Registered index-linked annuities.

What is a registered index-linked annuity (RILA)?

If you're looking for an opportunity to grow your retirement assets, and you're comfortable with a certain level of market risk, a RILA may be a good fit for you. RILAs are generally tied to the performance of a market index, offering the opportunity to capture positive index returns up to a limit ("cap rate"), while providing a level of protection ("buffer") if the index return is negative. However, you're not directly invested in either an index or the market.

Some RILAs may have an annual contract and/or administrative fees. The RILAs offered through Schwab does not have these fees. Surrender charges may apply in the event of an early withdrawal.

A RILA may be right for you if:

- You're in or near retirement.

- You're looking for equity-like returns if the index performance is positive and a level of protection if index performance is negative.

- You're looking for tax-deferred growth potential.

Small CTA

-

Questions about annuities?

Contact an annuity specialist at 866-663-5241.

How does a RILA work?

When choosing a RILA, there are three things to consider:

-

StepProduct and interest credit schedule ("term").

Select your investment time horizon (i.e., product and surrender charge schedule*). Next, select how often performance is measured (e.g., 1-, 3-, or 6-year "term").

-

Step"Buffer" and "cap rate"

Select the level of protection against loss ("buffer") and the corresponding maximum return you can receive ("cap rate").**

-

StepIndex

You earn interest based on the performance of an index (e.g., S&P 500® Index, MSCI EAFE Index, etc.).

RILA Charts

-

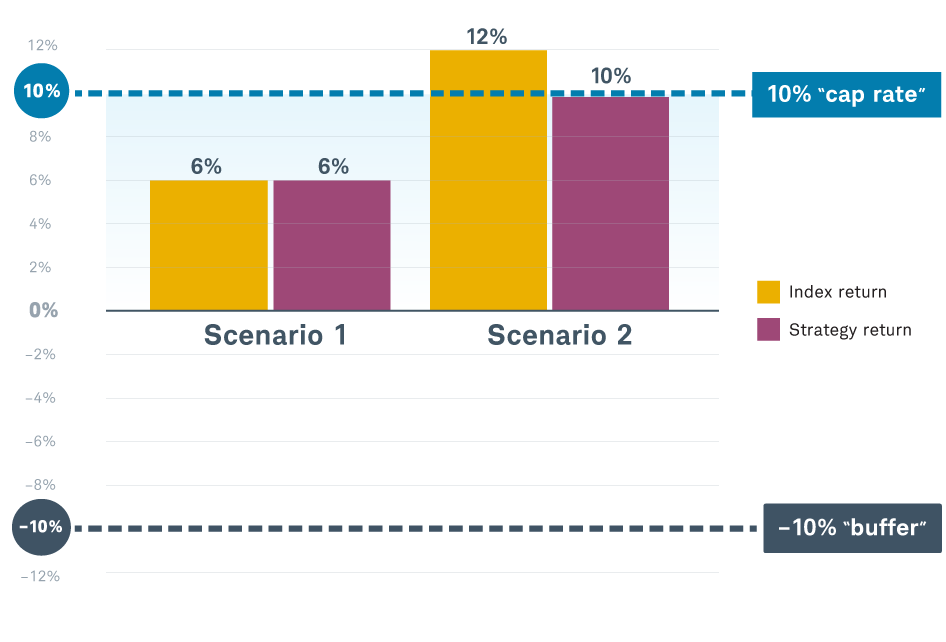

Growth opportunities during up markets

The "cap rate" in this example is 10%, meaning you capture any growth up to 10%.

