For options-approved traders, trading options can be useful in a variety of circumstances and in different market scenarios. Some options strategies can be complex, but for options beginners, it might make sense to start with fundamental strategies like basic call and put options.

Like all our strategy discussions, the following is strictly for educational purposes. It is not, and should not be considered, individualized advice or a recommendation.

Call and put options

A call option gives the owner the right, but not the obligation, to buy the underlying security at a specific price (the "strike" or "exercise" price) on or before a specific date (the "expiration").

A put option gives the owner the right, but not the obligation, to sell the underlying security, again, at a specific price on or before a specific date. For standard stock or equity options, each contract delivers 100 shares of stock. Non-standard options may have different deliverables so it's important to understand the terms before trading.

Call options strategies

Buying calls as a stock alternative

Buying a call option is often considered a bullish strategy because the price of the call option typically rises when the price of the underlying security rises. Similarly, call prices typically fall when the underlying security falls. The premium paid for an option is typically a fraction of the price of the underlying asset. Traders or investors who have a directional view might consider buying a call option as a lower-cost alternative to buying a stock outright.

It's important to remember that options expire, unlike stocks. If a trader buys an option and it expires worthless, they lose the entire investment. Additionally, options don't carry voting rights, and they don't pay dividends.

Selling calls for potential income

Some option traders turn to call options when they already own the stock. Instead of using calls as a typically lower-cost substitute for stock, they use calls to potentially generate income on shares they already hold. This strategy is called a covered call1 and involves selling the option rather than buying it.

When a trader sells a covered call, instead of paying a premium, they receive the premium. However, the call can be exercised at the will of the owner (buyer) of the call option at any time up until expiration. If the call is in the money2 (ITM) on or before expiration, the likelihood that the owner of the option will exercise their right to buy the underlying at the strike price increases. If the owner exercises the option, the trader will be required to deliver the stock. Additionally, the short (sold) option can be assigned at any time regardless of the ITM or out-of-the-money3 amount.

Using the data from the table below, let's look at an example. Suppose a trader owns 100 shares of a stock that's trading at $79.34. Assume the trader is bullish for the long term but doesn't think the stock will move much higher over the next several weeks. The trader creates a covered call by selling a call option against the stock.

Option chain data

- Stock price= $79.34

- Call bid

- Call ask

- Strike

- Put bid

- Put ask

-

Stock price= $79.3435 days until expirationCall bid6.05Call ask6.20Strike75Put bid1.73Put ask1.78

