With every transaction, there's a buyer and a seller, which is true for options trading too. Instead of buying a call or put option, traders can sell them, which means that instead of paying the premium, they can collect the premium, and instead of time value working against them, it can work for them. Of course, selling options comes with significant risks too. Here's a little background on what the options trader needs to know before selling options.

Please note that options trading involves significant risks and is not suitable for everyone. Certain requirements must be met to trade options through Schwab. Not all clients will qualify. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

Short selling options

Generally, a trader buys a call if they're bullish and buys a put if they're bearish. However, selling a call is usually a bearish strategy, and selling a put is usually a bullish strategy.

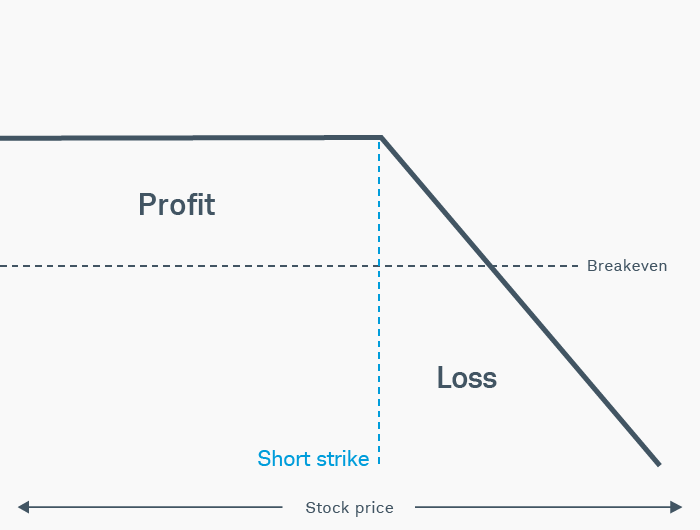

Selling or "shorting" options obligates the trader to either buy or sell the underlying security at any time up until the option expires or until the option is bought back to close or assigned1. In the case of a short call options position (see figure below), the trader has the obligation to sell the stock at a set price, known as the strike price, and is taking on unlimited risk because there's no limit to how far a stock can climb.

Risk profile of short call

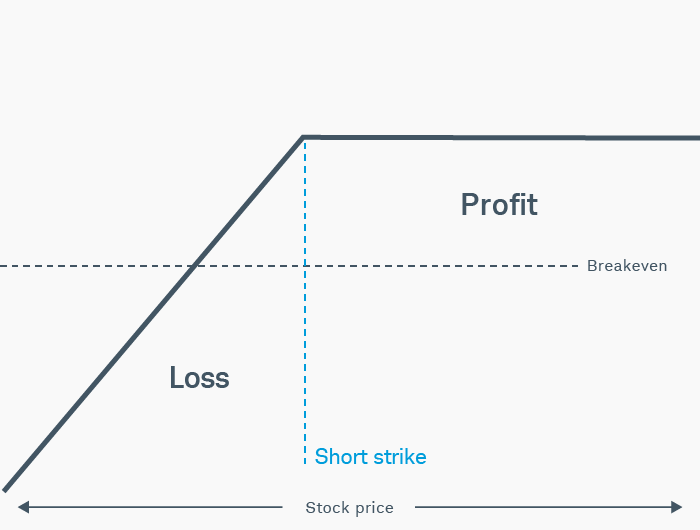

With a short put options position, the trader accepts the obligation to buy the stock at the strike price when the market price of the stock will likely be lower and could continue to fall. And although the stock could drop considerably before the trader decides to sell, the risk is technically limited because a stock's price cannot drop below $0.

The short put

Traders might employ a short put strategy2 for two main reasons: to potentially buy the stock at a lower price and/or to collect options premiums. With a short put position (see figure below), the trader takes in some premium in exchange for taking on the responsibility of potentially buying the underlying stock at the strike price. This money is credited to the account, and the trader keeps it even if the stock trades below the strike of the short put option.

Risk profile of short put

At any time prior to expiration, the trader who owns the put has the right to exercise the option. The likelihood of the put option being exercised increases if the stock trades at a price that's lower than the strike price. In that case, the short put seller would have a higher probability of assignment, meaning they'd have to buy the underlying stock at the strike price.

