Many of us save money in traditional 401(k)s, individual retirement accounts (IRAs), or other tax-deferred investment vehicles assuming that when we start withdrawing required minimum distributions (RMDs) in retirement, our income tax rate will be lower. However, it's not unusual for retirees to find themselves in the same or an even higher tax bracket. How so?

"Many people tap accumulated wealth outside their IRAs to support their livelihood during retirement," says Kathy Cashatt, CFP®, a Schwab senior financial planner in Phoenix. "When you add other income like investments and Social Security to your RMDs, you can land in an unexpectedly high tax bracket."

We explain how you can estimate your RMD and provide a number of strategies that can help reduce the impact of your distributions.

How is your RMD calculated?

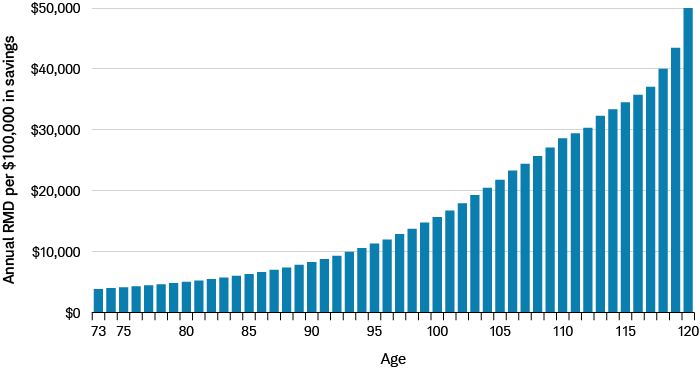

The IRS calculates RMDs by taking the balance of each tax-deferred retirement accounts at the end of each year and dividing it by a number based on life expectancy and other factors. The denominator gets smaller and smaller as your age increases, meaning your distributions get larger and larger. For example, the denominator starts at 26.5 for those age 731—or about $3,650 for every $100,000 in savings—and declines to a low of 2.0 for those age 120 or older—or about $50,000 for every $100,000 in savings.

RMD amounts change over time

Required minimum distributions (RMDs) from tax-deferred retirement accounts increase as you age.

Source: IRS.gov.

Many IRA custodians will notify account holders of their RMD amount each January, but you're ultimately responsible for ensuring the calculation is correct. You have until December 31 to take your RMD—or April 1 for your first distribution.

Take note that if you decide to delay your initial distribution until April, your second RMD will be due on December 31 of that same year. "Two sizable, taxable withdrawals in the same tax year can more easily bump you into a higher bracket," says Hayden Adams, CPA, CFP®, director of tax and wealth management at the Schwab Center for Financial Research, "so it's often best to take your first distribution in the year you reach your RMD age."

Once you start withdrawing funds, you should remain vigilant because your account balances will continue to fluctuate—and with them your RMDs.

A step-by-step guide to calculating your RMD

- Determine the balance of each tax-deferred retirement account as of December 31 of the previous year.

- Find the distribution period that corresponds to the age you'll turn this year.

- Divided the account balance for each account by the distribution period to get determine your RMD for each account.2

| Age | Distribution period (DP) |

|---|---|

| 73 | 26.5 |

| 74 | 25.5 |

| 75 | 24.6 |

| 76 | 23.7 |

| 77 | 22.9 |

| 78 | 22.0 |

| 79 | 21.1 |

| 80 | 20.2 |

| 81 | 19.4 |

| 82 | 18.5 |

| 83 | 17.7 |

| 84 | 16.8 |

| 85 | 16.0 |

| 86 | 15.2 |

| 87 | 14.4 |

| 88 | 13.7 |

| 89 | 12.9 |

| 90 | 12.2 |

| 91 | 11.5 |

| 92 | 10.8 |

| 93 | 10.1 |

| 94 | 9.5 |

| 95 | 8.9 |

| 96 | 8.4 |

| 97 | 7.8 |

| 98 | 7.3 |

| 99 | 6.8 |

| 100 | 6.4 |

| 101 | 6.0 |

| 102 | 5.6 |

| 103 | 5.2 |

| 104 | 4.9 |

| 105 | 4.6 |

| 106 | 4.3 |

| 107 | 4.1 |

| 108 | 3.9 |

| 109 | 3.7 |

| 110 | 3.5 |

| 111 | 3.4 |

| 112 | 3.3 |

| 113 | 3.1 |

| 114 | 3.0 |

| 115 | 2.9 |

| 116 | 2.8 |

| 117 | 2.7 |

| 118 | 2.5 |

| 119 | 2.3 |

| 120 and over | 2.0 |

For example, let's say you're 85 and not married. You had a total of $2 million in your tax-deferred IRAs at the end of last year. Your distribution period is 16.0, which means your RMD for this year will be $125,000 ($2,000,000 ÷ 16.0).

If you miscalculate your RMD or fail to withdraw the full amount on time, you'll owe a penalty on the amount not withdrawn: 50% for tax years before 2023 and 25% for 2023 onward under SECURE Act 2.0.3

Calculate your RMD

Use Schwab's online calculator (schwab.com/ira/ira-calculators/rmd) to estimate your annual distributions.

