Placing an options trade involves a series of decisions about what to trade, how much to trade, and when to exit. We'll use a long call as an example, but the same general process would apply to a long put. As a quick recap, a long call strategy is bullish, so the ideal condition is a bullish market. The strategy is driven by long options, which tend to be effective in markets with low overall implied volatility—conditions that have generally favored long strategies. Let's see how these conditions work by walking through the sample long call investing plan.

An investing plan is a defined set of rules that can help you trade more systematically. It describes your:

- Trading objective (the goal of your strategy)

- Watchlist criteria (which type of securities you're looking for)

- Entry and exit rules (when you plan to get in and out of a trade)

- Money management (strategies for managing risk)

- Routines (steps for monitoring and evaluating your positions)

The sample investing plans available on the course dashboard are not meant to be one-size-fits-all recommendations for how to trade, but rather examples you can use to learn. Consider creating your own investing plan that reflects your unique preferences and risk tolerance and update your plan as you gain experience.

A smarter approach to long calls

The approach to trading long calls in this investing plan may be a little different from what you see other places. Some traders swing for the fences with long calls every time, making high risk and high potential return trades. That can mean big wins when it works out, but it's also a strategy that could bring lots of strikeouts and big losses.

The approach in this sample investing plan is more about pursuing success through lots of singles and doubles over time—trades that last for a few days to a few weeks but may move at a more manageable pace. It boils down to choosing at-the-money options a few months from expiration on uptrending stocks that you believe are ready to pop.

As you've learned, the objective of a long call is to profit from a short-term gain in the underlying stock or ETF by purchasing a long call. This means that stocks that tend to make larger moves in a short period of time tend to be favorable.

Watchlist criteria: Selecting an underlying stock

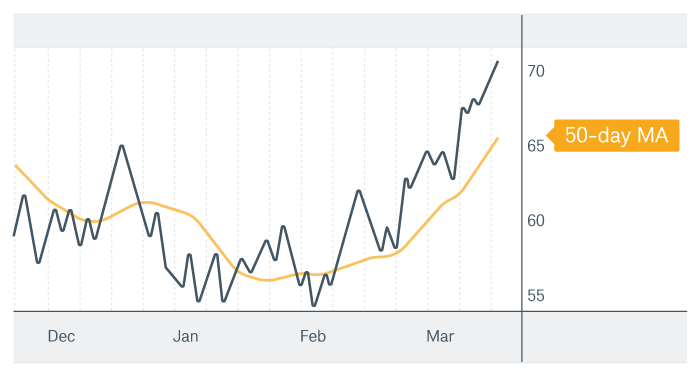

Candidates for long calls include stocks and ETFs that are uptrending. Of course, there's no guarantee that the trend will continue. One way to identify an uptrend is by using a moving average. The sample investing plan calls for a 50-day moving average where the stock's price is above an uptrending moving average.

Next, the sample investing plan says to consider stocks that have a high average daily volume (many traders look for at least 1 million shares). Stocks that see greater volume are more likely to have active options contracts with narrower bid/ask spreads.

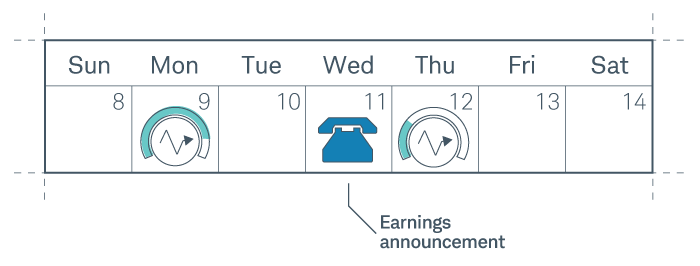

Finally, stocks with low implied volatility compared to historical implied volatility over the previous year are also preferable. A common mistake some new traders make is buying calls on stock around events like earnings in hopes of profiting from big moves in the underlying. The problem is that the options can be expensive at this time because of the high implied volatility. But as soon as the event occurs and the uncertainty around price movement ends, all that extrinsic value commonly disappears and the price of the options collapse. This is called a volatility crush, and it can be so dramatic that even if the stock moves in your direction, you can still lose money. That's why the sample investing plan includes a rule about avoiding underlying stocks with upcoming events like an earnings announcement.