Let's say XYZ stock is currently trading at $64.50. However, the trader doesn't want to pay more than $60 per share to own it. They could sell the XYZ January 60 strike put for $2 per contract, obligating them to pay $60 per share for XYZ stock if assigned—exactly what they wanted. But because they're collecting $2 for the put, the net cost for the stock would be $58 per share (plus transaction fees) if they're assigned on the 60-strike put.

What about assignment?

If assigned on a short put, the trader takes delivery of the stock at the strike price, and it becomes part of their portfolio. For a standard options contract, the result is the purchase of 100 shares per put that has been assigned, but the quantity might be different if the contract has been adjusted after a stock split or is "nonstandard" for some other reason. Once an assignment notice is received, it's too late to close the options position, and the put seller is required to take delivery of the shares. Like any other stock position, they can then choose to hang on to the stock or sell it.

The impact of dividends

It's true that if XYZ stock happened to pay a dividend, then by owning XYZ entitles the shareholder to that dividend. By being short a put in XYZ stock, on the other hand, the trader is not entitled to a dividend. That said, keep two things in mind.

First, if a trader is assigned on short puts, then they take delivery of the stock, thereby granting them the right to all future dividend payments as long as they remain the stock owner.

Second, put options are adjusted to some degree for upcoming dividends. Puts sold on dividend-paying stocks are built to trade at a slightly higher premium than where they otherwise would trade if the underlying stock didn't offer a dividend, all else being equal. Among other factors, the deeper in the money3 the put option is, the greater the likelihood that the short option will be assigned and converted to stock, the greater the adjustment for the dividend.

Selling a call

Like selling a put, selling a call provides a premium in exchange for an obligation (to sell 100 shares of stock at the strike price per call option). Now, suppose a trader wants to sell a call option on a stock that is trading at $59.75. Imagine they sold a 60-strike call at $3. This premium is credited to the trader's account, and they get to keep it regardless of where XYZ is at expiration.

If XYZ stays below $60 per share until expiration and the short call isn't assigned, the 60-strike call will likely expire worthless, and the trader will keep the $3 premium. On the other hand, if XYZ trades above $60 per share prior to, or at, expiration, there is a high likelihood of assignment on the short call option. However, keep in mind that a short option can be assigned at any time up to expiration of the option regardless of where the price of the underlying is trading.

Assignment due

If a short call is assigned, the trader will receive a notice and be asked to sell the stock at $60. If they don't own or buy the necessary number of shares, the account will end up short4 those shares, which will require the use of margin (as well as any subsequent margin interest on the short position) and the price of the shares could rise, leading to losses, or fall, leading to gains. If the trader doesn't own the underlying stock, then the risk of loss of the subsequent short stock is unlimited because there's no limit to how much higher the stock can rise.

Deflating dividends

Options on dividend-paying stocks usually have lower call premiums because the stock price drops to reflect the dividend. Despite this effect, a call seller does carry the risk of the buyer exercising the call to grab the dividend before its paid. And the closer the ex-dividend date approaches, the higher the risk.

Because the risks of selling options can be substantial, many traders allocate only a small percentage of their portfolios to selling them. Also, whether selling puts or calls, the selling must be done in a margin account that's been approved for advanced options strategies. Just as with any new trading approach, traders will want to carefully balance the risks with the potential opportunities before diving in.