Drawing down your accounts

Your retirement savings will need to last you for the rest of your life. Planning ahead and making tax-efficient withdrawals could potentially leave you with more funds in your accounts, allowing your money to last longer. Here are three options to consider.

1. Begin taking withdrawals at age 59½

One approach is to start withdrawing funds from tax-deferred accounts at age 59½—generally your earliest opportunity without incurring a 10% penalty—although not so much that you edge yourself into a higher tax bracket. "One way to do this is by using a proportional withdrawal strategy," Hayden says.

This strategy can reduce the overall size of your tax-deferred accounts, and with them your future RMDs. Such withdrawals can also help make it possible to defer claiming your Social Security benefit, which increases 8% for every year you wait to collect beyond your full retirement age (up to age 70, after which there is no incremental benefit for delaying).

2. Convert to a Roth account

A second strategy is a Roth conversion, where you convert holdings in your tax deferred accounts to a Roth account, which is exempt from RMDs.

There are several situations in which such a conversion may make sense:

- You believe you'll be in a higher bracket when you eventually withdraw the money.

- You want to manage or reduce distributions once you hit your RMD age.

- You want to leave your heirs an income-tax-free asset, as Roth withdrawals aren't subject to income tax, assuming you've held the account for at least five years.

"If you have a sizable income in retirement or don't need the IRA money for living expenses, a Roth conversion could be a good approach," Hayden says. However, you'll pay ordinary income tax on the amount distributed from your regular IRA—and it's to your advantage to pay any income-tax liability from other taxable account assets.

That's because if you're under age 59½, by tapping IRA funds to pay the tax bill stemming from your conversion as well as the 10% penalty on top of any ordinary income tax, you maximize the amount going into the Roth. If you're over age 59½, using your IRA funds to satisfy your tax bill reduces the amount left to grow tax-free, undercutting the rationale behind your Roth conversion to begin with.

A Roth IRA conversion can be especially advantageous during your initial years of retirement, when RMDs haven't yet kicked in and you're most likely to be in a lower tax bracket vis-à-vis your working years.

Does converting to a Roth IRA make sense for you?

Use Schwab's Roth IRA conversion calculator (schwab.com/ira/ira-calculators) to compare the estimated future values of keeping your traditional IRA versus converting it to a Roth, as well as calculate the taxes you'd owe on a Roth conversion.

Consult a qualified financial planner or tax professional before making any decisions.

3. Make a qualified charitable distribution

Once you reach 70½, a third option to reduce or entirely satisfy your RMDs opens up: a qualified charitable distribution (QCD), in which funds are transferred directly from an IRA to a qualified charitable organization. Unlike RMDs, QCDs are not taxable, and each individual (married or single) can donate up to $100,000 a year from their IRA.

As part of the SECURE Act 2.0 legislation, the annual QCD limit will be adjusted for inflation starting in 2024. The new law also allows you to direct a one-time, $50,000 QCD to a charitable remainder trust or charitable gift annuity in 2023.

Before making a QCD, there are a couple of caveats:

- Your IRA custodian must transfer the funds directly—and only to a 501(c)(3) organization (donor-advised funds aren't eligible).

- You can't claim the QCD as a charitable deduction, but the distribution doesn't count as taxable income either.

"A QCD can make a lot of sense if charitable giving is already part of your overall financial plan," Hayden says. "You get the satisfaction of helping a worthy cause, while also covering a portion or all of your RMD."

Putting the puzzle together

Given the complexities involved with RMDs and the tax strategies involved with the options mentioned above, it's best to consult with a certified public accountant or qualified tax advisor who can help you navigate the intricacies of taking your distributions.

"From multiple tax-deferred accounts to Social Security to other potential sources of income, there are a number of moving pieces," Kathy says. "That's why we recommend meeting with a financial planner or tax professional to help you strategize the best way to minimize taxes in retirement."

1Effective January 1, 2023, SECURE Act 2.0 changed the age at which RMDs kick in from 72 to 73. An individual who turned 72 in 2022 is covered by the prior RMD rules. An individual who was born after 12/31/1950 and before 01/01/1959 is covered by the new RMD rules. Starting in 2033, the RMD age will increase to 75 for an individual born after 12/31/1958.

2The IRS permits you to aggregate your RMD amounts for all your IRAs and withdraw the total from a single IRA. For most defined contribution plans, such as 401(k)s, you cannot aggregate the RMD (this rule does not apply to 403(b)s).

3SECURE 2.0 reduces the penalty for missing an RMD due for 2023 and beyond. It does not impact missed RMDs in 2022 or before. Under SECURE 2.0, if you don't take your RMD by the IRS deadline, a penalty tax on insufficient or late RMD withdrawals applies. If the RMD is corrected timely, the penalty can be reduced. Follow the IRS guidelines and consult your tax advisor.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Investing involves risk including loss of principal.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax free and subsequent conversions will require their own 5-year holding period. In addition, earnings distributions prior to age 59½ are subject to an early withdrawal penalty.

This information does not constitute and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, or investment manager.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

0623-33F6