Entry rules: Underlying stock setup and entry trigger

For a long call to be profitable, we need more than just an uptrend; we need significant upward movement in a short amount of time, typically five to 15 days. That's where technical analysis can help. One common entry for bullish traders is the support bounce. A support bounce occurs in a series of candles at support. An acronym that some find helpful when identifying a support bounce is CAHOLD, or a Close Above the High Of the Low Day. The pattern first identifies the bar with the lowest price in the series—this is the low day. Then, when a bar has a closing price above the high of the low day, technical traders would say it confirms the pattern.

When traders see an upward bounce like this, they expect price to rise. Because of these expectations, this is an entry for bullish traders hoping to profit from a stock's gains.

Entry rules: Selecting an expiration and strike

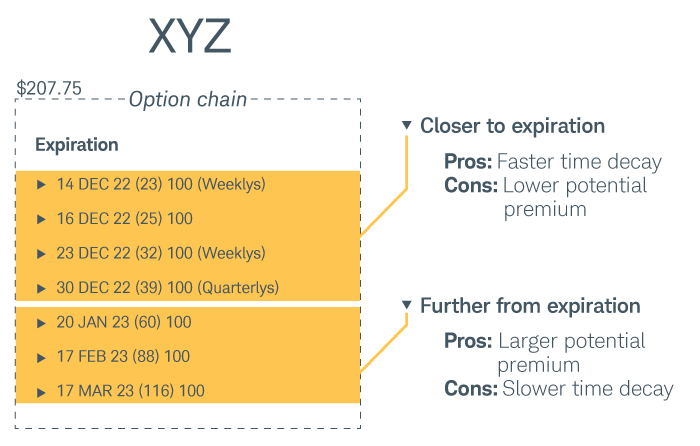

Next, we need to select an option, which comes down to selecting an expiration and a strike. The type of long call strategy taught in this course is a short-term trade where you'd expect the move to happen about five to 15 days after opening the trade. But that doesn't mean choosing a contract with only a few days to expiration. Remember, as an option buyer, time decay is working against you, eating into the value of your option. As expiration approaches, time decay speeds up. Options that are further away from expiration tend to have lower theta, which means less time decay. However, the longer the expiration, the more expensive the contracts will be, so you must weigh the low theta against the cost of the contract. Therefore, options with an expiration of 50 to 100 days may balance theta and premium.

