"Should I own individual bonds or bond mutual funds?"

It's a question we're asked frequently, especially by those worried about the effects of rising interest rates. If you're not familiar with the ins and outs of each option, it can be hard to decide may be best for your needs.

There are pros and cons to each approach, and which option may be best for you comes down to your personal investment goals, including your time horizon and risk tolerance.

This article discusses bond mutual funds—if you’re interested in bond exchange-traded funds (ETFs) and how they compare with mutual funds, check out ETFs vs. Mutual Funds: It Depends on Your Strategy.

Individual bonds

Bonds typically pay semiannual coupon or interest payments and have fixed principal values—also known as face or par values—that are repaid at maturity. Although the par values are generally fixed, the price of a given bond can fluctuate in the secondary market depending on the direction of interest rates. When rates rise, bond prices typically fall, and vice versa. As the bond approaches its maturity date, its price generally will converge with its par value. Holding a bond to maturity does come with an opportunity cost: If rates rise while you're holding the bond, you could miss out on the higher coupons offered by newer bonds on the market.

The key benefits to owning individual bonds, barring bond default, are:

- A reliable income stream that is great for planning: If an investor has periodic upcoming expenses, like college tuition, having a reliable income stream can be great for planning.

- A predictable value at maturity: Assuming the bond is not callable (eligible to be called back by the issuer at or above par prior to its maturity date), you will receive the par value of the bond at maturity, barring default. Knowing this may help you ignore potential price fluctuations for the bond if you plan on holding it to maturity.

- Your own cost basis: With individual bonds, the price you pay to purchase the bond, and the amortization of any premium or discount for the bond, forms your cost basis. This feature is useful for tax-planning purposes.

The downsides to owning individual bonds are:

- You need a significant amount of bonds to achieve diversification. There are many sub-asset classes within the fixed income market, and diversification may be difficult to achieve using only individual bonds. Along with diversification among sub-asset classes, diversification across issuers is also crucial. The amount you have to invest to achieve this level of diversification1 might be cost prohibitive for some investors.

- Pricing is generally less attractive than the pricing institutional investors receive. Institutional investors—those who purchase large quantities of bonds at one time—generally receive better pricing than individual investors. It is important to examine the price you are paying when purchasing individual bonds.

- It takes a significant amount of time to research individual bonds and manage a strategy for the bonds. There are thousands of individual bonds from thousands of individual issuers that are available to buy. Researching the issuer alone to get a sense of its creditworthiness often isn't enough—most issuers have multiple bonds outstanding, each with its own characteristics. Taking this all in, it's a comprehensive process to make sure you're owning the bonds that are right for you. Even after investing in a portfolio of bonds, managing the holdings can still be time-consuming.

Bond mutual funds

Bond mutual funds usually hold a large number of bonds with a variety of issuers, maturity dates, coupon rates and credit ratings. Unlike individual bonds, which usually make semiannual interest payments, bond funds usually make monthly distributions that can be paid directly to the investor or reinvested into the fund to compound returns. One key difference between individual bonds and bond funds is that with bond funds, there's no guarantee that you'll recover your principal at a specific time, particularly in a rising-rate environment.

The key benefits to owning bond funds are:

- Greater diversification per dollar invested: It is much easier to achieve a diversified bond portfolio per dollar invested using a fund, because you obtain exposure to a basket of bonds within the fund.

- Access to institutional pricing: Bond funds generally receive better pricing on individual bonds than individual investors do. All else being equal, a lower price means a higher yield.

- Professional management: Some of the riskier segments of the fixed income market, like high-yield bonds, bank loans or preferred securities, have many nuances. They require a good knowledge of industry trends and credit analysis to navigate them successfully. If the fund is more actively managed, it also allows for the manager to buy or sell bonds depending on the economic and interest rate environment, potentially increasing returns and income.

The downside to owning bond funds is:

- The management fee: Management fees for the more actively traded bond funds can be higher, which may lead to lower returns. In contrast, when owning individual bonds, there's usually a commission charged when the bond is purchased, and unless it's sold prior to maturity, there are no other charges.

- The net asset value (NAV) will fluctuate with the market: As interest rates rise and fall, the NAV of a given bond fund will fall and rise respectively, and there's no certainty as to what the NAV may be at a point in the future. This makes bond funds less attractive than individual bonds when planning for future liabilities.

- Different cost basis and tax consequences: Bond funds pool money in order to purchase the bonds in the portfolio. With pooled funds, your cost basis for tax purposes won't be as simple as if you had purchased an individual bond and held it to maturity. Additionally, you do not have control of the buying and selling of the individual bonds, which can lead to capital gain distributions at the end of the year. These capital gain distributions can be hard to anticipate and plan for from a tax standpoint.

Investor preferences and circumstances

| Individual Bonds | Bond Mutual Funds | |

|---|---|---|

| Management Style | Managed by the investor | Professional management that can be active or passive |

| Minimum Investment Amount | Preferably large | Small |

| Fees and Costs | There is generally a commission to buy or sell a bond, but then there are no ongoing fees. | Management fees and sales fees depending on the share class |

| Income Frequency | Typically semiannually | Typically monthly |

| Predictable Market Value at Maturity | Yes, barring default | No |

| Option for Automatic Coupon Reinvestment | No | Yes |

| Cost Basis | Individual cost basis for each bond | Cost basis is based on the price paid for the share of the fund |

| Customization | Yes | No |

| Diversification | Harder to achieve | Easier to achieve |

All of the pros and cons for individual bonds and bond funds need to be placed into the context of your preferences and circumstances. What works well for you might not work well for others, and vice versa. The table above is a good starting point for deciding what is better for you. There are three important considerations when determining whether an individual bond or bond fund is better for you: the amount you have to invest, your financial goals and your behavioral preferences.

