Paying off student loans: Develop a plan

Paying off student loan debt may be among your top financial priorities for several reasons, whether you've just graduated from college or whether you earned your degree years ago.

Student loans often fund an education that can prove valuable with increased job opportunities and higher salaries. Still, the debt can be substantial, and it can feel restrictive. Without the burden of student loan debt, you might improve your credit score and cash flow, and perhaps better qualify for loans for major purchases ranging from a car to a home.

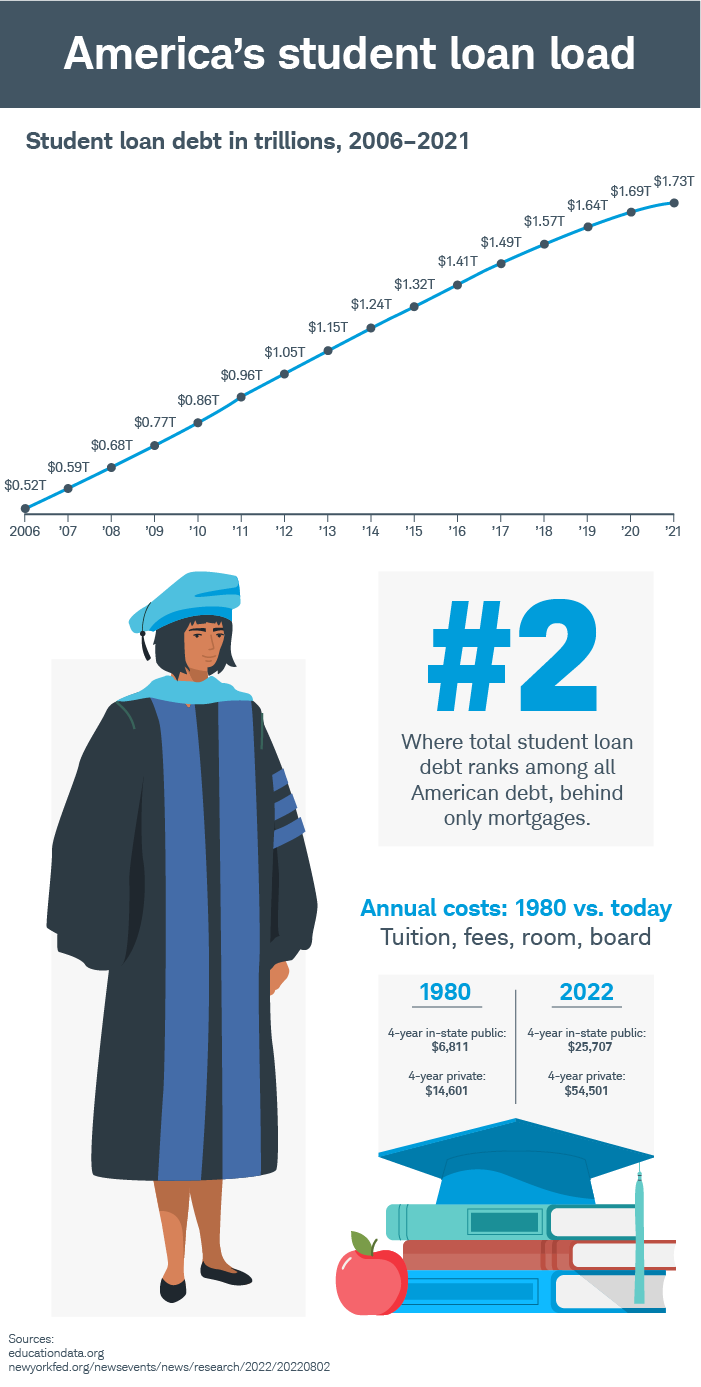

About 32% of all undergraduates take out student loans, according to Educational Data Initiative, with the average federal student loan debt balance hitting $37,787 in 2022. What's more, in 2021, the total amount of student loan debt in the United States was a staggering $1.73 trillion.

The good news is you can more easily pay off your student loans if you have a well-developed plan that takes your total financial health into account.

