Corporate defaults and bankruptcies are on the rise. That might seem troubling for corporate bond investors in general, but we don't believe it should be a concern for investors who hold highly rated corporate bond investments, like those with investment-grade ratings. Defaults tend to occur at the lowest rungs of the credit rating scales, not the highest rungs.

The rise in defaults doesn't mean investors need to abandon their corporate bond holdings, but it makes sense to take a look at what you own and try to limit your exposure to those bonds where default risk might be highest. Investment-grade corporate bonds still appear attractive, as their issuers generally have stronger balance sheets than issuers with sub-investment-grade ratings, and they generally have less refinancing risk as well. High-yield bond investments, however, could suffer price declines if defaults do continue to rise.

Defaults are on the rise

What does "default" mean? In its simplest form, it's when an issuer fails to make scheduled interest or principal payments on its bonds. According to credit rating agencies, if a corporation breaks one of its covenants, that can also trigger a default.1 For example, a covenant might limit how much debt an issuer can have relative to its earnings. The rating agencies also consider a "distressed-debt exchange" a default.2 Individual investors generally don't have much say in the details of a distressed-debt exchange, as the negotiations generally happen with large institutional investors who likely own a large portion of the debt. In a distressed-debt exchange, the value of the proceeds is generally below the initial par value of a given investment.

In fact, during most defaults, what's returned to bondholders (known as the "recovery rate") has historically been well below the bond's stated par value. According to Moody's, the average recovery rate for senior unsecured bonds was just 39 cents on the dollar, or 39% of a bond's par value.3

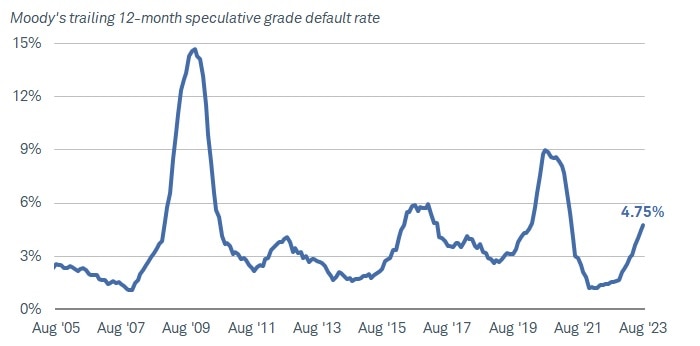

Corporate defaults are now occurring at the fastest rate since the fallout from the pandemic. According to Moody's Investors Service, the trailing 12-month speculative-grade default rate rose to 4.75% at the end of August 2023, its highest reading since May 2021, when defaults were on the decline. Default rates are generally calculated on a rolling 12-month basis, so as a high number of defaults roll out of the calculation, the rate naturally declines. The rate peaked at 9% in August 2020. The number of corporate defaults is expected to keep rising, according to both Moody's and Standard & Poor's (S&P).

Corporate defaults are on the rise

Source: Moody's, using monthly data as of 8/31/2023.

Moody's Investors Services, "August 2023 Default Report," September 15, 2023.

There are likely a number of drivers behind the rise in the default rate, but rising borrowing costs and flat or declining corporate profits are two of the main culprits.

The rise in interest rates and bond yields can be a double-edged sword—good for investors looking for more income, but a risk for borrowers as annual interest expense rises. Consider this: Many high-yield issuers were able to issue debt from mid-2020 through the end of 2021 at historically low rates, often below 5%. Today, average borrowing costs are closer to 8.5% or higher, depending on the issuer. Companies that need to refinance their debt may be facing significantly higher borrowing costs, just as corporate profits are already declining.

According to the Bureau of Economic Analysis, corporate profits before taxes peaked in the third quarter of 2022 at $3.3 trillion and have since declined by roughly 4%. After hitting that peak in the third quarter of 2022, corporate profits declined for two quarters before rising modestly in the second quarter of 2023, coming in at $3.17 trillion. While the decline has been relatively modest, it highlights the risk in the current environment. With high labor and borrowing costs in an environment where demand may slow, profits should remain challenged and those low-rated companies with large debt loads may struggle to remain current on paying interest or repaying their debts as they come due.

Corporate profits are off their recent highs

Source: Bloomberg, using quarterly data as of 2Q23.

US Corporate Profits With IVA and CCA Total SAAR (CPFTTOT Index).

The "speculative-grade" default rate shown above only represents those issuers with high-yield, or "junk," credit ratings, since they are the most likely to default. In other words, that 4.75% rate is the 12-month rate of issuers defaulting in the high-yield bond market. If shown as a percent of the whole corporate bond market, including those with investment-grade ratings, that number would be much lower. In fact, the investment-grade corporate bond default rate was 0% in 14 of the 22 years from 2001 through 2022, and the highest annual default rate was just 0.75% in 2008 during the global financial crisis.4 Investment-grade corporate bonds simply don't default very often.

