Call options can be complicated because there are a lot of moving parts. There's far more to them than just anticipating how much price will move.

The options greeks refer to a set of calculations option traders use to measure different factors that might affect the price of an options contract over its lifetime.

If traders can visualize the changes in the greeks, it can help them build expectations for how the option itself moves, which, in turn, helps them make more informed decisions about which options to trade and when to trade them.

But before we get into the greeks, let's review the basic structure of an options premium.

Intrinsic and extrinsic values

An options premium consists of intrinsic and extrinsic value. Intrinsic value of in-the-money1 (ITM) options is the value an option has only because of where the underlying stock is right now; at expiration, the extrinsic value of an option is $0.

Intrinsic value is calculated by taking the difference between the strike price and the current price of the underlying stock. For a call option, if the underlying's price is above the strike price, the intrinsic value will be the difference between the two prices. If the underlying's price is below the strike price, then the option will have no intrinsic value. You may remember that options with intrinsic value are ITM and options without intrinsic value are out of the money2 (OTM).

Extrinsic value is the difference between the call premium and the intrinsic value. Extrinsic value is affected by time and implied volatility3 (IV).

Notice in the chart below how the extrinsic values are highest near the at-the-money (ATM) option. As we explore the greeks, you'll learn why.

Source: paperMoney platform

For illustrative purposes only.

In options trading, there are four major greeks: delta, gamma, theta, and vega. Delta and gamma deal mostly with the price of the underlying security, whereas theta and vega deal with the extrinsic value. Let's discuss each.

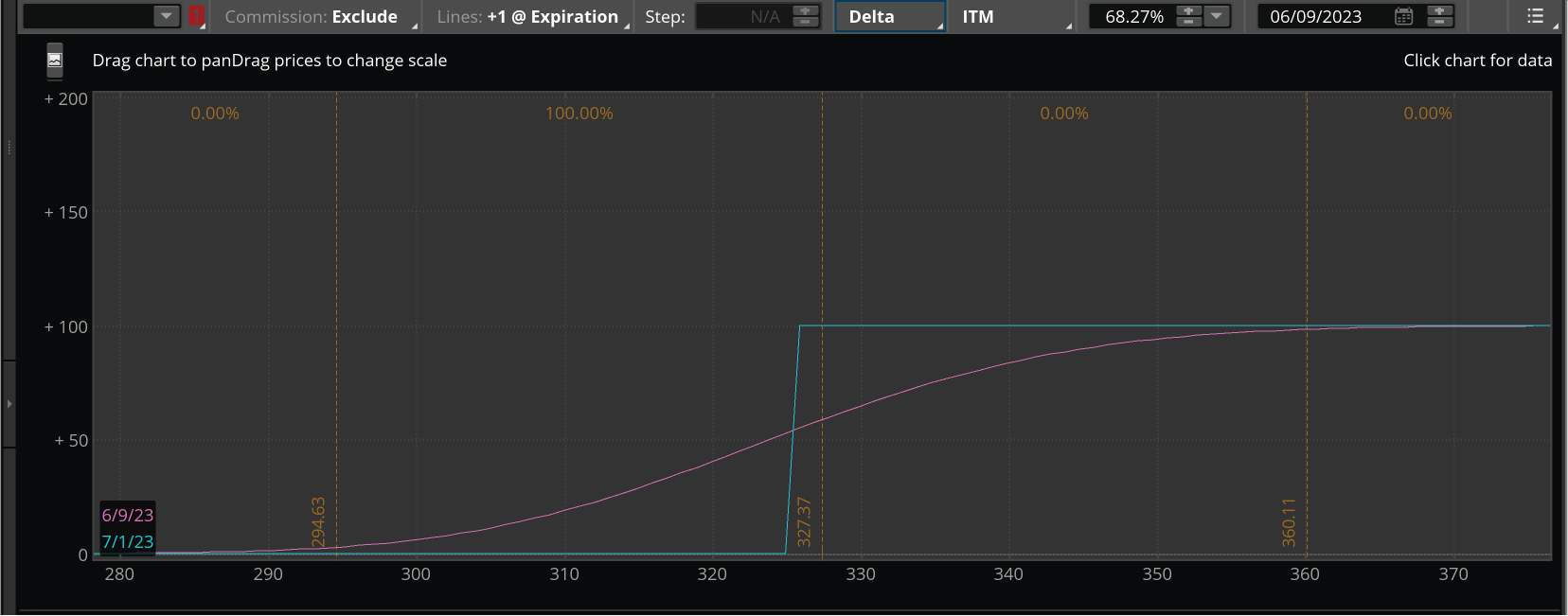

Delta

Delta measures how much the options premium will change, theoretically, with a $1 move in the underlying price. For example, if a call option has a delta of .53 and the underlying climbs $1, the option is expected to increase $0.53 in value. Below is a graph of the change in delta for a call option. Notice how the purple line, which includes both intrinsic and extrinsic values, rises as the underlying's price increases. The green line, which shoots straight up and then straight across, includes only intrinsic value. (The delta of 1 on the y-axis is equal to 1,000.)

