How to Trade Futures

Here are the basic steps involved in the futures trading process.

1. Understand and prepare for the risks.

One of the key concepts in understanding futures trading is that, as leveraged investments, a relatively small amount of capital is used to control a much larger contract amount. While this leverage provides a highly efficient use of capital, it is also a double-edged sword, potentially amplifying losses far beyond the amount originally invested.

In order to help protect against substantial loss, plan your futures trades carefully before you establish a position in the market. Identify both a profit objective and an exit plan, should the trade go against you.

Regardless of your trading objective, you'll need a brokerage account that's approved to trade futures in order to proceed with any strategy involving futures. Talk to a Schwab specialist at 888-245-6864 to learn more.

2. Select a futures market to trade in.

A good way to get started with futures is to focus on markets relevant to the companies, industries, or sectors you’re already knowledgeable about. For instance, if you’ve been a long-time investor in precious metal mining company stocks, gold futures may be a good candidate for your first trade. Keeping your focus on just one or two markets will increase the amount of time and attention available for following the commentary and news for those markets.

Now that you’ve picked a futures market, it’s time to form an opinion on its future price movement by studying the relevant fundamental and technical research, just like you would to evaluate a potential equity trade. Once you have researched the specific futures market and think you know where its price might be headed, you can then identify available futures contracts by size and month to see which might be suitable.

With Schwab, futures traders get streaming futures charting and technical indicators plus in-depth research and commentary—all conveniently built-in to the trading platform.

3. Understand the margin requirement.

Just as you would with an equity trading strategy, you should develop a plan for your futures trade before you place it.

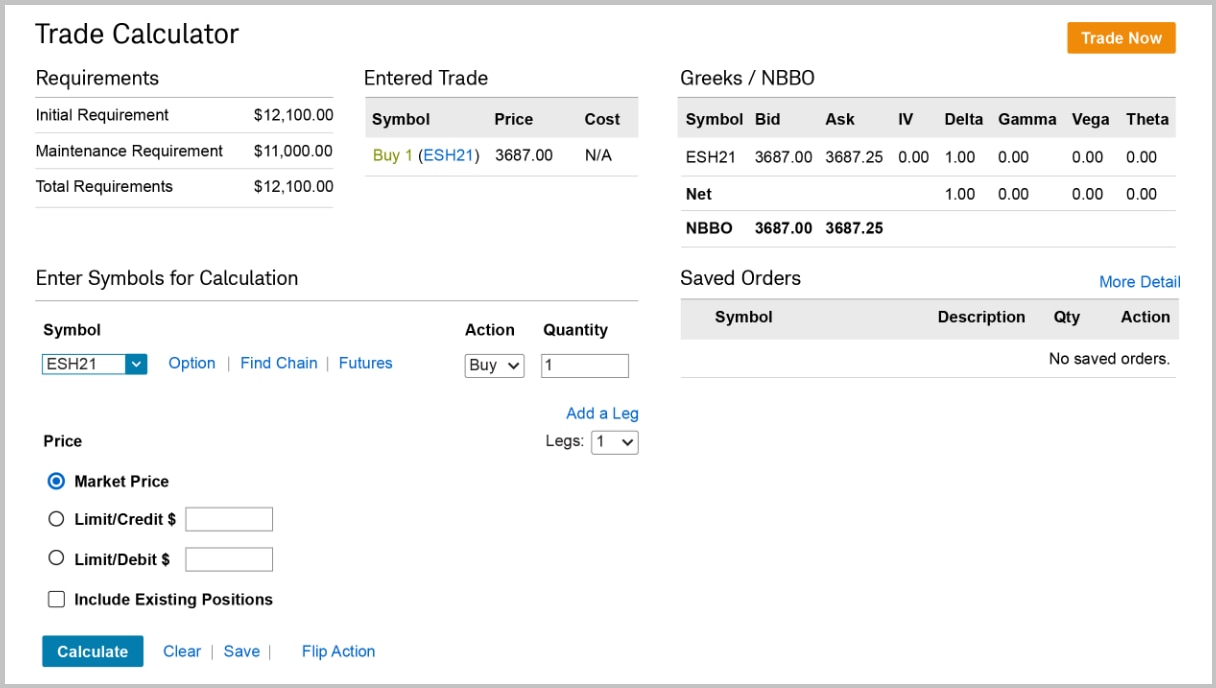

Schwab's Trade Calculator is designed to help traders understand the amount of money, or initial margin requirement, that you must deposit and keep on hand to make a futures trade.

4. Place and manage your futures trade.

Once you've settled on a specific futures contract to trade and created a plan for the trade, you're ready to use your futures account to establish the position by submitting an order for execution.

