, or roughly 26,190 barrels, have been leaked. The spill was discovered on Thursday and is suspected to have come from an oil pipeline operated by Main Pass Oil Gathering Co. Traders will be looking to the potential regulations to come from this incident.

Technicals

Since late September, oil has fallen about 16% as the markets were concerned with demand growth and economic slowdown. OPEC's production cuts have not helped to stabilize the price of oil.

Oil is currently trading below the 50- and 200-day simple moving averages but close to the 200. The 50-day is at $84.41, and the 200-day is at $78.15. With oil trading just below the 200-day SMA, this could be a point of resistance.

The 14-day RSI is at 44.5% and moving up.

The Directional Movement Index is indicating a negative direction. The ADX (white) is high indicating a strong trend. The positive directional index (+DI, green) is low but moving higher indicating a possible change in direction. The negative directional index (-DI, red) is high giving indication to the current trend on the chart. With the ADX being high along with the -DI, a move with the trend would be greater and more likely.

Our partners at Hightower indicate support at $76.63 and $77.33 with resistance at $78.33 and $78.62.

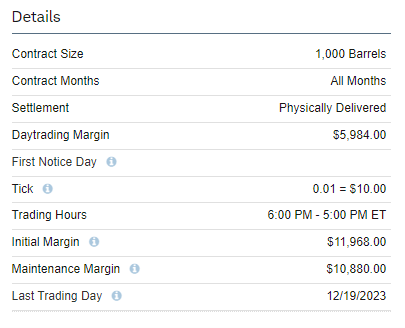

Contract Specifications

WTI Crude Oil January 2024 (CLF24)

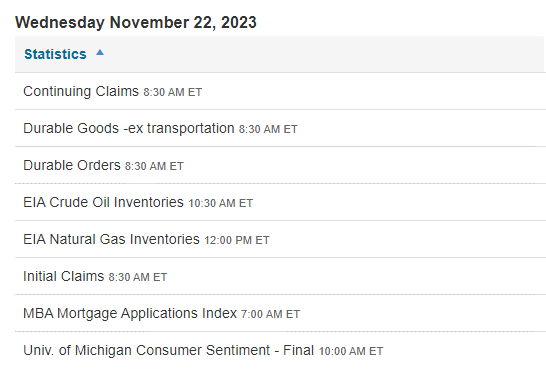

Trading Calendar

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice.

Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against trading losses.

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Futures accounts are not protected by SIPC. Futures and futures options trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify.

Charles Schwab Futures and Forex LLC (NFA Member) and Charles Schwab & Co., Inc. (Member FINRA/SIPC) are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation.

Virtual Currency Derivatives trading involves unique and potentially significant risks. Please read NFA Investor Advisory – Futures on Virtual Currencies Including Bitcoin and CFTC Customer Advisory: Understand the Risk of Virtual Currency Trading.

Charles Schwab & Co., Inc. 3000 Schwab Way, Westlake, TX 76262

1123-34SL