Source: paperMoney platform

For illustrative purposes only.

Let's discuss the changes in the purple line. If the underlying moves from $55 to $56, the delta will hardly increase compared to a change from $63 to $64. So, if a trader is a call buyer, they might consider options that are closer to ATM if they hope to capitalize on bigger moves. Of course, those big moves cut both ways, so traders should beware. If a trader is a covered call seller who wants to avoid losing stock through assignment, they could consider selling OTM calls so underlying price movements have little effect on their trade.

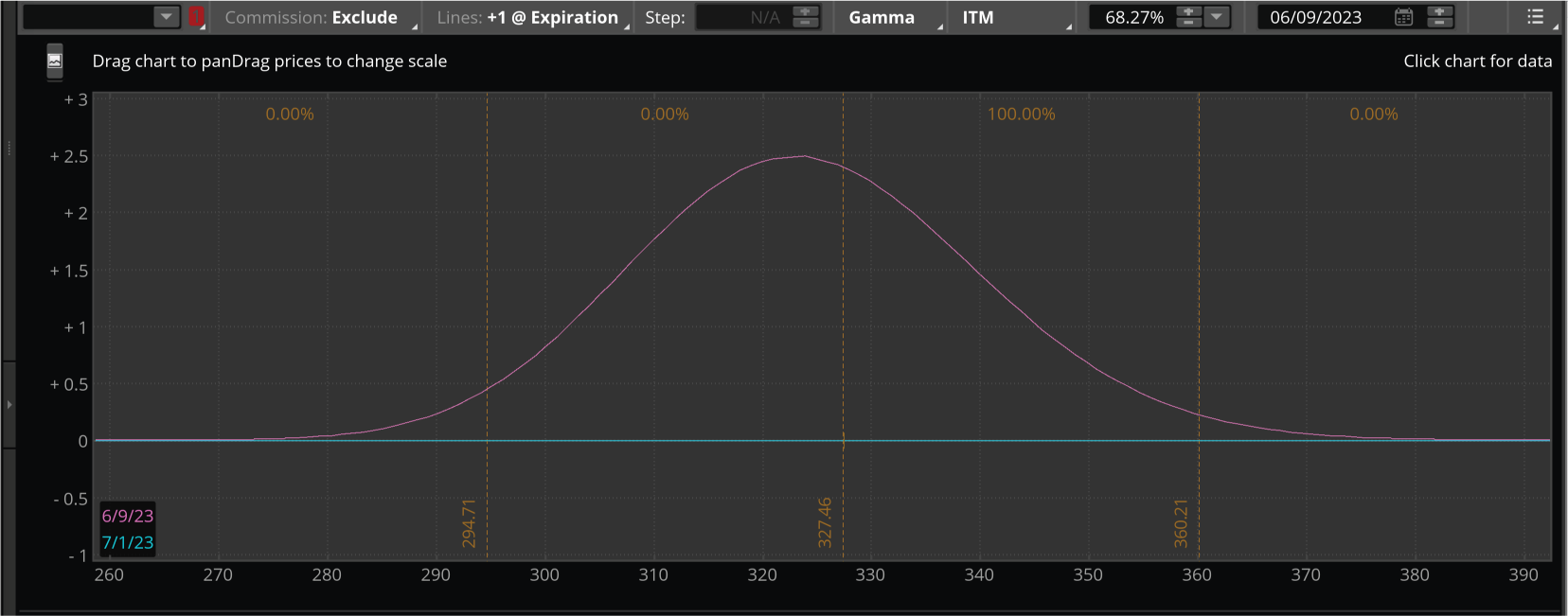

Gamma

Gamma measures how much delta is expected to change with each $1 move in the underlying. In the last chart, notice how the ends of the purple curve climbed at a slower rate. The middle of the curve is steeper, which reflects a higher rate of change. The rate of change is what gamma measures.

Now, look at the graph below. Notice the purple line swells in the middle and is flatter on the ends. This reflects changes in the delta curve as the underlying's price rallied into the strike price and then decelerated as it surpassed the strike price. Delta can only rise to a value of 1, so delta will generally grow at a faster rate when the option is ATM or nearly at ATM.

Source: paperMoney platform

For illustrative purposes only.

These two curves provide insight as to why extrinsic value is the highest when the option is ATM. When an option is ATM, the seller has the highest risk. Higher extrinsic value absorbs some of the price movement. The green gamma line shows how sensitive delta is when extrinsic value is a non-factor. So, as extrinsic value is reduced, gamma becomes a bigger factor.

