A butterfly spread1 is a common strategy among option traders who anticipate a stock's price to be at or close to the butterfly's short strike prices at expiration. The butterfly spread is typically put on as a debit, meaning the trader pays a net premium to initiate the trade.

However, by making a small adjustment to a butterfly spread, it's possible for a trader to potentially turn the debit into a credit through what's called an unbalanced, or broken wing, butterfly.

Following are some examples of potential spreads. For these examples, the assumption is that the underlying stock is trading at $70, and the call option chain looks like this:

| Call strike | Call bid | Call ask |

|---|---|---|

| 75 | $1.65 | $1.70 |

| 80 | $1.10 | $1.15 |

| 85 | $0.65 | $0.70 |

| 90 | $0.30 | $0.35 |

Standard butterfly options spread

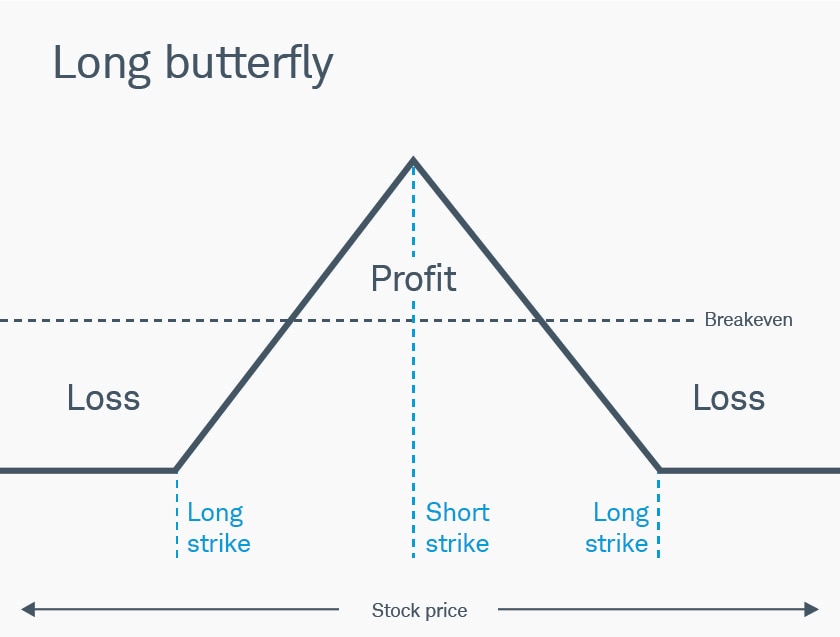

A standard butterfly spread is made up of either all calls or all puts, with three equidistant strikes on a 1x2x1 ratio (see image below).

Schwab.com

For illustrative purposes only.

In this example, a trader is using a butterfly spread with calls. Using the data from the option chain in the table above, the trader could buy the 75-80-85 call butterfly by buying one each of the 75 and 85 calls (the wings) at their ask prices and selling two of the 80 calls (the body) at the bid price. With the stock at $70, this butterfly would cost $0.20, plus transaction costs ($1.70 + $0.70 – (2 x $1.10).

The point of maximum profit for this butterfly spread (and the apex of the diagram above) is if the stock settles at $80 at expiration. The 75-strike call would, in theory, be worth $5, and the rest of the options would expire worthless, for a potential profit of ($5 – $0.20 initial debit x 100) $480. And the point of maximum loss? If the underlying stock is on either side of the wings, below $75 or above $85, the trader loses the initial debit, $20, plus transaction costs. Traders should consider, however, that short options can be assigned at any time up until expiration regardless of in-the-money2 (ITM) amount.

Reviewing a position

As expiration approaches, options might have different risks. Depending on where the underlying stock settles on expiration day, and assuming all in-the-money short and long options are assigned and exercised, respectively, a trader might be left with different positions (see below).

| If the stock settles... | the trader will likely end up with... |

|---|---|

| below $75 at expiration, | no position as all three strikes expire worthless. |

| between $75 and $80 at expiration, | a purchase of 100 shares from the exercise of the 75-strike call. |

| between $80 and $85 at expiration, | selling short 100 shares from the exercise of the 75-strike call and assignment of two 80-strike calls. |

| above $85 at expiration, | no position as all three strikes are exercised/assigned. |

Transaction costs, including exercise and assignment fees, may vary depending on the brokerage firm.

How the broken wing spread works

If the underlying stock is near the 80 strike as the option expires, a trader might not know if they've been assigned until after the market closes, so they must wait until the next trading day to cover their position. Additionally, exercise and assignment costs may be higher than standard commission rates. Some option traders choose to unwind such positions before expiration to potentially help reduce these risks.