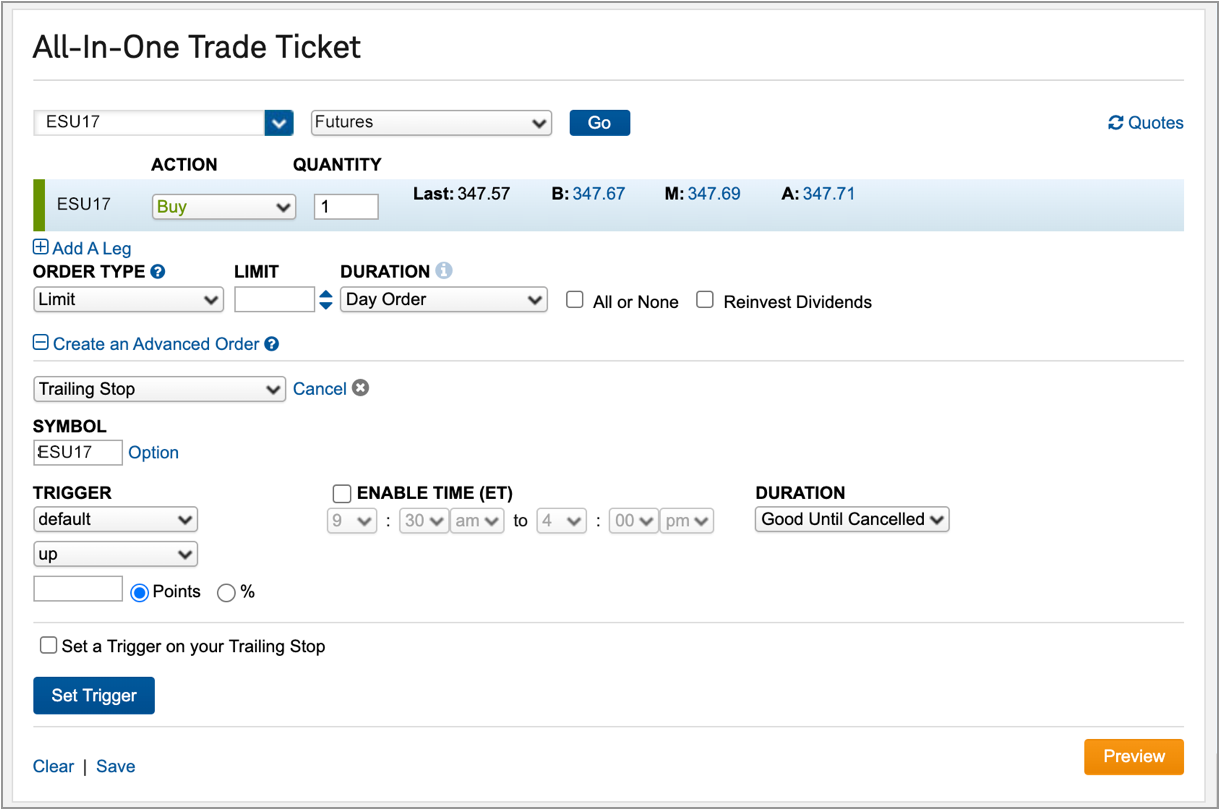

Using an online trade ticket for futures, enter the underlying symbol to find and select the specific futures contract you want to trade, then confirm the order details and submit the order. Don’t forget to set up an exit strategy using additional order types like a stop order and/or bracket order. Once your order is submitted, it will be routed to the market to be matched with an order to buy or sell your contract.

With your futures position established and protective orders in place to help manage your risk, it still pays to be diligent and prepared to reevaluate your exit strategy or take an action, depending on how the market moves.

Schwab’s All-in-One Trade Ticket® allows you to place orders for futures as well as stocks, ETFs, and options—all in the same window. You can also place advanced entry and exit orders simultaneously.

Why trade futures with Schwab?

-

Many types of futures to trade

Access a variety of futures products, including energies, metals, currencies, indices, interest rates, grains, livestock, and softs.

-

Expert commentary and research

Get market news and reports from industry-leading analysts, including Hightower, Wyckoff, Gramza, and more.

-

Live trade help from futures specialists

Let our dedicated team of specialists review your trades and even place them for you.

-

$2.25 futures per contract trade commission

Pay the same commission online or through a broker1 and your satisfaction is guaranteed.2

Open an account today

-

Open an account today

Already a client? Start trading or apply online for futures approval.

Have questions about futures? We’re here to help.

-

Call

Call -

Chat

Chat -

Visit

Visit