A simple, modern way to pay yourself in retirement from your portfolio.

Meet Schwab Intelligent Income®. You can generate a monthly paycheck from your investments for retirement, available with Schwab Intelligent Portfolios®.

See how it works

A few piano notes play and the Charles Schwab logo appears on screen, then quickly animates off. The music transitions to be more upbeat with piano, drums and guitar.

The screen turns blue as the words "Meet Schwab Intelligent Income appear on screen", and a multicolored circle forms around the words.

Narrator: Meet Schwab Intelligent Income.

The circle stays on screen as the words "Simple" and "Modern" animate in the middle.

Narrator: A simple, modern way to pay yourself from your portfolio.

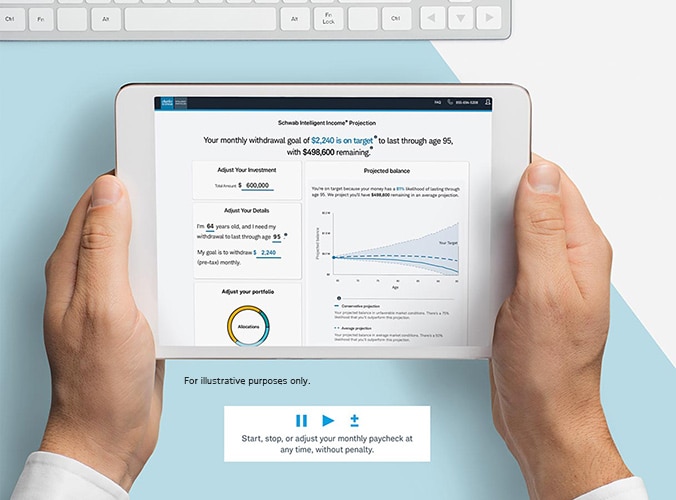

A tablet device animates on, replacing the circle, and shows a screengrab of the Schwab Intelligent Income interface with a portfolio allocation graphic on it showing a mix of fixed income, cash, commodities, and stocks strategies.

The tablet animates off and two multicolored, horizontal lines stacked on top of each other animate on.

Narrator: Tell us how much you have and how long you need it to last.

The numbers $600,000 and 30 years animate on top of the lines. Then the two lines merge into one and the numbers are replaced with $2,110/month.

Narrator: We'll estimate how much you could spend.

The lines and numbers disappear as four circles with icons in them animate on. The icons show a graduation cap, a plane, a house, and a golf course.

Narrator: Then, you can decide how you'll spend it.

The plane icon flies out of its circle.

The screen shifts again back to the portfolio allocation graphic on it showing a mix of fixed income, cash, commodities, and stocks strategies.

Narrator: You'll get a diversified portfolio of exchange-traded funds.

The tablet device animates off, and some text appears.

Onscreen Text: Manage complexity with automated, tax-smart withdrawals

Narrator: Schwab manages the complexity with automated, tax-smart withdrawals

The text animates away and new text animates, followed by an illustration of a paycheck.

Onscreen Text: One or multiple accounts

Narrator: in predictable paychecks from one, or multiple, accounts

Four multicolored squares animate on below the text and a white line connects the squares to the paycheck. These graphics animate off, and three circles animate on with icons inside them: a play button, a pause button, and a +/- sign.

Narrator: That you can start, stop, or adjust at any time with no penalties.

The circles animate off and text animates on.

Onscreen Text: Ultimate Flexibility

The word flexibility animates up and down.

Narrator: for the ultimate flexibility

New text animates on screen replacing the text before.

Onscreen Text: You can have confidence in retirement.

Narrator: Helping you feel confident as your goals and life change in retirement.

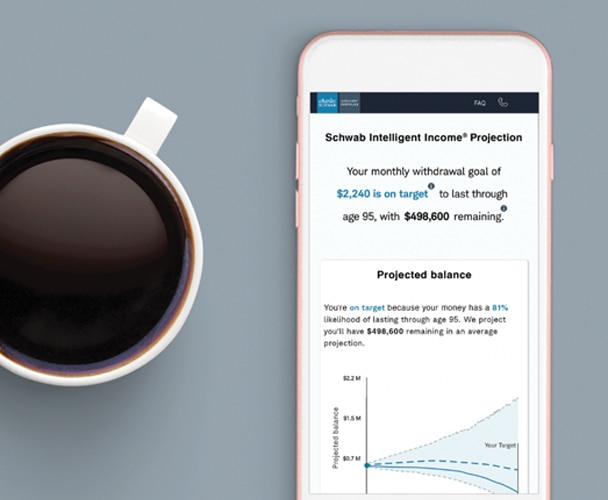

A tablet device appears again, showing the graph with age on the X axis and Projected Balance on the Y axis and multiple lines that show conservative, average, and extreme projections for how long your money could last based on your inputs. To the right of the graph there is onscreen text: On Target $2,110 per month.