-

Stock price= $79.34Call bid4.50Call ask4.65Strike77.5Put bid2.68Put ask2.76

-

Stock price= $79.34Call bid3.35Call ask3.40Strike80Put bid3.95Put ask4.05

-

Stock price= $79.34Call bid2.37Call ask2.42Strike82.5Put bid5.45Put ask5.55

-

Stock price= $79.34Call bid1.65Call ask1.68Strike85Put bid7.25Put ask7.35

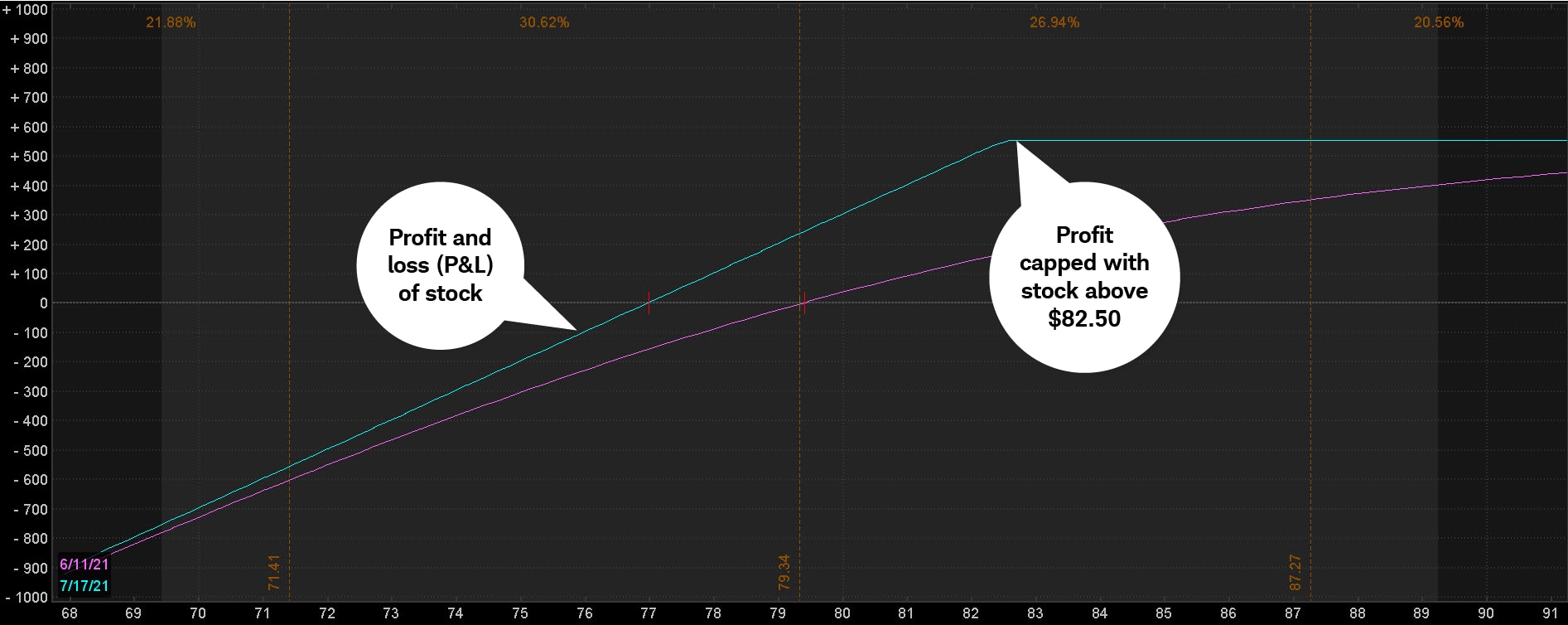

Looking at the above table, suppose a trader sells the 82.5 strike call at the bid price of $2.37. The trader would collect $237 of premium ($2.37 x 100) minus transaction costs. If the stock stays below $82.50 between the time the trader buys it and expiration, the call would likely expire worthless. If the call option buyer does not exercise the option, the trader would keep the stock as well as the premium. Some traders refer to this as an "income enhancement" to the stock the trader owned.

On the other hand, if the stock rallies above $82.50, the trader might be required to deliver the stock at $82.50 per share. Because the stock was at $79.34 when the trader sold the call option, if the stock rallies above $82.50 by expiration, the return is capped at $553 ($237 premium + $316 stock gain) minus transaction costs. The total return is capped because the trader is required to sell the 100 shares owned, so if they only had 100 shares to begin with, they don't own additional shares of that stock.

Risk profile of a covered call

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Buying puts for protection

The protective put is a basic options strategy that can potentially help limit potential losses on a stock a trader already owns. Buying a put option is usually considered a bearish strategy because the price of a put tends to rise as a stock price falls and vice versa. A put gives the owner the right, but not the obligation, to sell the underlying at the strike price at any time up until expiration. If the long put expires worthless, the entire cost of the put position would be lost. This strategy provides only temporary protection from a decline in the price of the corresponding stock.

If a trader is bearish on a stock, they might consider buying a put instead of shorting the stock. Shorting stock might be considered risky because there's no cap on potential losses. The theory behind the protective put is that a trader buys the put option on stock they already own in case the stock drops.