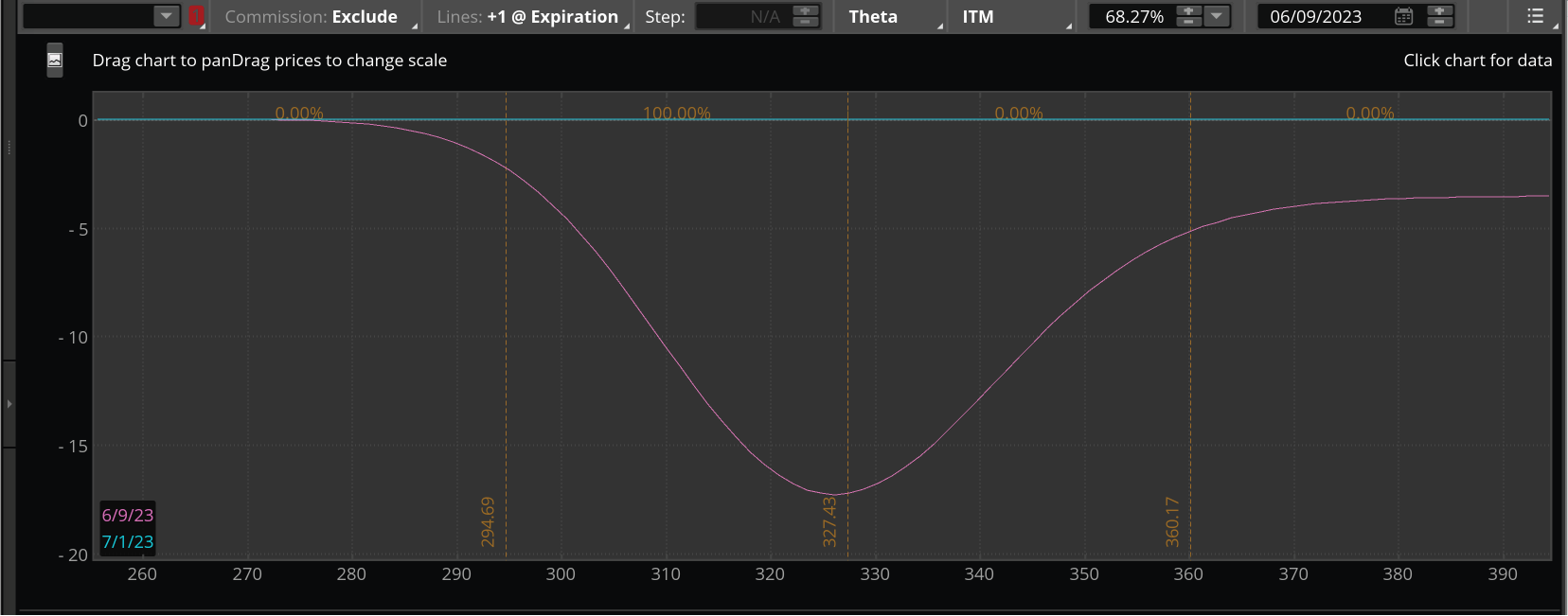

Theta

Theta is a greek dealing directly with extrinsic value. Theta measures how much the price of an option theoretically decreases each day as the option nears expiration, if all other factors remain the same. Remember, time decay works against option buyers and favors option sellers.

The chart below shows theta is highest for ATM options and lower for OTM and deep ITM options. Theta accelerated as the underlying's price rallied into the strike price and decelerated as it rallied passed the strike price.

Source: paperMoney platform

For illustrative purposes only.

Earlier, we observed that the biggest changes in delta and gamma, and by extension, the options premium, occur when the option is ATM. For option buyers, this can be a challenge because they have to overcome the extrinsic value that is working against them; in other words, time decay.

Option sellers can get the most extrinsic value by selling ATM options. However, they have a higher likelihood of assignment by doing this. So, they need to reconcile this risk by either accepting assignment or reducing the likelihood of assignment by selling OTM for a smaller premium.

