Choosing and implementing an options strategy like the covered call can be similar to driving a car. There are a lot of moving parts, but once you're familiar with the characteristics, you can steer toward your objective. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved.

What draws investors to the covered call options strategy? A covered call gives someone else the right to purchase stock shares you already own (hence "covered") at a specified price (strike price) and at any time on or before a specified date (expiration date). Covered calls can potentially earn income on stocks you already own. Of course, there's no free lunch; your stock could be called away at any time during the life of the option. But selling (or "writing") covered calls has many other potential uses that many investors may not fully realize.

So, let's pop the hood and look at three features of this basic options strategy: selling stock, collecting dividends, and potentially limiting taxes.

Exit a long position

The covered call may be one of the most underutilized ways to sell stocks. If you already plan to sell at a target price you might consider trying to collect some additional income in the process.

Here's how it works. Let's say XYZ stock is trading at $23 per share, and you want to sell your 100 shares at $25 per share. Sure, you could probably sell your XYZ shares right now for $23 per share in your brokerage account, but you could also sell (write) a covered call with your target price (strike price) of $25 per share.

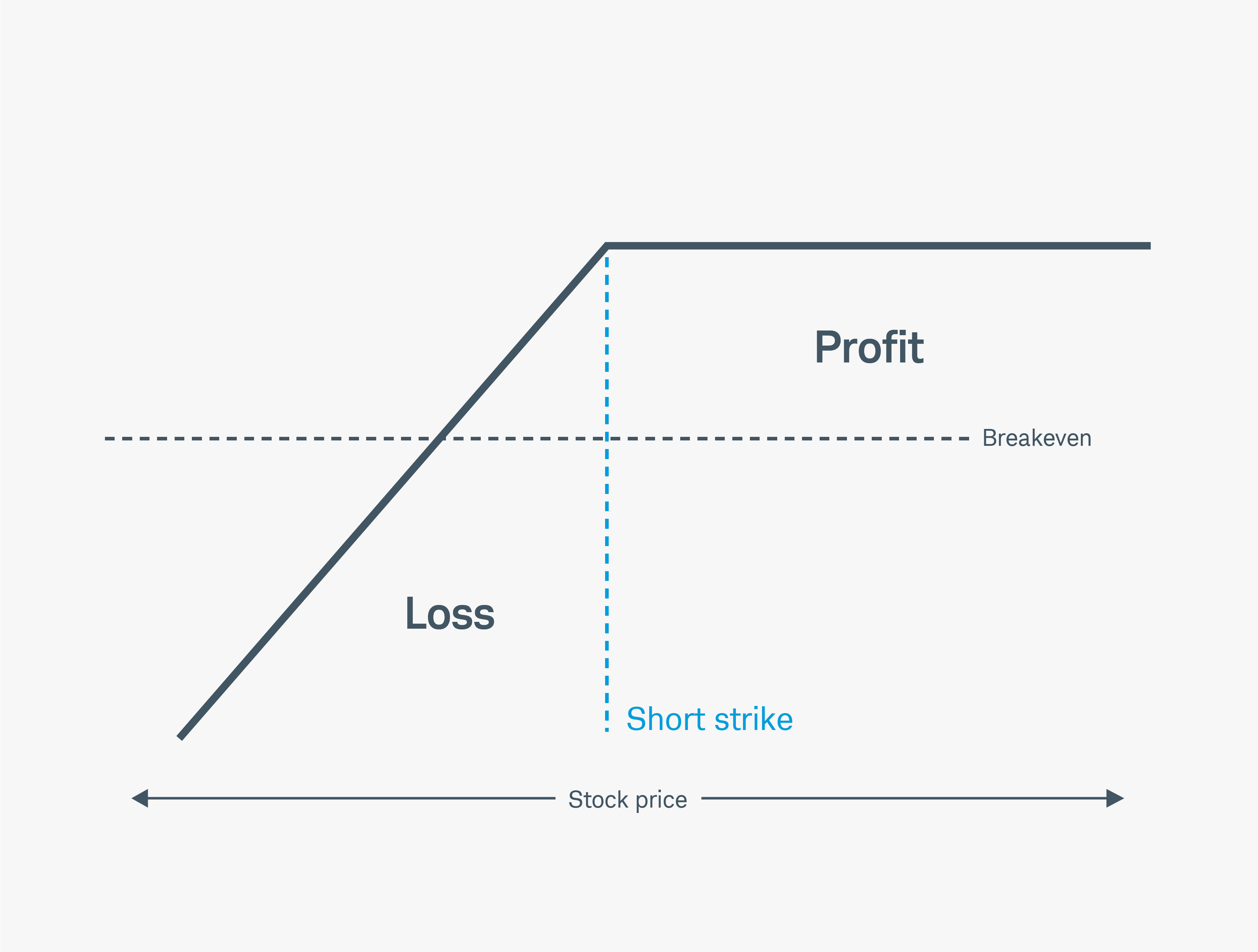

Take a look at the covered call risk profile in the chart below.

