SCHWAB PRIVATE CLIENT SERVICES™

Your access to premium Schwab benefits.

Talk to a Financial Consultant or call us at 866-855-9102.

Welcome to Schwab Private Client Services.

Schwab offers a complimentary suite of benefits to meet the needs of sophisticated investors who expect a higher level of professional guidance and support.

Clients who have more than one million dollars in qualifying assets at Schwab automatically get access to these benefits, including—a dedicated Financial Consultant, access to a wide range of specialists, tailored solutions, and pricing advantages. See program details.

A dedicated Financial Consultant.

A dedicated Financial Consultant.

As a Schwab Private Client, you receive access to a dedicated Financial Consultant who can help manage various aspects of your financial life and connect you to all that Schwab has to offer.

Personalization on your terms.

With a clear view of who you are and the future you want, your Consultant can help you choose the right level of advice and service based on your goals and investing needs. Your Consultant can also help you create a personal financial plan or maintain and adapt your plan as your goals evolve.

The kind of relationship you want.

Your Consultant will work with you however you want: in-person, over the phone, by video, or by email. And there is no cost for working with them.

We are always transparent about how our Consultants are compensated, and we employ a structure that allows us to focus on your priorities.

Priority assistance, wherever you are.

Priority assistance, wherever you are.

Every question you have should be treated as a priority. As a highly valued client, you receive the support of your Private Client Services Team, with seasoned professionals and fast response times.

Reach out to your team for all your needs, including:

- General and tax-efficient trading strategies from licensed trading specialists and answers to questions related to Schwab trading platforms.

- Service requests like opening new accounts, account updates, and completing wires and money transfers.

Based on your goals, your team can also refer you to additional licensed professionals experienced in financial planning, managed products, and retirement planning.+

Count on the experience of Schwab wealth management specialists.

Count on the experience of Schwab wealth management specialists.

