You may be at the stage in life where your kids are out of the house—or perhaps you're just looking for a change—and want to downsize your home. There's no question that downsizing can have many financial advantages. A smaller house can mean less upkeep, lower monthly expenses—and maybe even potential cash from a sale.

But before making a decision, it's important to assess how taxes could play a part. Will selling your home be worth it if it comes with a big tax bill?

Under current law, if you sell your principal residence for a profit, you may qualify to exclude up to $250,000 ($500,000 for married couples filing jointly) of that capital gain from your income tax.1 While many people may not profit enough to have to pay capital gains tax at all, those whose homes have appreciated considerably could face a significant bill.

First, the basics

In order to claim the maximum exclusion, you'll need to pass what the IRS calls the ownership and use tests. This means:

- You must have owned the house for at least two years.

- You must have lived in the house as your principal residence for two out of the last five years, ending on the date of sale.

There are exceptions to these rules—for example, moving before owning the home for two years due to a job change or experiencing what the IRS designates an "unforeseen circumstance," such as a divorce or natural disaster. In such cases, the IRS will allow you to prorate the exclusion. One thing to note: If you go through a divorce after having lived in the home for just one year, you would be entitled to only 50% of the exclusion.

Additionally, the two years of residency don't have to be consecutive as long as you've lived in your home for a total of 24 months out of the five years prior to the sale. You're also able to claim this exclusion on multiple sales, but you can only claim this exclusion once every two years.

Calculate your cost basis

To determine capital gains on the sale of your home, subtract your cost basis from the selling price. But what exactly is your cost basis?

Your cost basis is not just the purchase price. It can include certain settlement fees, closing costs, and commissions associated with both the purchase and the sale—excluding escrow amounts related to taxes and insurance, etc.2 Add to this the cost of significant capital improvements (but not repairs) you made over time for renovations, additions, roofing, landscaping, and other upgrades. All these improvements will increase your cost basis and, therefore, lower your potential tax liability. Hopefully, you've kept good records because this can add up.

On the other side of the equation, there are a few things that can reduce your cost basis, increasing not just your profit but potentially your taxes as well. For example, if you received tax credits for energy-related improvements, you'll have to subtract those amounts from your cost basis. Also, if you ever claimed depreciation for a home office, you may have to "recapture" and pay tax on that amount.

Capital improvement or repair?

Tax rules let you add the cost of a capital improvement to your cost basis but not the cost of a repair. The difference? A capital improvement increases the value of your property. A repair simply restores your property to its original condition.

A new deck is a capital improvement. Fixing your plumbing is a repair. Sometimes, though, the distinction is less clear. For example, if you replace your entire roof, that's a capital improvement. But if you simply replace a few shingles, that's a repair.

A sample tax bill

Jon and Jane bought their home in 1988 for $250,000. Now in their mid-60s, they've decided to downsize. They sell their home for $875,000.

Over the years, Jon and Jane did a lot of remodeling and made many home improvements. Because Jane has a home office, they've claimed depreciation on their income tax return, which now has to be subtracted from the cost basis. They are in the 32% tax bracket and pay a 15% long-term capital gains tax rate. Here are the numbers.

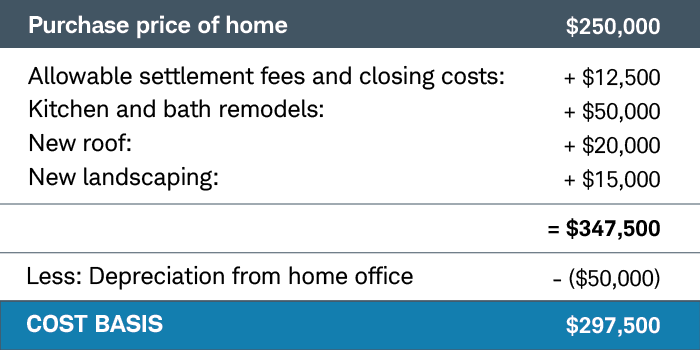

What did they spend?

When Jon and Jane bought their home, they paid $12,500 in allowable settlement fees and closing costs at the time of purchase, and over the years, they spent $50,000 remodeling their kitchen and master bath, $20,000 on a new roof, and $15,000 on new landscaping—a total of $347,500. Because they had to recapture $50,000 of depreciation costs for Jane's office, the total cost basis of their home is $297,500.

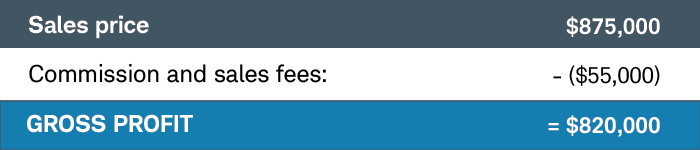

What did they sell it for?

Jon and Jane sell their house for $875,000, but the $55,000 in commission and sales fees reduces their gross profit to $820,000.

How much did they make?

After subtracting their cost basis of $297,500 from their gross profit of $820,000, Jon and Jane will earn $522,500 in capital gains.

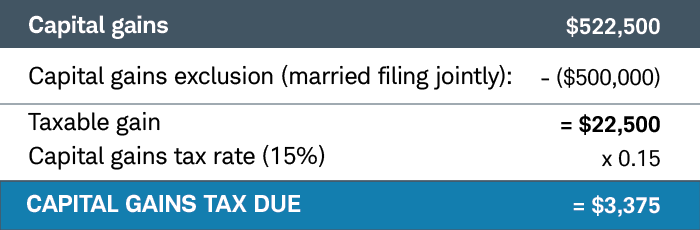

How much do they owe in capital gain taxes?

Because Jon and Jane are filing jointly, they can exclude the up to $500,000 of their capital gains, leaving them with a taxable gain of $22,500. Based on their income, their capital gains tax rate is 15%, resulting in a capital gains tax bill of $3,375.

Note: Jon and Jane must also "recapture" the $50,000 of home office depreciation deductions on their tax return as a "unrecaptured section 1250 gain." In this example it will be taxed at the maximum rate of 25% ($12,500 in tax). They would have to do this even if their capital gain was less than their $500,000 exclusion.

Looking ahead: Rent or buy?

Downsizing may mean buying a smaller house or moving to a less expensive area. Alternatively, you could decide that it'd make more sense to rent.

On the plus side, renting releases you from worry about things like property taxes and upkeep—potentially giving you more freedom both economically and emotionally. If you don't deposit money into another house, it could also give you a nice retirement nest egg. On the minus side, if you rent, you won't be building equity, and you'll be subject to the whims of a landlord.

There's no right or wrong answer. A lot will depend on where you live and how long you plan to stay in your next home. In either case, if you make a considerable profit on the sale of your home, talk to your financial advisor about the best way to invest this money in light of your overall financial situation.

2Ibid.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized tax or investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The information provided here is for general informational purposes only, and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, you should consult with a qualified tax advisor, CPA, Financial Planner, or Investment Manager.

0923-3TRS