How do you choose between corporate and municipal bonds? Both have characteristics that can be useful in your portfolio, depending on your goals and circumstances, but they're not right for every situation.

First, start with the type of account you're using:

- Interest income from municipal bonds is generally exempt from federal and potentially state income taxes, so munis can make more sense than corporate bonds in taxable accounts, like a brokerage account, but it will depend on a few factors that we'll discuss below.

- For tax-deferred accounts, such as an individual retirement account (IRA) or 401(k), corporate bonds generally make more sense because they usually pay higher yields in exchange for the lack of tax benefits that munis usually offer.

Beyond that, you should be aware of factors such as yields, maturity, and credit quality, as they can differ between the two types of bonds and influence which is more attractive. Here's what you should consider when deciding between investment-grade municipal and corporate bonds.

1. What account type are you investing in?

As noted above, if it's a tax-deferred account, such as an IRA or 401(k), then corporate bonds will likely make more sense than munis.

A key benefit of municipal bonds is that their coupon payments are generally exempt from federal and potentially state income taxes, and they aren't subject to the 3.8% tax on high earners' investment income.

For tax-advantaged accounts, however, that benefit goes away, because earnings aren't taxed until the time of distribution (usually at a later date). As a result of the tax benefits, munis tend to pay a lower rate of interest relative to corporate bonds of similar maturity and credit quality, so holding municipal bonds in a tax-deferred account likely means you're missing out on higher yields that corporate bonds can provide.

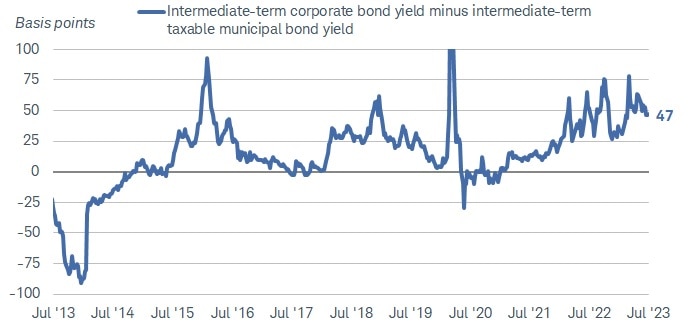

One caveat is taxable municipal bonds. Their interest income is subject to federal and state taxes, just like corporate bonds. Corporate bonds historically have yielded more than taxable municipal bonds because they generally have lower credit ratings, on average, but there have been times where taxable munis yielded more than corporate bonds. In instances such as these, taxable munis should be considered along with corporate bonds for tax-deferred accounts.

Corporate bonds historically have yielded more than taxable munis

Source: Bloomberg, weekly data as of 7/14/2023.

Bloomberg Intermediate Taxable Municipal Bond Index (I22079US Index) and Bloomberg U.S. Intermediate Corporate Bond Index (LD06TRUU Index). The chart is truncated at +100 for visual purposes. The maximum value was 265 on 3/23/2020. One basis point is equal to one one-hundredth of one percent, or 0.01%. Past performance is no guarantee of future results.

2. What's your tax rate?

If you're investing in a taxable account, like a brokerage account, the decision between corporates and munis gets more nuanced and depends on a variety of factors. The primary factor will be your tax rate. At higher tax rates, munis generally yield more than corporate bonds of similar maturities.

For example, the seven-year component of the Bloomberg Municipal Bond Index yields 3.0%, compared with 5.4% for the Bloomberg U.S. Intermediate Corporate Bond Index.1 Both indices have similar durations, a measure of interest-rate sensitivity, and therefore offer a reasonable comparison, in our view.