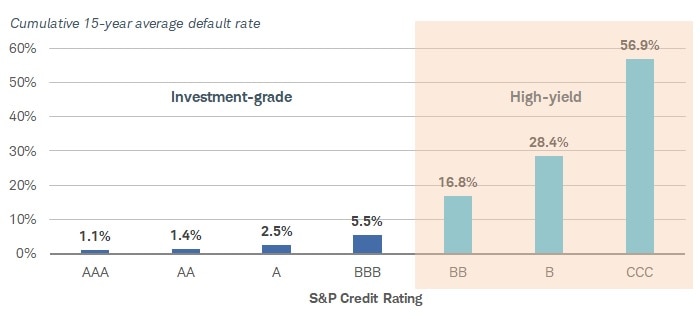

This chart illustrates how investment-grade corporate bond defaults stack up against high-yield bond defaults over time. The rates shown below are cumulative 15-year default rate, and they are based off a given issuer's initial credit rating. While investment-grade corporate bonds rarely default, that's because they are usually downgraded to "junk" first. But even over time, bonds that were initially rated investment grade tend to default at a much lower rate than high-yield bonds, as seen by the large jump in the default rate from "BBB" bonds to "BB" bonds.5

High-yield bonds tend to default much more frequently than investment-grade bonds

Source: Schwab Center for Financial Research with data from Standard & Poor's 2022 U.S. Corporate Default Study, as of 6/13/2023.

The 15-year cumulative average default rate is calculated by weight-averaging the marginal default rates in all static pools. Past performance is no indication of future results.

Investment-grade corporate bonds are more insulated from rising borrowing costs than high-yield issuers. Investment-grade issuers tend to issue bonds with a wide range of maturities, including long-term maturities. For example, if an investment-grade rated issuer needs to refinance maturing debt, it might issue bonds with maturities of two years, five years, 10 years, and 30 years. So when an investment-grade corporate bond matures in a high-rate environment like we're in now and needs to be refinanced at a high rate, that high rate likely only represents part of the issuer's financing needs.

High-yield bond issuers tend to have high levels of debt relative to their earnings and volatile cash flows, so lenders and investors aren't very interested in lending to these issuers for long periods of time. High-yield bonds tend to have initial maturities of around eight years or less, although some may be longer, depending on the issuers.

The average maturity of the Bloomberg US Corporate High-Yield Bond Index is relatively low as a result of those dynamics. The average maturity of the high-yield index is roughly five years, compared to an average maturity of more than 10 years for the Bloomberg US Corporate Bond Index, an index of investment-grade corporate bonds. This means that a larger share of high-yield bonds will be maturing over the next few years while interest rates are high, eating into corporate profits. That's less of a risk for investment-grade corporate bonds given their more diversified maturity breakdown.

The average maturity of high-yield bonds is much shorter than investment-grade corporate bonds

Source: Bloomberg, using weekly data as of 9/22/2023.

Bloomberg US Corporate Bond Index (LUACTRUU Index) and Bloomberg US Corporate High-Yield Bond Index (LF98TRUU Index).

What to do now

The rise in corporate defaults doesn't mean investors need to eliminate exposure to corporate bonds, but a focus on higher-quality bonds makes the most sense. We continue to think investment-grade corporate bonds appear attractive, as they currently offer average yields of 5.5% or more for both short- and long-term maturities.6 We believe the strength of their balance sheets should help issuers hold up even as high-yield defaults continue to rise.

We're more cautious with high-yield bonds and see more room for their prices to fall, especially if the economic outlook deteriorates. But they are called "high-yield" bonds for a reason—they tend to offer relatively high yields to compensate investors for the heightened risk of default. We do believe there should be better entry points to consider high-yield bonds down the road. Long-term investors who can ride out the potential ups and downs can still consider them, but be prepared for volatility.

1A covenant is a legal agreement that defines what the issuer can or cannot do over the life of the bond. For example, a bond covenant might include a restriction on the issuer's ability to take on additional debt, since a rising amount of debt may make the issuer less creditworthy.

2 A distressed debt exchange occurs when an issuer may be facing financial difficulties, which sends its bond prices lower. The issuer may then offer to "tender" the bonds at a price above the price that the bonds trade at in the secondary market, but below the par value. According to the credit rating agencies, this is generally viewed as a default since the issuer has redeemed an obligation at a price below the previously promised price.

3 Source: Standard and Poor's, "2022 Annual U.S. Corporate Default and Rating Transition Study," June 13, 2023.

4 Source: Moody's Investors Services, "August 2023 Default Report," September 15, 2023. Five-year recovery rate calculated from August 2018 through August 2023.

5 The Moody's investment-grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment grade scale is Ba, B, Caa, Ca, and C. Standard and Poor's investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.

6 As of 9/26/2023, based on the USD US Corporate IG BVAL Yield Curve on Bloomberg, which provides an average yield of investment grade corporate bonds (including all investment grade credit ratings) of all maturity tenors. Every tenor offers an average yield of 5.5% or more.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Past performance is no guarantee of future results.

Investing involves risk including loss of principal.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. Lower rated securities are subject to greater credit risk, default risk, and liquidity risk.

This information provided here is for general informational purposes only, and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, you should consult with a qualified tax advisor, CPA, Financial Planner, or Investment Manager.

Schwab does not recommend the use of technical analysis as a sole means of investment research.

Diversification strategies do not ensure a profit and cannot protect against losses in a declining market.

Supporting documentation for any claims or statistical information is available upon request.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

0923-39RS