Scenario 1: Index return = 6% → RILA return = 6%

Scenario 2: Index return = 12% → RILA return = 10% ("cap rate" 10%)

-

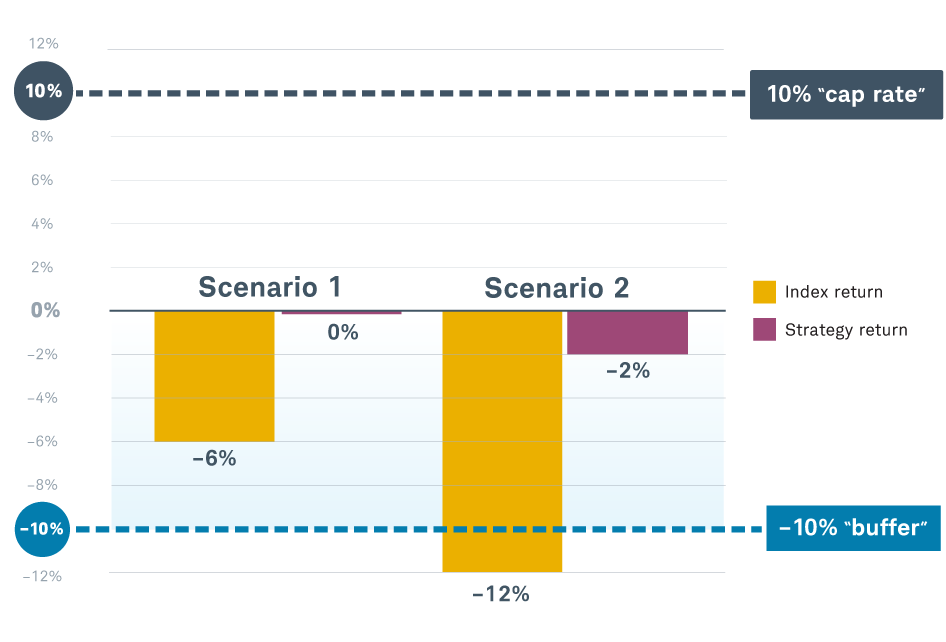

Protection during down markets

The "buffer" in this example is –10%, meaning the insurance company will absorb losses up to –10%. Your account value is reduced when the negative index return exceeds the "buffer" percentage.

Scenario 1: Index return = –6% → RILA return = 0%

Scenario 2: Index return = –12% → RILA return = –2% ("buffer" –10%)

This is a hypothetical example; it is not intended to predict your index or strategy returns. This hypothetical example assumes the contract was held to full term and no withdrawals were taken. Crediting strategies illustrated use a point-to-point crediting approach; the RILA return, which can be positive or negative, is only applied to account value at the end of each index term. Index-linked variable annuity products are complex insurance and investment vehicles. There is risk of loss of principal if negative index returns exceed the selected protection level. Gains or losses are assessed at the end of each term. Early withdrawals may result in a loss in addition to applicable surrender charges. Please reference the prospectus for information about the levels of protection available and other important product information.

*A surrender charge schedule is the length of time you need to keep your money in the RILA without incurring a fee, and it may be the same or longer than the "term" you select.

**Your account value is reduced when the negative index return exceeds the "buffer" percentage. The "buffer" corresponds with the "cap rate" available to you (a higher level of protection generally means a lower "cap rate"). The "cap rate" percentage is the maximum index return that you may receive in the "term" selected. In addition to "cap rate" crediting type, the RILAs available through Schwab may offer other options for potential growth (i.e. a "step rate"). Please refer to the product information below for more information.

What RILA is offered through Schwab?

-

Brighthouse Shield® Level Annuity

- Issuer: Brighthouse Life Insurance Company and Brighthouse Life Insurance Company of NY

- Financial strength—Standard & Poor's:2 A+

- State availability: 6-year—Available in all states except Alaska and Oregon; 3-year—Available in all states except Alaska, New York and Oregon

To find out more about the Brighthouse Shield Level Annuity, click on the product brochure, the 3-year fact card, the 3-year prospectus, the 6-year fact card, the 6-year prospectus, and the 6-year NY prospectus.

For resources specific to NY, including the product brochure and fact card, please contact an annuity specialist at the number below.

Final CTA

-

Interested in learning more about RILAs?

Call 866-663-5241 to connect with an annuity specialist today.

Have questions? We're here to help.

-

Call

Call -

Chat

Chat -

Visit

Visit