The corporate bond index offers a higher yield before taxes are taken into consideration—but once taxes come into play, that yield advantage begins to decline. In order for the municipal bond index to break even with the after-tax yield of the corporate bond index, a 45% total cumulative tax rate is needed. We're referring to this as the "break-even" rate. The current break-even tax rate is off its recent highs, but still at the high end of its 10-year range. Keep in mind that this break-even tax rate includes multiple types of taxes—such as federal, state, and potentially the 3.8% net investment income tax (NIIT). For example, you might be in the 37% federal tax bracket, live in a state with a 10.75% top marginal income tax rate, and be subject to the 3.8% NIIT, which would put your tax rate above 50%.

If your total tax rate is below 45%, intermediate-term corporate bonds will likely make more sense than intermediate-term municipal bonds after taxes. However, if your tax rate is above that ~45% break-even tax rate, municipal bonds will likely yield more after taxes. Don't always assume that this is static because the break-even rate has fluctuated over time, as illustrated in the chart below. Since 2010, this break-even tax rate has averaged 32%.

Your tax rate will determine whether munis or corporates yield more after taxes

Source: Bloomberg, weekly data as of 7/14/2023.

Bloomberg Municipal Bond 7-year (6-8) Index (LM07TR Index) and Bloomberg U.S. Intermediate Corporate Bond Index (LD06TRUU Index), using weekly data. Past performance is no guarantee of future results.

3. Are you looking for very highly rated (AAA/Aaa and AA/Aa rated) investments?

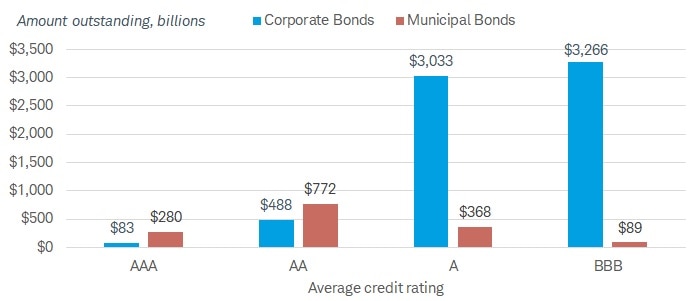

If you're looking for very highly rated investments, like "triple A" or "double A" rated bonds, corporates likely don't make as much sense. Munis may make sense depending on your tax bracket and what maturity you're considering. Most investment-grade munis carry ratings in the upper tiers of the investment-grade spectrum, meaning AA ratings or above by Standard & Poor's or Aa and above by Moody's Investors Service.2

Although the corporate bond market is more than four times larger than the municipal bond market, there are actually more AAA and AA rated munis than there are AAA and AA rated corporate bonds. In fact, there are only 13 unique issuers3 of AAA rated bonds in the Bloomberg U.S. Corporate Bond Index, with two issuers accounting for the vast majority of the AAA rated corporate bonds outstanding.

This matters because diversification with AAA rated corporate bonds is harder to achieve given the small number of AAA rated issuers in the corporate market relative to the muni market. Likewise, municipal bond investors looking for lower-rated investment-grade bonds and the higher yields they offer don't have too many options.

The corporate market is made up of mostly A and BBB rated issues

Source: Bloomberg, as of 7/14/2023.

Bloomberg Municipal Bond Index (LMBITR Index) and Bloomberg U.S. Corporate Bond Index (LUACTRUU Index). Columns represent the amount outstanding of the credit rating subindexes of the corporate and municipal bond indexes, respectively.

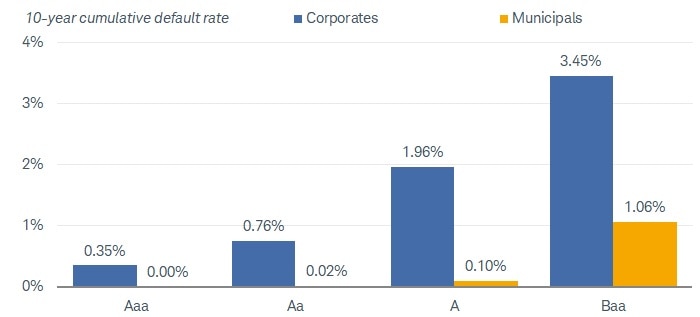

While there are fewer A and BBB rated municipal bonds outstanding relative to the corporate bond market, they historically have defaulted at a lower rate than corporate bonds with similar ratings.