Tips for paying off student debt

Crunching the numbers

College grads must consider a number of factors as they make choices that impact their financial health and balance costs against savings. There are must-have necessities that include housing and groceries weighing against discretionary spending for entertainment and restaurant dining.

As many college grads already know, it isn't easy to save much when you're just starting out. But remember, even saving just a little bit counts. And it could add up to something substantial in the future through the power of compound interest.

As graduates review their financial picture, it might be wise to first look at the interest rate on their student loan debt. Interest payments on the outstanding loan balance can really add up over time, so the faster you pay down the loan, the more money you can save. Plus, if you can find a way to refinance your student loan to get a lower interest rate, you can also save money.

When it comes to maintaining overall financial health when you have student loan debt, remember to develop a retirement strategy best suited for your budget. Even with debt, you should not pass up a money-saving opportunity to save toward your retirement. For example, if your employer matches a percentage of your contributions to your 401(k), consider contributing the maximum to match that. This maximizes the free money you can get from the match.

The importance of budgeting

Student loans can certainly take a toll on your finances. With a proper budget, you can better analyze your best strategy for early payoff. A good budget takes into account expenses, including essentials, such as rent, car loan payments, and food costs. It also takes into account non-essentials, such as luxury items, eating out, and entertainment. A truly healthy budget will also factor in savings, whether for major purchases like a home or vacation or for preparing for retirement.

Even with a student loan, you can try to accomplish all your financial goals. A key first step is to establish a budget by looking at your total income. That tells you how much in total you have to fund your needs. Next, determine your necessary expenses, such as rent and groceries.

Then, with the extra money, consider paying down your highest interest loans first, such as credit card debt. Or, if your student loan is your loan with the highest interest, consider trying to make more than the minimum payment when you can. Paying down highest interest loans first will save you money on interest, perhaps allowing you to pay down other loans faster.

Of course, budgeting to pay down a student loan doesn't necessarily mean you must get rid of all non-essential expenses in your life—just try to ensure they don't deter you from pursuing your other financial goals.

If you're fortunate to receive unexpected money, such as a tax refund, bonus, or monetary gift, it pays to apply all or some of it to reducing student loan debt. Again, the more you can pay off sooner, the sooner you'll be out of debt.

The power of compounding

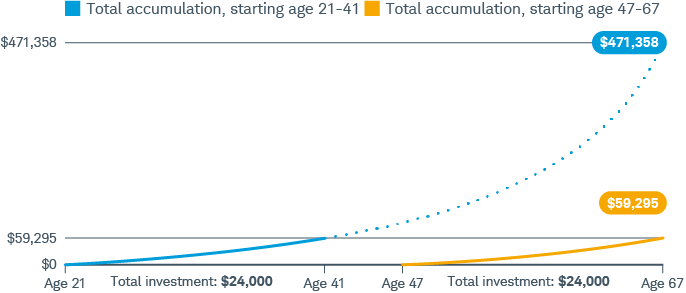

Compounding can work heavily in your favor, especially if you're young and even if you're carrying student loans. By investing in a way that provides compounding returns, you may be able to overpower the losses you incur from student loan interest. Below is an example of the power of compounding over time.

Compound it: Why it doesn't pay to wait

This hypothetical example assumes an initial $24,000 contribution and no additional contributions, compounded monthly, with an annual rate of return of 8%. The ending values do not reflect taxes, fees, inflation, or withdrawals. If they did, amounts would be lower. This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for 8% annual rate of return also come with risk of loss.

Getting a head start: How to begin investing

Here are a few tips financial professionals suggest to investors as they are starting out:

- Start investing as early as you can to take advantage of the power of compounding.

- Put savings on autopilot by setting up automatic deposits into a 401(k), IRA, or both.

- Match your lifestyle to your income. By setting habits early and earmarking money to your 401(k) on a regular basis, you can adjust your lifestyle to your net income minus that 401(k) contribution. As your income goes up, increase your 401(k) contribution so it rises as your income does.

College graduation is an exciting time in your life, but it can feel a bit overwhelming, financially if not emotionally. But starting to develop those good habits early, such as putting savings on autopilot and letting the small savings add up, can help put you on the right track toward your goals.

Investing involves risk, including loss of principal.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any investment decisions.

0123-2TR5