Onscreen Text: You're on target because your money has a 80% likelihood of lasting through age 95. We project you'll have $582,300 remaining in an average projection.

Narrator: With projection tools that provide ongoing monitoring so you'll always know where you stand

A bar graph appears, replacing the device. There are two bars—one short one with the word Fees underneath and one taller one with the words Your $$$ underneath. The Fees bar animates down until it disappears and the Your $$$ bar grows taller.

Narrator: And since lower fees means more money for you to invest

Text animates in replacing the graph.

Onscreen Text: $0 Advisory Fee

Narrator: you pay no advisory fee

There's a pause in the narration, and more text animates on.

Onscreen Text: That's right $0 Advisory Fee

The screen changes to white, and some text is revealed.

Onscreen Text:

Schwab Intelligent Income®

Easily Adjustable + No Penalties + No Advisory Fee

Available with Schwab Intelligent Portfolios®

Narrator: Schwab Intelligent Income. Available with Schwab Intelligent Portfolios

The text disappears and is replaced by a blue square.

Narrator: Schwab, a modern approach to wealth management

The blue square turns around, revealing the Charles Schwab logo, the Own Your Tomorrow tagline.

Onscreen Text:

We encourage you to read the Schwab Intelligent Portfolios Solutions™ disclosure brochures for important information, pricing, and disclosures. Before you enroll, it's important you understand any and all costs, including the role of cash and the way Schwab earns income from the cash allocation in your portfolio, which may affect performance, and how Schwab and its affiliates work together.

We can't guarantee the amount or duration of your withdrawals or any specific tax results such as meeting Required Minimum Distributions.

Just as if you'd invested on your own, you will pay the operating expenses on the ETFs in your portfolio - which includes Schwab ETFs™. The portfolios also include a cash allocation to FDIC-insured Deposit Accounts at Charles Schwab Bank, SSB ("Schwab Bank"). Schwab Bank earns income on these deposits, and earns more the larger the cash allocation. The lower the interest rate Schwab Bank pays on the cash, the lower the yield. Some cash alternatives outside of Schwab Intelligent Portfolios Solutions pay a higher yield. You may incur IRS penalties for early withdrawal of funds depending on what type of account you have.

Schwab Intelligent Income® is an optional feature available with Schwab Intelligent Portfolios®, which has no advisory fee and doesn't charge commissions, and Schwab Intelligent Portfolios Premium®, which offers financial planning for an initial fee of $300 and a $30 per month advisory fee charged quarterly after that. Schwab does not charge an advisory fee for the SIP Program in part because of the revenue Schwab Bank generates from the Cash Allocation (an indirect cost of the Program).

Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium® are made available through Charles Schwab & Co. Inc. ("Schwab"), a dually registered investment advisor and broker dealer. Portfolio management services are provided by Charles Schwab Investment Advisory, Inc. ("CSIA"). Charles Schwab Investment Management, Inc. ("CSIM"), the investment advisor for Schwab Funds, receives management fees on ETFs. Schwab, CSIA, and CSIM are subsidiaries of the Charles Schwab Corporation.

©2023 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. (0523-3JUD) ADS118798-06

why to buy

-

See how long your savings could last.

Gain clarity on how much you could withdraw from your portfolio to meet your income needs.

-

Automated investing with tax-smart withdrawals.

We'll build you a diversified portfolio of Tooltip (ETFs) based on your goals and automate predictable withdrawals.

-

Flexibility without penalties.

Get the flexibility to start, stop, or adjust at any time without penalties. Plus, access projection tools and monitoring, so you know where you stand.

-

Plan for your income needs and future goals.

Unlike some other income solutions, you have full control of any remaining principal to pass on to heirs or use for other purposes.