The amount of assets you have to invest in your bond portfolio is a key consideration when determining whether to invest in individual bonds or bond funds. Individual bonds have denominations that can be cost-prohibitive for some investors. Add in how many individual bonds an investor needs for sufficient diversification, and the dollar amount continues to rise. For some, it might make sense to use a more accessible bond fund, or a combination of bond funds with individual bonds.

Financial goals are another important factor to consider. If you are looking for predictable value and certainty for your financial goals, then individual bonds may be a better fit. Meanwhile, if you are looking for professional management and want greater diversification for your financial goals, then bond funds may be a better fit.

Behavioral preference is another important consideration. If seeing the NAV of your fund fluctuate and having no control over certain tax consequences makes you uncomfortable, then bond funds might not be the best solution for you. It is important to realize that while you cannot eliminate the emotions involved in investing, you can recognize how a certain investment might make you feel and adapt your investment choices accordingly.

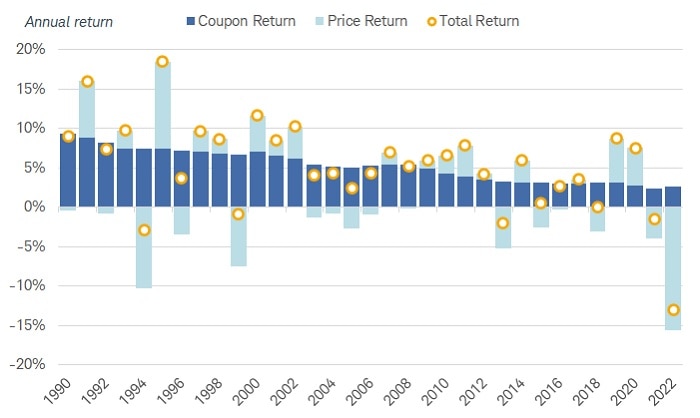

In the long run, the difference in performance between a portfolio of individual bonds and a bond mutual fund with the same duration and credit quality, held for the same amount of time, is likely to be small, because most of what an investor gets out of investing in bonds is the income generated by coupon returns, rather than the price change. The key is to make sure the investment vehicle you choose aligns with your goals and time frame.

Coupon returns are always positive, and account for a large portion of total returns

Source: Bloomberg U.S. Aggregate Bond Index, as of 12/31/2022.

Annual returns are the products of monthly total returns. Total returns assume reinvestment of interest and capital gains. The price return columns in this chart include both price return and “other” return, which includes paydown return for mortgage-backed securities. Past performance is no guarantee of future results.

What you can do next

There's no one right answer—bonds or bond funds—for every investor. The decision often comes down to the amount you have to invest, the preference for a professional manager, and the need for a predictable value at maturity.

Holding individual bonds generally requires more time and effort by the investor, but a Schwab fixed income specialist can help get you started. For bond funds, knowing your risk tolerance and investment time horizon makes selecting bond funds much easier. The Schwab Mutual Fund OneSource Select List® can help streamline the process even further, enabling you to screen a high-quality group of funds based on these criteria.

The Schwab Mutual Fund OneSource Select List® can help streamline the process even further, enabling you to screen a high-quality group of funds based on these criteria.

1 When owning individual bonds, the Schwab Center for Financial Research generally recommends holding at least 10 individual issues. For non-government guaranteed bonds like municipal or corporate bonds, we recommend holding at least 10 different issuers as well, to boost the diversification benefit and reduce the impact if any of the issuers were to default. Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives.

Investors should consider carefully information contained in the prospectus, or if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Past performance is no guarantee of future results.

Investing involves risk including loss of principal.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. Lower rated securities are subject to greater credit risk, default risk, and liquidity risk.

Tax-exempt bonds are not necessarily a suitable investment for all persons. Information related to a security's tax-exempt status (federal and in-state) is obtained from third parties, and Schwab does not guarantee its accuracy. Tax-exempt income may be subject to the Alternative Minimum Tax (AMT). Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax.

Bank loans typically have below investment-grade credit ratings and may be subject to more credit risk, including the risk of nonpayment of principal or interest. Most bank loans have floating coupon rates that are tied to short-term reference rates like the Secured Overnight Financing Rate (SOFR), so substantial increases in interest rates may make it more difficult for issuers to service their debt and cause an increase in loan defaults. A rise in short-term references rates typically result in higher income payments for investors, however. Bank loans are typically secured by collateral posted by the issuer, or guarantees of its affiliates, the value of which may decline and be insufficient to cover repayment of the loan. Many loans are relatively illiquid or are subject to restrictions on resales, have delayed settlement periods, and may be difficult to value. Bank loans are also subject to maturity extension risk and prepayment risk.

Preferred securities are a type of hybrid investment that share characteristics of both stock and bonds. They are often callable, meaning the issuing company may redeem the security at a certain price after a certain date. Such call features, and the timing of a call, may affect the security’s yield. Preferred securities generally have lower credit ratings and a lower claim to assets than the issuer's individual bonds. Like bonds, prices of preferred securities tend to move inversely with interest rates, so their prices may fall during periods of rising interest rates. Investment value will fluctuate, and preferred securities, when sold before maturity, may be worth more or less than original cost. Preferred securities are subject to various other risks including changes in interest rates and credit quality, default risks, market valuations, liquidity, prepayments, early redemption, deferral risk, corporate events, tax ramifications, and other factors.

Diversification strategies do not ensure a profit and cannot protect against losses in a declining market.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively 'Bloomberg'). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

0823-3UUW