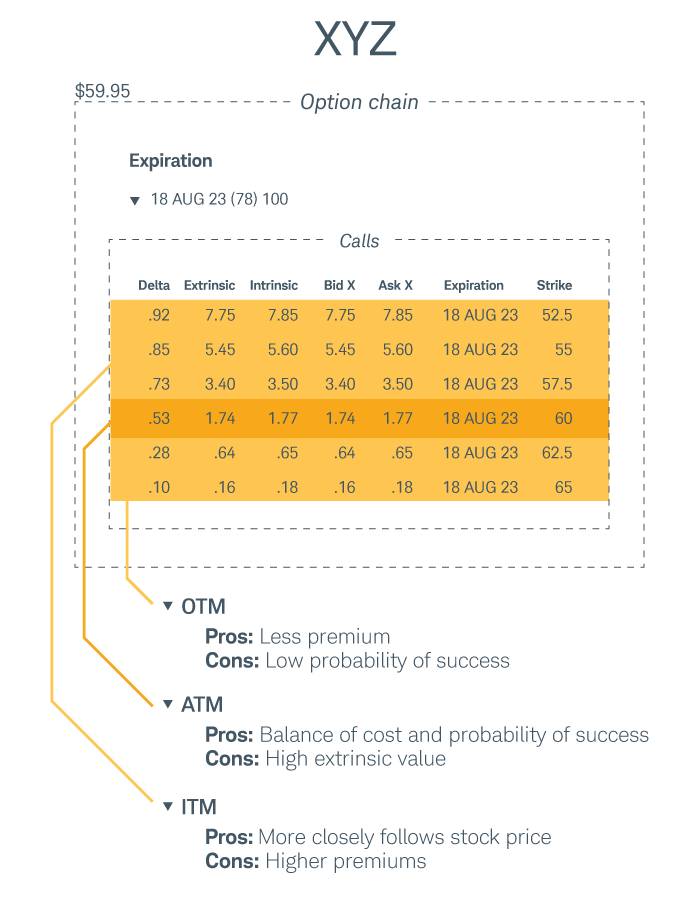

When it comes to selecting the strike, many traders would consider the at-the-money, or slightly in-the-money, strikes to balance cost with probability of success. Options that are deeper in the money are more expensive and may have wider spreads. Some traders are tempted to choose far out-of-the-money strikes because they tend to be much cheaper and the potential returns are big. But these options are cheap for a reason: You need a much bigger move in the underlying stock price just to break even, so the probability of profit is lower. The at-the-money strike provides a balance between costs and the probability of profit.

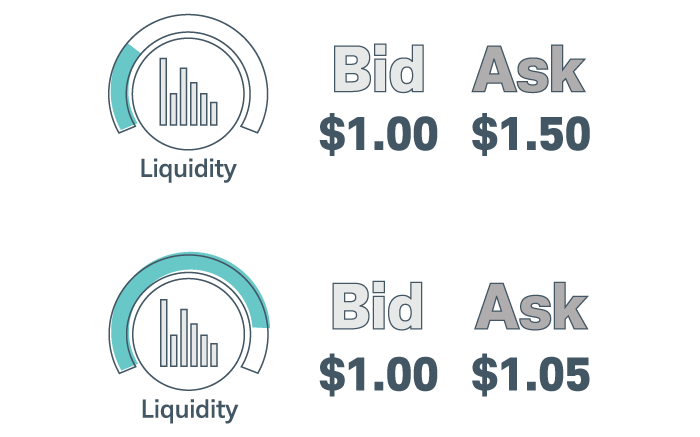

Also, consider underlying securities with highly liquid options. First, consider volume and open interest. Both of these tell you information about the liquidity of an option. Options with higher volume and open interest tend to have narrower bid/ask spreads. Some traders define a narrow bid/ask spread as 10% or less of the ask price.

Money management: Position sizing

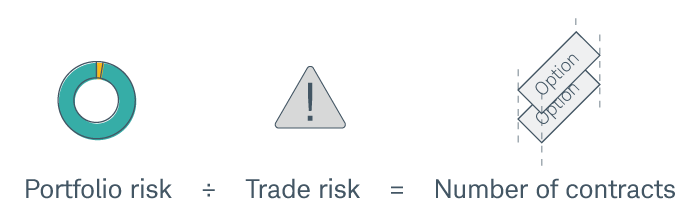

Once we've selected an option, we need to determine how many contracts to trade. For this strategy, consider using this common money management formula.

The portfolio risk is the amount of your active trading portfolio you're willing to risk on a single trade. For this strategy, consider a portfolio risk of 0.5% to 1%. For example, if you had a $100,000 active trading portfolio, you might risk $1,000 ($100,000 x .01).

The trade risk is the amount you'll lose if the trade fails completely, or the max loss.

The long call sample investing plan calls for using a 50% stop order to help manage risk by automatically triggering an order to close the position if the price of the option falls to the set price. However, we can't assume that we're going to get the order filled at 50%, so we'll assume our risk is the entire contract.

Let's walk through an example. Say a trader has a $50,000 active trading portfolio and is willing to risk 1% on a trade. Their portfolio risk is $500 ($50,000 x .01). Now, say our trader bought a long call for $2, or $200 per contract. If we divide the portfolio risk by the trade risk, we learn that our trade can buy two contracts ($500/$200) without risking more than 1% of the portfolio on the position.

In the following the video, an investing coach walks you through an example of setting up a long call.