Curious about how much you can afford to withdraw in retirement?

With just a little information about your goals, we can give you an idea of how much you could withdraw with Schwab Intelligent Income.

Take the next step and let Schwab tailor your portfolio and monthly paycheck.

Get Started

See the details of how Schwab Intelligent Income works for you.

We start by helping you figure out how long your money could last.

First, we get to know you. We ask a few simple questions to understand your needs, timeline, and risk tolerance.

You tell us: How much you have in your portfolio and how long you need it to last.

We tell you: How much you can withdraw each month.

With Schwab Intelligent Income, we'll help you gain clarity on how much could be withdrawn from your enrolled accounts and be confident in knowing how long it could last.

We build a diversified portfolio across your accounts.

Schwab Intelligent Portfolios builds a diversified portfolio of ETFs across all of your enrolled investment accounts. You can expect our intelligent technology to help:

- Monitor and automatically rebalance your portfolio.

- Keep you diversified and on track.

- Possibly offset taxes on your investment gains if you enroll in automatic Tooltip .

We manage the complexity of making tax-smart withdrawals for you.

Schwab Intelligent Income handles the complexity for you by using algorithms to generate a tax-smart withdrawal across all your enrolled accounts. Prioritized account withdrawals will help you:

- Consider required minimum distributions Tooltip (RMDs) from enrolled Traditional IRA accounts.

- Plan for distributions for the long term with proportional withdrawals from taxable brokerage accounts and IRAs.

- Maintain flexibility by not tapping Roth IRAs until you need them.

You get the flexibility and visibility to spend with confidence.

What if you need money for an unexpected expense and need to change your withdrawal amount? Schwab Intelligent Income gives you flexibility by allowing you to:

- Start, stop, or adjust your paycheck any time without penalty.

- See the potential impact of changes with our dashboard and projection tools.

- Receive alerts when you get off target and get ideas for how to get back on track.

- Access live Schwab professionals 24/7.

You get the freedom to plan for your income needs and legacy goals.

Unlike less flexible income solutions, you can plan and adjust to meet your income needs and still have principal remaining for your legacy and other financial goals.

- Your portfolio stays invested in the market so it has the opportunity to grow as you withdraw.

- You can see how much principal could remain after your income needs are met, given a range of market scenarios.

- If you choose to modify your paycheck or unenroll assets, you can see the impact on your portfolio over time.