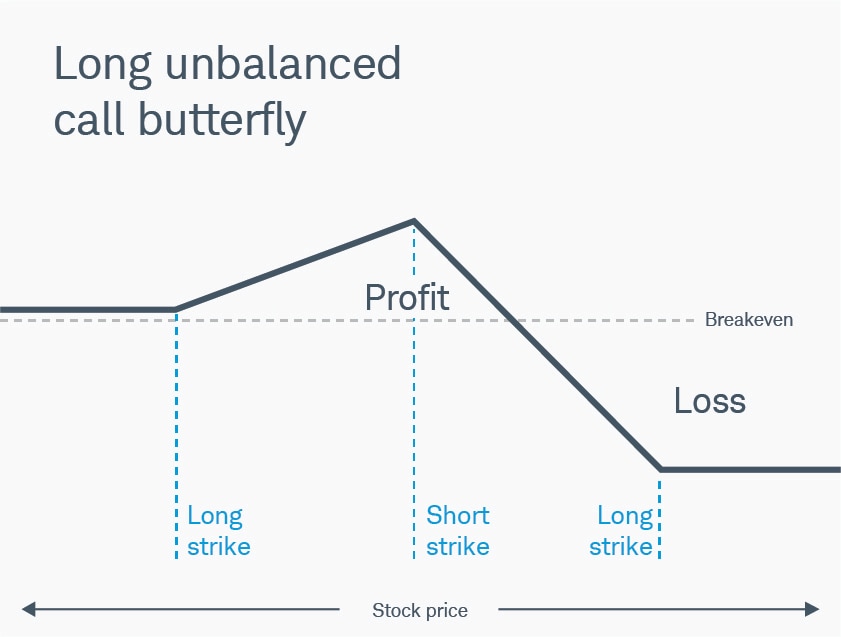

A trader might decide to "break" the butterfly wing by initiating a spread at a credit instead of a debit. One approach is to choose a higher (and thus less expensive) strike for the last leg (see below). This might allow a trader to collect an initial premium, but it might also expose them to more potential risk.

Schwab.com

For illustrative purposes only.

Referring back to the prices in the option chain table, assume that instead of buying the 85-strike call for $0.70 as the far wing, a trader bought the 90-strike call at $0.35. It costs less and turns the trade into the 75-80-90 broken wing (or "skip-strike") butterfly, and instead of paying $0.20 for the butterfly spread, a trader could take in a credit of $0.15 (with the standard multiplier of 100, that's $15, minus transaction costs).

In theory, if the stock is below $75 at expiration, instead of losing the price paid at order entry, the trader has received a premium after transaction costs. That's why some traders might use a broken wing butterfly as a substitute for an out-of-the-money3 (OTM) vertical credit spread4. But, unlike credit spreads where the maximum profit potential is limited to the entry credit, broken wing butterflies retain the profit potential of the regular butterfly. With this example, if the stock settles at $80 at expiration, the maximum profit of this broken wing is potentially $5 plus the entry credit of $0.15 (or $515 with the standard multiplier), minus transaction costs.

A trader can also review the "if-then" expiration scenarios illustrated above using the 90 strike to evaluate potential setbacks after expiration.

Potential downsides to a broken wing butterfly

Breaking off, or unbalancing, that wing brings a trader something they might not want—added risk. Because a trader is moving the wing further OTM, they're potentially increasing their risk. For every dollar further away the wing is moving, a trader potentially increases the risk of the trade by $1 ($100 with the multiplier). In this example, moving the highest wing from the 85-strike call to the 90 strike adds $500 of risk, for a worst-case scenario of $485, plus transaction costs ($500 – the $15 initial credit).

thinkorswim® platform

For illustrative purposes only. Past performance does not guarantee future results.

Additionally, a debit butterfly, with equidistant wings, often incurs no additional margin requirements. However, when a trader "breaks" a wing or skips a strike, it's considered a debit spread and a credit spread, so a trader will likely be required to post additional margin.

When evaluating the added potential risk of a broken wing butterfly, some traders set the middle strike of the broken wing at the far end of their expected range for the underlying stock. That way, it'd take a bigger-than-expected move to get the stock to a potential "danger zone." For some traders, it can make sense to close the trade early if it becomes too risky for their strategy or tolerance.

Broken wing butterflies aren't appropriate for every trader, every market, nor every level of implied volatility. But understanding the mechanics of the strategy can help a trader decide whether the strategy makes sense for them.

Because broken wing butterflies can be complicated, it might make sense to practice with a paperMoney® account before attempting this strategy.

1Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type (i.e., calls or puts). The strategy assumes the underlying will remain relatively unchanged during the life of the trade, in which case, as time passes and/or volatility drops, the combined short options premiums exhibit more decay than the combined long options premiums, resulting in a profit when the spread can be sold for more than its original debit (which is also its maximum loss).

2Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

3Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

4A defined-risk directional spread strategy composed of an equal number of short (sold) and long (bought) calls or puts with the same expiration in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

Spread trading must be done in a margin account. Multiple-leg options strategies will involve multiple commissions.

All stock and options symbols and market data shown are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0723-3Y74