This is generally due to municipalities having a natural monopoly on the residents they serve. For example, residents are generally limited to only one water utility district, which means that district doesn't have to compete for customers like corporations do. Municipal issuers also generally exhibit less business risk than corporations do.

Munis historically have defaulted less frequently than corporates

Source: Moody's Investors Service, "U.S. municipal bond defaults and recoveries, 1970-2021," 4/21/2022.

Moody's cumulative default rates calculated from marginal default rates, which represent the probability that an issuer that has survived through a particular date will default over the next time interval (10 years in this case). Default rates only include bonds rated by Moody's. Past performance is no guarantee of future results.

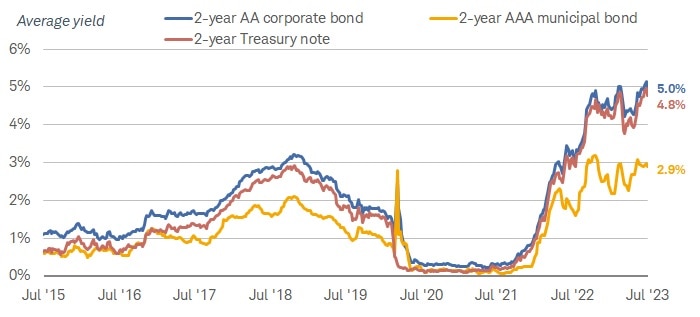

4. Are you looking for high-quality, short-term investments?

If you're looking for short-term bonds with very high ratings, consider certificates of deposit (CDs), Treasuries, or agency bonds (that is, securities issued by a government-sponsored enterprise or a federal department other than the U.S. Treasury). There aren't many short-term AA or AAA rated corporate bonds available, and the average yields for the ones that are available are barely higher than Treasury yields.

To illustrate, a two-year AAA muni yields 2.9%, compared to 4.8% for a two-year Treasury note. For investors in very high tax brackets, munis may still make more sense than Treasuries, but that break-even tax rate is still relatively high.

Yields for highly rated munis are low relative to Treasuries and corporate bonds

Source: Bloomberg, as of 7/14/2023.

USD US Corporate AA+, AA, and AA- BVAL 2-Year Index (IGUUDC02 BVLI Index), BVAL Muni AAA 2-Year Index (BVMB2T Index) and Generic United States 2 Year Government Note (GT2 Govt). Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

The story changes when considering bonds that are lower-rated and have longer maturities. Either munis or corporate bonds could make sense when compared to Treasuries, but which to choose will depend on your tax bracket.

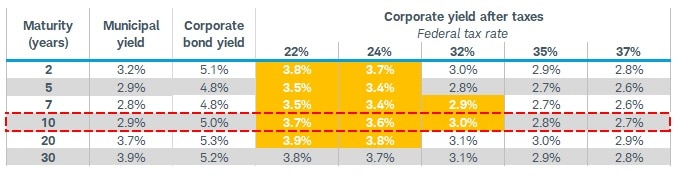

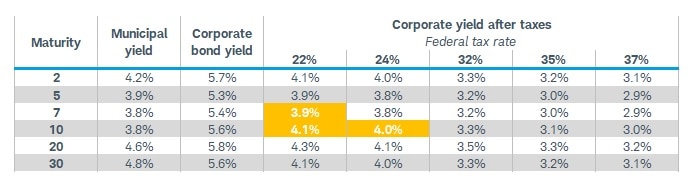

The tables below illustrate the average yields-to-worst of A and BBB rated muni and corporate bonds, based on maturity and tax rates. The columns on the left labeled as "Municipal yield" represent average municipal bond yields based on the given maturity, and those yields don't change based on the tax rates since they are not subject to federal taxes. The columns labeled "Corporate bond yield" are the average, before-tax corporate bond yield for the maturities listed, and the columns to the right represent the yields after taxes assuming different tax rates.