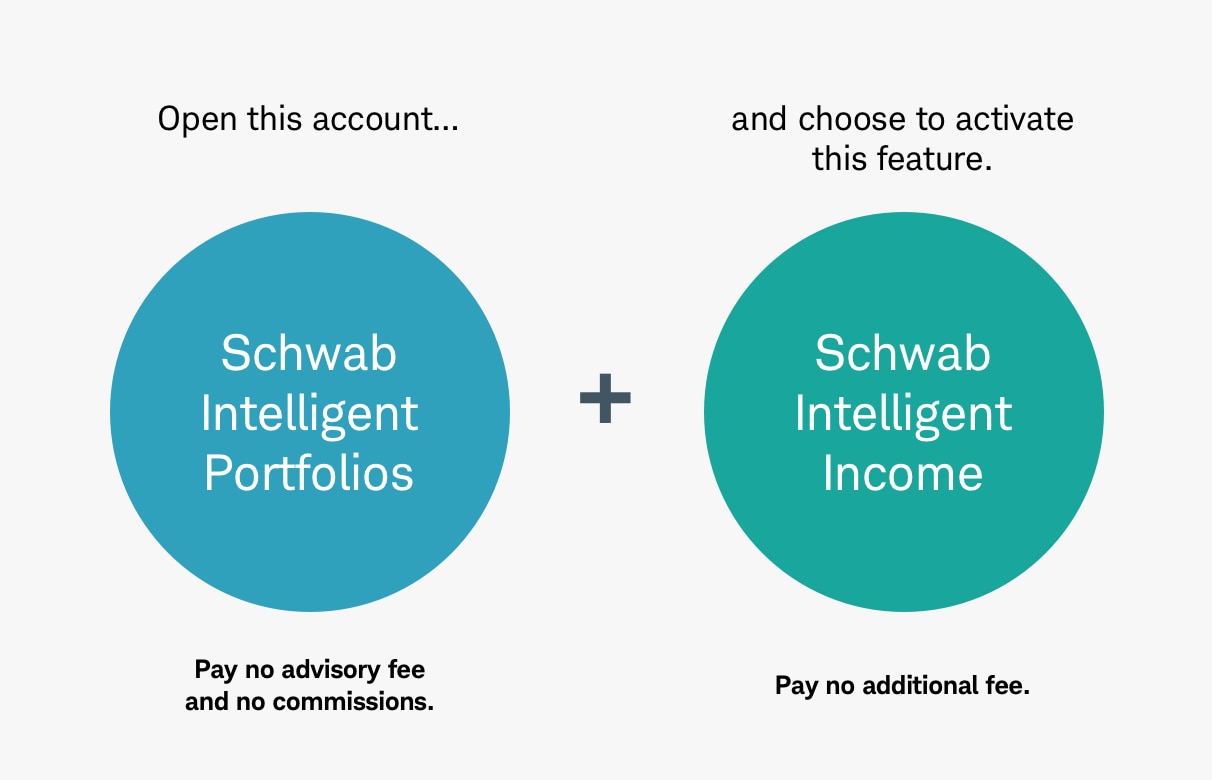

What you pay.

Schwab Intelligent Income is a feature you can activate when you open a Schwab Intelligent Portfolios account.

Schwab Intelligent Portfolios

- Pay no advisory fee and no commissions.

- You'll be invested in a portfolio of exchange-traded funds (ETFs). Just as if you'd invested on your own, you'll pay the operating expenses on the ETFs in your portfolio, including Schwab ETFs™.

- We believe cash is a key component of any investment portfolio. Based on your risk profile, a portion of your portfolio is placed in an FDIC-insured deposit at Schwab Bank. Some cash alternatives outside of the program pay a higher yield. See more information.

Schwab Intelligent Income

- You'll pay no additional fee for this feature.

Ready to get started

-

Ready to get started?

To activate Schwab Intelligent Income, choose "Invest to support current spending" during the account open process.

If you have any questions, call us at 855-694-5208.

Want to add ongoing guidance from a CERTIFIED FINANCIAL PLANNER™ professional?

For a one-time $300 planning fee and a $30/month advisory fee after that, you can choose to get unlimited access to a CFP® professional plus an interactive online planning tool to create a customized financial plan. This plan can consider other sources of income, including Social Security and pensions. To access this service, select Schwab Intelligent Portfolios Premium® during the account open process.

Common questions

-

There are no additional fees for the Schwab Intelligent Income feature. To enroll you must have a minimum of $5,000 per account for Schwab Intelligent Portfolios or a minimum of $25,000 for Schwab Intelligent Portfolios Premium, though these assets may be held across multiple Schwab Intelligent Portfolios Premium accounts.

-

Yes, Schwab Intelligent Income is designed to help you make predictable tax-smart withdrawals across multiple accounts, including taxable, IRA and Roth accounts. Most account types that can be used in Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium can be enrolled in Schwab Intelligent Income, with the exception of Custodial and Inherited IRAs and Joint Accounts.

-

Yes, Schwab Intelligent Income is a feature of Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium.

-

When the time is right and you need to set up your recurring withdrawal, you decide how much you want distributed, the frequency of the distribution and provide an account−generally a checking or savings account−where you would like the money to be transferred.

-

You are able to choose the frequency and deposit account to suit your needs. You can set up Schwab Intelligent Income to make withdrawals on a monthly, quarterly, semi-annual or annual basis and are able to direct your withdrawals to the account of your choosing. And of course, you can start, stop, or adjust your withdrawals at any time without penalty.

-

No, your withdrawals are not guaranteed and due to various factors, you may need to adjust your recurring withdrawal amount to help reach your goal. If you need or would like guaranteed income please contact us at 855-694-5208 to help find the right product for you.

-

You will be invested in a diversified portfolio of exchange-traded funds (ETFs) based on your goals, risk tolerance, and time horizon. Our advanced technology will help: monitor and automatically rebalance your portfolio, keep you diversified and on track, and may help to offset your taxes on your investment gains if you enroll in automatic tax-loss harvesting.

Ask us questions

-

Call

Call -

Chat

Chat -

Visit

Visit