Option Hacker

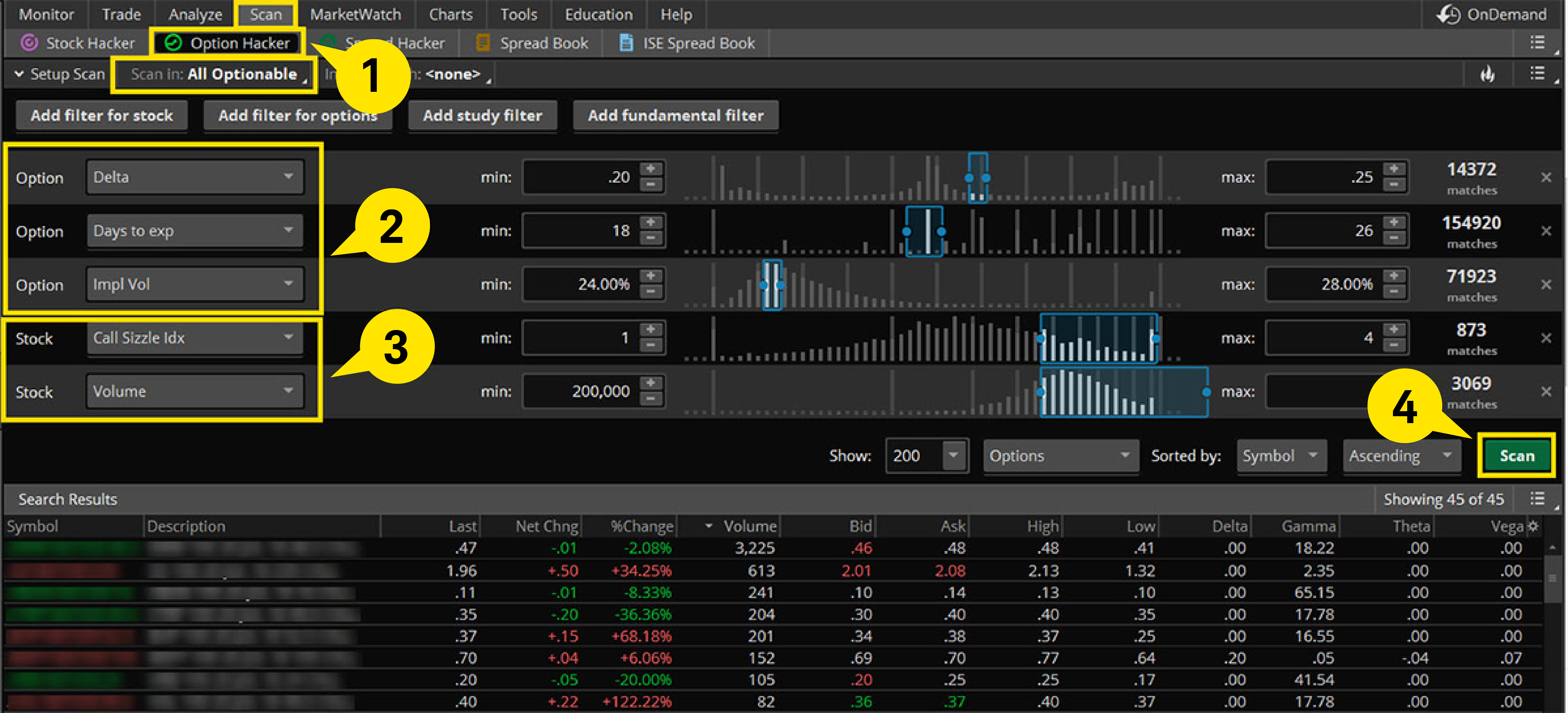

The Option Hacker tool on the thinkorswim® trading platform can help traders find options that meet their trading criteria. Under the Scan tab, select Option Hacker, then All Optionable in the drop-down menu. From here, traders can choose their options criteria. If it helps, traders can also add stock filters, such as volume or the Sizzle Index, to find movers and shakers. Finally, select the Scan button to see the scan's results populate at the bottom of the screen as shown below.

Option Hacker

Source: thinkorswim platform

1 Assignment occurs when an option holder exercises their put or call and a delivery notice is delivered to the trader with the short option. With calls, assignment involves the short option party selling shares, and with puts, assignment means the short option party buying the shares.

2A bullish strategy in which a put option is sold for a credit, usually at a strike price below the current price. This may be done with a goal of the stock staying above the strike price and the option expiring worthless and the premium collected. Or it may be done with a goal of being assigned the stock at the lower strike price. The risk is that the stock is assigned and then falls in value, taking the total risk of the strike price down to $0 minus the premium from selling the put.

3In the money (ITM) describes an option with intrinsic value. A put option is ITM if the strike price is above the underlying stock price. A call option is ITM when the strike price is below the underlying stock price.

4Short selling typically involves borrowing a security from the brokerage, selling it on the open market in anticipation of a move lower, and buying back and returning the borrowed shares later.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled "Characteristics and Risks of Standardized Options". Supporting documentation for any claims or statistical information is available upon request.

Margin trading increases your level of market risk. For more information, please refer to your account agreement and the Margin Risk Disclosure Statement.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0723-3GDW