The yields highlighted in yellow are instances where the corporate bond yields are higher than the municipal yields when the given tax rate is taken into account. Consider the example highlighted in the red dashed line in the table below, in which the average 10-year A rated corporate bond yields more after taxes than the average 10-year A rated municipal bond for investors in all but the 35% and 37% tax brackets.

Notably, A rated munis, on average, offer higher after-tax yields for all maturities shown for investors in the 35%-and-above tax brackets. When comparing BBB rated munis and corporates, there are very few instances when corporates yield more than munis on an after-tax basis.

A rated munis and corporates

Source: Bloomberg, as of 7/14/2023.

USD US Corporate A+, A, and A- BVAL Yield Curve (BVSC00074) and US General Obligation A+, A, and A- BVAL Yield Curve (BVSC1215). Corporate bonds assume an additional 5% state income tax and 3.8% ACA tax for the 32% and above brackets. The yields highlighted in yellow are instances where the corporate bond yields are higher than the municipal yields when the given tax rate is taken into account. Past performance is no guarantee of future results.

BBB rated munis and corporates

Source: Bloomberg, as of 7/14/2023.

USD US Corporate BBB+, BBB, and BBB- BVAL Yield Curve (BVSC0075) and US General Obligation BBB+, BBB, and BBB- BVAL Yield Curve (BVSC1218). Corporate bonds assume an additional 5% state income tax and 3.8% ACA tax for the 32% and above brackets. The yields highlighted in yellow are instances where the corporate bond yields are higher than the municipal yields when the given tax rate is taken into account. Past performance is no guarantee of future results.

What to consider now

Do your homework before investing in municipal bonds and corporate bonds, but also figure out how each investment fits into your risk profile and how each may help you reach your goals. Corporate and municipal bonds come with risks that always need to be considered when deciding which types of bonds to invest in—like interest rate risk (the risk that prices fall if yields rise) and credit risk, like the aforementioned risk of default.

The type of investment account or your tax bracket are just two things to consider—you also need to consider the credit quality, the time to maturity, and how the taxable equivalent yields stack up.

Municipal bonds tend to make more sense in taxable accounts for investors in higher tax brackets, but it will depend on the maturity and credit quality.

In tax-advantaged accounts, investment-grade corporate bonds generally will offer higher yields, but keep in mind that their credit ratings are lower, on average, and they have historically defaulted more than investment-grade municipal bonds. Schwab clients considering municipal or corporate bonds can explore Schwab's Mutual Fund OneSource Select List or the ETF Select List. When searching for corporate bond funds in the select lists, first start in the "Taxable Bond" category, and then search for "Corporate Bond" under the Morningstar Category. When searching for municipal bonds, simply start in the "Municipal Bond" category.

A Schwab fixed income representative can also help you find the right solution to help you reach your goals.

1 As of 7/14/2023

2 The Moody’s investment grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment grade scale is Ba, B, Caa, Ca, and C. Standard and Poor’s investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.

3 There are 13 individual issuers of AAA rate corporate bonds, although each issuer may issue more than one bond.

Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. Please read it carefully before investing.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. All expressions of opinion are subject to changes without notice in reaction to shifting market, economic, and geopolitical conditions. Data herein is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed. Supporting documentation for any claims or statistical information is available upon request.

Past performance is no guarantee of future results.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors.

Tax-exempt bonds are not necessarily a suitable investment for all persons. Information related to a security's tax-exempt status (federal and in-state) is obtained from third parties, and Schwab does not guarantee its accuracy. Tax-exempt income may be subject to the Alternative Minimum Tax (AMT). Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax.

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager.

All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Supporting documentation for any claims or statistical information is available upon request.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

0723-381M