Most of us know we should save money.

But when it comes to actually doing it, people tend to fall into two camps: non-planners and planners. Non-planners typically save when they can, perhaps putting a small amount into a workplace retirement plan, hoping that everything will work out in the long run. Planners generally know what they're saving for, how much they need to put away, and how long it will take them to reach their goals.

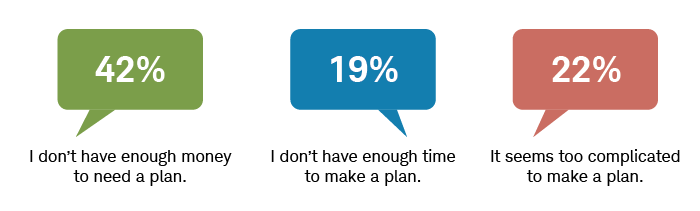

Does the first type sound more like you? If so, you're not alone: Only 33% of Americans have a written financial plan, according to Schwab's 2021 Modern Wealth Survey.1 Of the rest, almost half said they didn't have enough money to make a plan worthwhile. Others said it was too complicated, or they didn't have time to develop a plan.

Respondents face various roadblocks to creating a financial plan

Source: 2021 Schwab Modern Wealth Survey.

In the rush of daily life, planning for anything more than a few days in advance can seem like a headache. It's natural to wonder: Does financial planning really help?

We think it does. Here are five reasons why:

1. A written financial plan increases confidence

Our survey found that 65% of people with a written financial plan say they feel financially stable, while only 40% of those without a plan feel the same level of comfort. Fifty-four percent of planners felt "very confident" they would reach their financial goals, compared with only 18% of non-planners.

Having a written financial plan gives you a measurable goal to work toward. Because you can track your progress, you can reduce doubt or uncertainty about your decisions and make adjustments to help overcome obstacles that could derail you.

2. A financial plan can jumpstart savings, even with a small amount of money

The most common reason cited for not having a plan is "I don't have enough money." This is a misconception. Planning, even in small steps, doesn't take large sums of money to start.

In fact, financial planning can have a profound impact on lower-income households by helping people improve their saving and budgeting habits. A written plan helps savers prioritize their goals and, as mentioned earlier, provides a way to gauge success.

3. A financial plan can help you create an investment portfolio

Your financial plan can give you the full lay of the land: You'll know what your goals are, how much time you have to reach them, and how comfortable you are with risk. Once you have a comprehensive view, you can figure out how to reach each individual goal.

That will involve both saving—setting aside money you'll need in the short term or for emergencies—as well as investing, which is setting aside money you'll need in the long term and that, ideally, can grow. And with your financial plan as a roadmap, you'll be better able to make thoughtful investing decisions—instead of heading out without a sense of direction and just hoping for the best.

4. A financial plan can lead to better habits

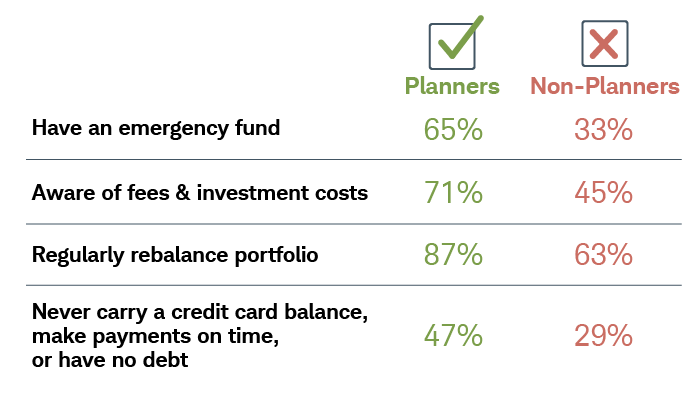

Financial planning isn't just about investing; it's about what money can do for your confidence, security, and quality of life—such as the protection that life insurance offers or the peace of mind that an emergency fund can provide. Research also shows that planning supports sound money habits as well.

Americans who have a financial plan also have healthy money habits

Source: 2021 Schwab Modern Wealth Survey.

There are good investing habits, and there are healthy money habits. A written financial plan can lead to both.

5. Planning can be tailored to every personality type

Your approach to life can influence every decision you make, including those that involve your finances. By understanding the type of person you are with regard to planning, you can take proper steps toward reaching your financial goals.

Here are six types of financial planning personalities:

- Organizer: Organizers love lists. Categorizing and arranging everything from their sock drawer to their personal finances gives them a warm, fuzzy feeling.

- Architect: Architects are masters of both creativity and logic. They not only imagine the future but design solutions to make it happen.

- Philosopher: Taken from the Greek word meaning "lover of wisdom," philosophers enjoy thinking about and solving problems.

- Dreamer: Dreamers are the free spirits of our world who shake their head in confusion at all those who schedule their lives to the last detail.

- Improviser: Improvisers are typically quite self-sufficient with a deep desire for independence and doing things their own way.

- Maverick: Mavericks are unafraid and unapologetic individuals who would rather reshape their world than try to fit in it.

What's your financial personality type? Take Schwab's Modern Wealth Quiz.

How can you plan according to your personality?

For organizers, architects, and philosophers, forethought and proactively finding solutions are in their nature. A written financial plan can offer a sense of security while leaving room for improvement and possible growth.

Dreamers, improvisers, and mavericks may prefer spontaneity, but even a bit of planning can significantly help them achieve the freedom to live the way they want while fulfilling the future they imagine. A written plan can provide the structure to keep them financially grounded while allowing them to make changes on the fly or use their earnings to support a carefree lifestyle.

Why consider a professional financial planner?

Research has shown that households that work with a professional financial planner were more likely to make better financial decisions than those without a planner, taking into account portfolio risk levels, savings habits, life insurance coverage, revolving credit card balances, and emergency savings.2

In a study published in the Journal of Financial Planning, David M. Blanchett, Ph.D., CFA, CFP®, used six rounds of the triennial Federal Reserve Board's Survey of Consumer Finances (from 2001 to 2016) to examine the results achieved by people using four information sources: financial planners (defined as advisors who provided more holistic services); transactional financial advisors (such as a banker or broker); friends; or the internet.

"Households working with a financial planner were found to be making the best overall financial decisions, followed by those using the internet, while those working with a transactional adviser were making the worst financial decisions," Blanchett wrote.

Bottom line

A financial plan may sound like a chore. But for successful investors, it's the foundation on which to build, understand and achieve your goals. Having a written plan can increase confidence and result in more constructive financial behavior. However, the potential value of financial advice may vary based on the nature of the planning engagement. People working with a financial planner who is taking a holistic look at their needs, beyond just products and portfolio, are likely better off than those working with a planner who takes a transactional approach.

Schwab clients: Log in to get a complimentary financial plan to help reach your retirement goals.

1Schwab Modern Wealth Survey. The online survey was conducted by Logica Research from February 1 to February 16, 2021, among a national sample of 1,000 Americans aged 21 to 75. Quotas were set to balance the national sample on key demographic variables. Supporting documentation for any claims or statistical information is available upon request. The margin of error for the national sample is three percentage points. Detailed results can be found here.

2Blanchett, David M. "Financially Sound Households Use Financial Planners, Not Transactional Advisers." Journal of Financial Planning 32 (4): 30–40, 2019

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for their own particular situation before making any investment decision.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager.

Investing involves risk, including loss of principal.

Logica Research is not affiliated with the Charles Schwab Corporation or its affiliates.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

0122-19CG