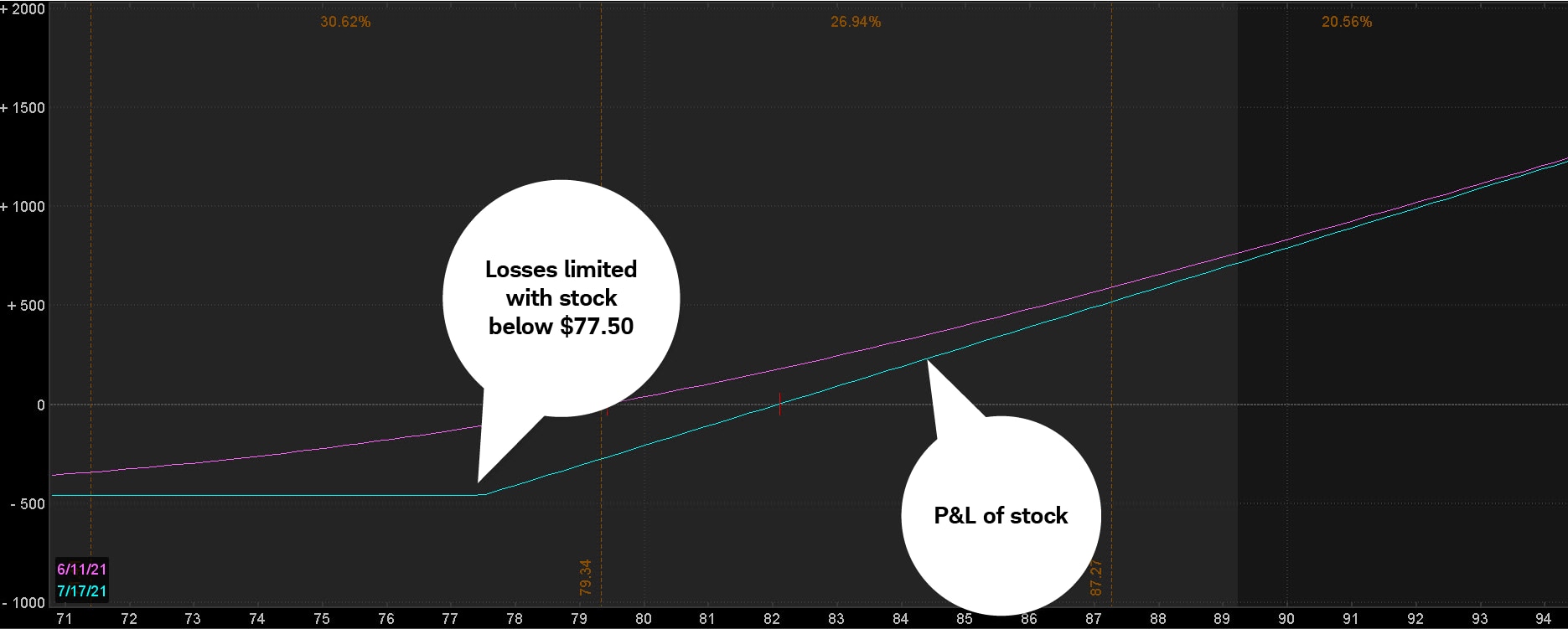

Using the data from the option chain table above, a trader might own the stock but isn't comfortable with the thought of it dropping below $77.50. This concern might be because the trader wants to attempt to protect profits or they might think that $77.50 represents a price support level on the price chart. Whatever the reason, paying $2.76 ($276 per contract) for the 77.5 put means the trader caps their losses at $4.60 if the stock falls below $77.50 on or before the expiration date of the option. That's the difference between the current stock price and the strike price ($79.34 – $77.50 = $1.84), plus the premium for the put ($2.76). And don't forget to add transaction costs.

In this example, the trader has limited their downside risk, but it's still possible to profit if the stock continues to rise.

Risk profile for protective put

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Although call and put options are used to make directional plays on a stock, it's also possible to use them to potentially generate income and protect stock you own.

1A limited-return strategy constructed of a long stock and a short call. Ideally, you want the stock to finish at or below the call strike at expiration. If the stock price settles above the strike price, you'd likely have your stock called away at the short call strike. You'd keep your original credit from the sale of the call as well as any gain in the stock up to the strike. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs.

2Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

3Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled "Characteristics and Risks of Standardized Options" before considering any options transaction.

With long options, investors may lose 100% of funds invested. Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Short selling must be done in a margin account.

Commissions, taxes and transaction costs are not included in this discussion but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0723-313F