If you sell the call, you'll receive cash (premium), which is immediately deposited into your account (minus transaction costs). The cash is yours to keep no matter what happens to the underlying shares. If XYZ rises above $25 at any time until the option expires, you'll likely be assigned on your short option, and your shares of XYZ will be called away from you at the strike price. In fact, that move may fit right into your plan. You received a premium for selling the call, and you made an additional two points (from $23 to $25) on the stock.

As desired, the stock was sold at your target price (i.e., called away from you) at $25. If the stock goes higher than $25, you made what you wanted, but not a penny more. After all, you agreed to sell XYZ at $25. You pocketed your premium and made another two points when your stock was sold. But you won't participate in any stock appreciation above the strike price. Also, keep in mind that transaction costs (commissions, contract fees, and options assignment fees) will reduce your gains.

Covered call risk profile

On the other hand: Even though you'd like to sell XYZ at $25, it's possible that the stock price could fall from $23 to $20, or perhaps even lower. In this case, you'd keep the premium you received and still own the stock on the expiration date. But instead of the two points you hoped to gain, you're now looking at a potential loss (depending on the price at which you originally bought XYZ). In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option.

Hint: Many option traders spend a lot of time analyzing underlying stocks in an effort to avoid unwanted surprises. They use their research to try to improve the odds of choosing stocks that won't suffer a serious, unexpected price decline. But keep in mind, no matter how much research you do, surprises are always possible.

Another hint: Whenever your covered call option is at the money (ATM) or in the money (ITM), your stock could be called away from you. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price.

Keep in mind: If your option is ITM by even one penny when expiration arrives, your stock will likely be called away.

Sell covered calls for premium

Selling covered calls can sometimes feel like you've made a triple play. After you sell a covered call on XYZ, you collect your premium, and you still receive dividends (if any) and any potential capital gains on the underlying stock (unless it's called away). It's important to note that any capital gains received from holding the stock are capped at the strike price.

On the other hand: The option buyer (the person who agreed to buy your option) may also want that dividend, so as the ex-dividend date approaches, the chance your stock will be called away increases.

Hint: The option buyer (or holder) has the right to call the stock away from you any time. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date.

Another hint: Not surprisingly, some option buyers will exercise the call option before the ex-dividend date to capture the dividend for themselves. And if the option is deep ITM, there's a higher probability the stock will be called away from you before you get to collect the dividend. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. When you sell a covered call, you receive premium, but you also give up control of your stock.

Keep in mind: Though early exercise could happen at any time, the likelihood grows as the stock's ex-dividend date approaches.

Get potential tax advantages by selling covered calls

There may be tax advantages to selling covered calls within an individual retirement account (IRA) or other retirement account where premiums, capital gains, and dividends may be tax-deferred. However, there are exceptions, so consult your tax professional to discuss your personal circumstances.

If the stock is held in a taxable brokerage account, there are some tax considerations.

For example, let's say in November you have potential profits on XYZ stock, but for tax purposes, you don't want to sell. You could write a covered call that is currently ITM with a January expiration date. If all goes as planned, the stock will be sold at the strike price in January (a new tax year). Remember, you're always accepting the risk, no matter how small, that your option will be assigned sooner than you planned.

On the other hand: If the stock falls rather than appreciates, you'll likely still be holding the stock, and the call option will expire worthless. You could always consider selling the stock or selling another covered call. Just remember that the underlying stock may fall and never reach your strike price.

Hint: If you believe the benefits of selling covered calls outweigh the risks, you might look for stocks you consider good candidates for covered call writing. A buy-write allows you to simultaneously buy the underlying stock and sell (write) a covered call.

Keep in mind: You may be subject to two commissions: one for the buy on the stock and one for the write of the call. Even basic options strategies like covered calls require education, research, and practice. Remember, no options strategy may be right for you unless it's true to your investment goals and risk tolerance.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled "Characteristics and Risks of Standardized Options" before considering any options transaction. Call Schwab at 800-435-4000 for a current copy. Supporting documentation for any claims or statistical information is available upon request.

Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Commissions, taxes, and transaction costs are not included in this discussion but can affect the final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0423-3D3J