Vega

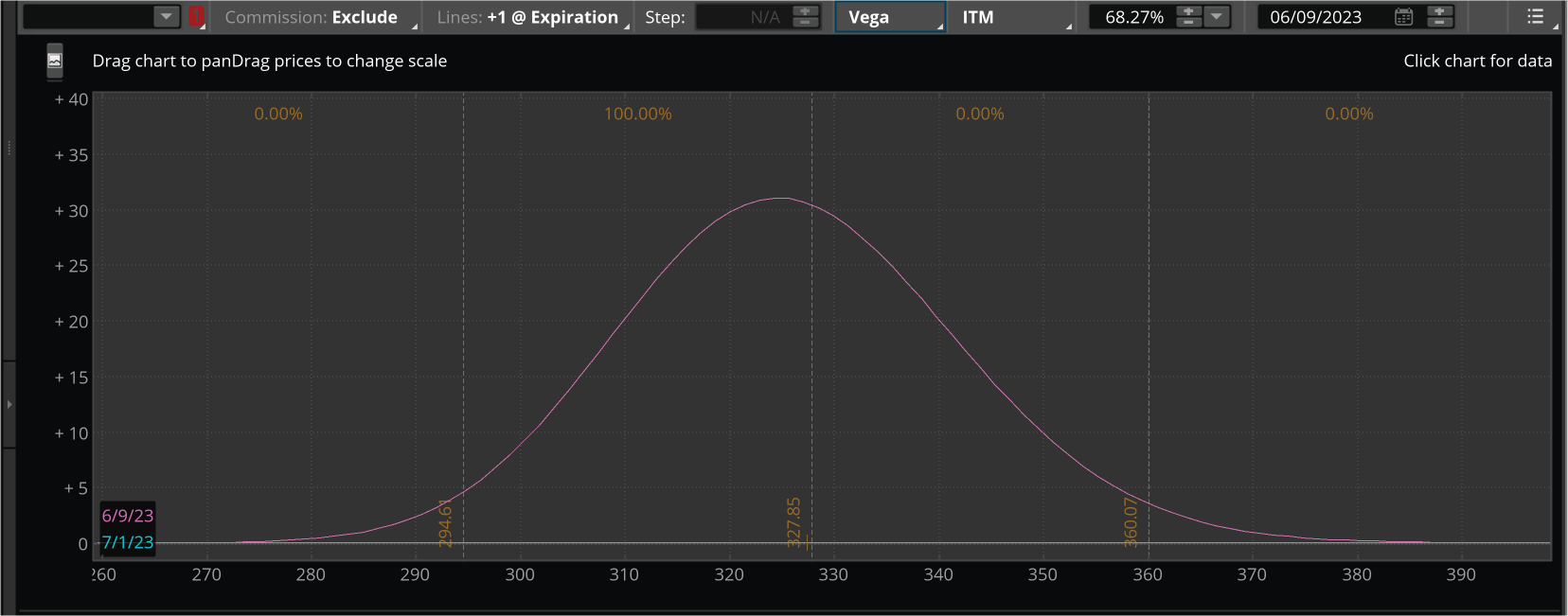

Vega measures how sensitive an option is to changes in IV. The chart below shows when the option is ATM, it has the highest sensitivity to IV.

IV can rise and fall independent of price movement. However, it commonly rises when price falls. This means the curve in the chart below can shrink and grow. Notice how the green line is flatlined on the bottom of the chart. This indicates there's no IV at expiration. Vega is highest ATM but shrinks as price pulls away in either direction.

Source: paperMoney platform

For illustrative purposes only.

So, what does this movement tell us about call strategies? This indicates buyers would prefer to buy when IV is low, and it's a bonus if IV rises. In fact, if traders bought an OTM option, they might potentially benefit from both the rising price and the rising IV if the stock moved in their favor.

However, buying OTM options tends to be a strategy with a lower probability of success.

An option seller who sells ATM might benefit if the IV drops. On the other hand, the trade could severely suffer if IV rises. Therefore, a seller might potentially benefit most by selling when IV is high and then falls.

Bottom line on greeks

By graphing the greeks, it's possible to draw a few conclusions. First, long calls have good potential if the stock appreciates, but they also have risks to keep in mind (like all options strategies) because of the difficulty of anticipating several variables.

Delta and gamma help explain the price movement of options when the price of the underlying security increases. Watch theta and days to expiration as time works against a long call position. Also, be aware of IV because when it's higher, premiums are also higher.

Unlike long calls, short calls or selling calls have opposite effects for theta and vega. As time goes by, theta is in a trader's favor and high IV means a trader might be able to receive bigger premiums for a short call. However, traders have to balance the risk of assignment with the amount of premium they wish to sell.

ATM options offer the highest extrinsic value and benefit the most from falling IV. However, they have a high risk of assignment and high vega risk, so a common practice is to sell OTM calls.

With a better understanding of how options prices work and how greeks can help traders manage the different portions of a premium, traders can build and plan their options strategies accordingly.

1Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

2Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

3The market's perception of the future volatility of the underlying security directly reflected in the options premium. Implied volatility is an annualized number expressed as a percentage (such as 25%), is forward-looking, and can change.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled "Characteristics and Risks of Standardized Options." Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Uncovered options strategies involve potential for unlimited risk, and must be done in margin accounts.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0723-3FDV