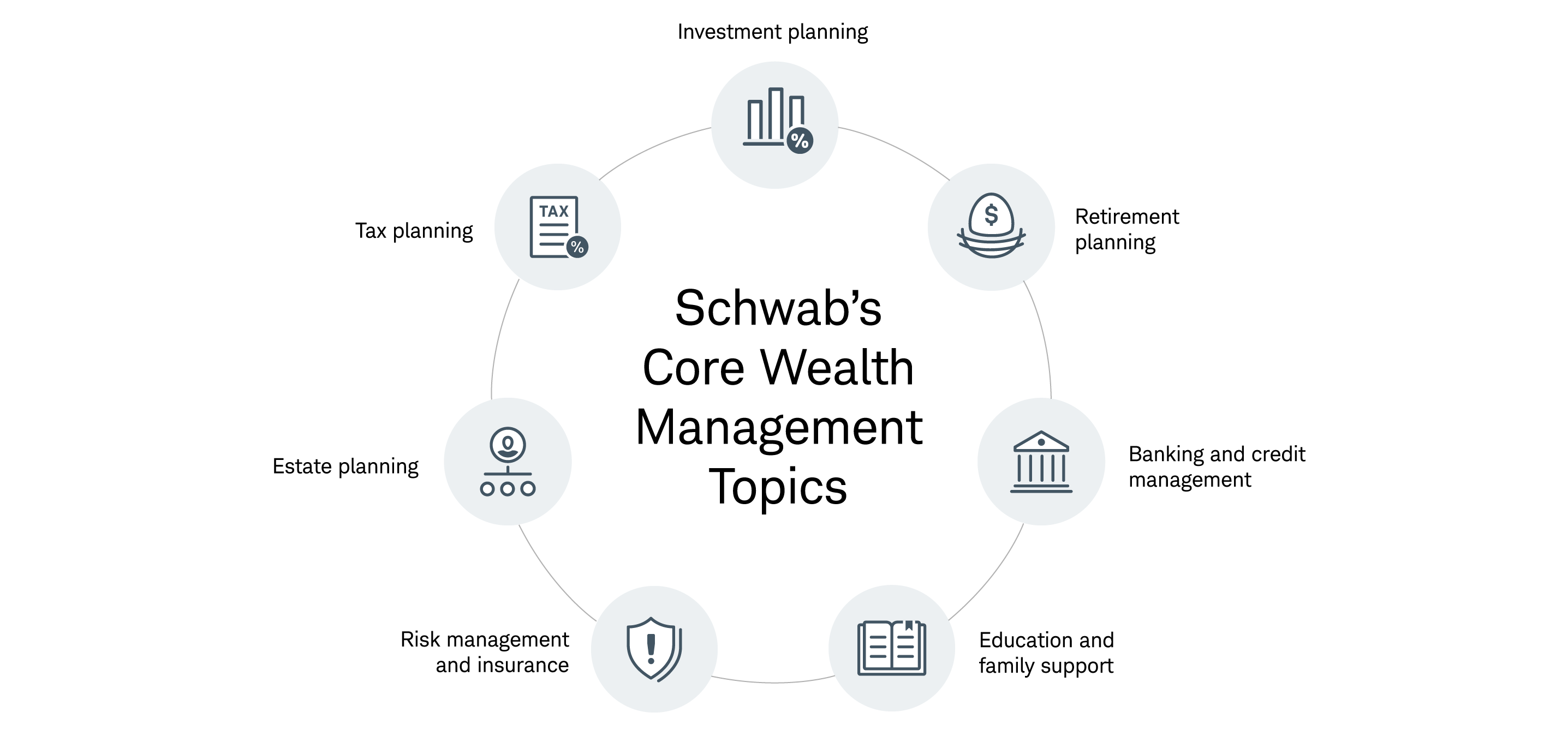

Everyone has unique needs, and when your financial needs get complex, your Consultant can refer you to specialists whose insights and personalized guidance can help you navigate a range of wealth management topics.

Certain services may be provided by fee-based affiliated professionals and third-party firms. Schwab does not provide specific individualized legal or tax advice. Please consult a qualified legal or tax advisor where such advice is necessary or appropriate.

Rewards and benefits designed around you.

Rewards and benefits designed around you.

Schwab is committed to cost-effective investing because we understand that every dollar matters. That's why you'll only pay for products or financial solutions that you choose, and any costs will be explained to you. Below are some of the pricing benefits that await you.

Savings on frequent transactions.

Receive unlimited free domestic wire transfers through your brokerage account.

*Entering into a Pledged Asset Line and pledging securities as collateral involve a high degree of risk. Before you decide to apply for a Pledged Asset Line, make sure you understand the risks. A Pledged Asset Line is available to all qualifying Schwab clients.

Curated insights for smarter decisions.

Curated insights for smarter decisions.

As a Schwab Private Client, your Consultant can help guide you through our research so you can apply it to your particular circumstances. Together, you and your Consultant can use Schwab insights to seize opportunities in changing markets and make progress toward your goals.

You'll also receive our quarterly magazine, Onward, which includes valuable articles on wealth management, including perspectives from Schwab experts like Liz Ann Sonders, Jeffrey Kleintop, and Kathy Jones.

Access to specialized solutions.

Access to specialized solutions.

Should you have more complex needs, your Consultant can give you access to a suite of fee-based solutions to meet your needs. The fees for these products will be clearly explained and disclosed to you by your Consultant.

Access to specialized solutions.

Beyond the above specialized solutions, your Consultant can also recommend and discuss the full range of Schwab offerings based on your individual needs, including personal trust services; lower-cost money market funds; exposure to cryptocurrency markets; and environmental, social and governance (ESG) investment vehicles.

Check the background of our firm and work histories of our Financial Consultants on FINRA's BrokerCheck.

#1 in Investor Satisfaction with Full-Service Wealth Management Firms

J.D. Power 2023 U.S. Full-Service Investor Satisfaction StudySM

____

Charles Schwab received the highest score in the J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study, which measures investor satisfaction with full-service investment firms. Visit jdpower.com/awards for more details. The J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study is independently conducted, and the participating firms do not pay to participate. Use of study results in promotional materials is subject to a license fee.

Common questions

Schwab clients with $1M in qualifying household assets, including a retail account are automatically enrolled in Schwab Private Client Services.

No, Schwab Private Client Services is complimentary, with no fees to join-and your experience is enhanced with the following benefits:

- A dedicated Financial Consultant for premium guidance and support

- Priority assistance from a team, to help with your day-to-day needs and provide knowledgeable support

- An annual $200 Card Statement Credit with the Platinum Card® from American Express Exclusively for Charles Schwab. 1Credit Card approval required. Terms apply.

- Access to specialists in a wide range of areas, including tax, trust, and estate planning, to help with your specific financial goals

- Pricing benefits on mortgages and unlimited domestic wire transfers through your brokerage accounts

Yes, family members who also reside at your primary address and have a Schwab account also qualify for these benefits.

At Schwab, our highest priority is looking through clients' eyes. This philosophy is instilled in our consultants and reinforced through training, supervision, and oversight. Our consultants follow Regulation Best Interest and the fiduciary standard to provide transparent guidance, so clients know their financial goals always come first.

- We are always transparent about how our consultants are compensated—and we employ a structure that allows us to focus on your priorities. See how our professionals are compensated.

- Our consultants' service is also backed by our Satisfaction Guarantee.

To find a consultant, please call 866-855-9102.

Qualifying households with $1M to $10M of assets at Schwab are enrolled in SPCS for a minimum of 12 months. After 12 months, your household will be re-evaluated on an ongoing basis to determine if it will remain eligible.

Yes, your consultant can connect you with trading specialists who are well-versed in equity, exchange-traded funds (ETFs), options, and futures/forex trading. They can answer any of your trading-related questions and offer support with our trading platforms.