Schwab Genesis Variable Annuity™

Intro copy

Take charge of your retirement with more investment choices, guaranteed income, and protection for your beneficiaries. Schwab puts it all together in this flexible variable annuity with base annuity fees 50%-65%1 below the industry average and NO surrender charges.2

Questions about annuities? Contact an annuity specialist at 866-663-5241.

Find a Branch

Benefits

- Create a personalized tax-deferred3 growth and income strategy.

- Keep more of your money working while maintaining flexibility, with costs 50%-65% lower than the industry average1 and NO surrender charges.2

- Choose from over 100 professionally managed portfolios and make adjustments as your needs change.

- Generate guaranteed retirement income for life.

- Protect money for loved ones, regardless of how the market performs, with an optional death benefit.

Schwab Genesis Variable AnnuityTM is a variable annuity offered by Charles Schwab and issued by Protective Life Insurance Company (PLICO) and Protective Life and Annuity Insurance Company (PLAIC) in New York. All annuity guarantees are subject to the terms and conditions of the contract and the financial strength and claims-paying ability of the insurer. Schwab does not provide any insurance guarantees.

Right for you?

-

Keep more of your money working without sacrificing flexibility.

Genesis base annuity costs are 50%-65% lower than the industry average for similar annuities.1 This may significantly enhance growth potential and help counteract the long-term effects of inflation.

-

No surrender charges.

Choosing Genesis means no concerns about being locked in for a set period of time.2 There are no surrender charges.

-

Choose from a broad mix of investment options.

Genesis offers a wide variety of investment choices from over 100 professionally managed portfolios and 18 fund/model families.

-

Generate guaranteed retirement income for life.

Choose periodic payments via annuitization at no additional cost; or utilize SecurePaySM Life, an optional Guaranteed Lifetime Withdrawal Benefit (GLWB), for an additional cost, designed to provide an income guarantee and lock in gains on benefit anniversaries.5

Please note that the GLWB is not a contract value and is not available for withdrawal like a cash value. Your actual contract value and death benefit will decrease with each withdrawal, although you may continue to receive your guaranteed annual withdrawal for life even if your contract value has been depleted to zero. In addition, when the GLWB is elected, allocation guidelines and investment restrictions apply.

-

Protect money for loved ones regardless of market performance.

The Schwab Genesis Variable Annuity offers two death benefit options. With the standard death benefit, your beneficiaries receive your account value, less any premium tax. For an additional cost of 0.20%, the optional Return of Purchase Payments Death Benefit offers your beneficiaries the greater of your current account value or the amount of your investment (less adjustments for withdrawals and premium taxes), regardless of how the market performs.

Costs and savings

Lower overall costs mean you can keep more of your money working for you. Over time, this can significantly enhance the growth potential of your annuity investment and help counteract the long-term effects of inflation.

- Schwab Genesis Variable Annuity = 0.45% compared to 1.29% Industry Average

- Keep more of your money working, with costs 50%-65% lower than the average for similar annuities.1

- No surrender charges.

Source: The industry average is 1.29% according to a April 18, 2022 survey of 2,344 non-group variable annuities. This does not include fees associated with the optional death benefits, GLWB, or underlying investment options.

Schwab Genesis Variable Annuity Fees

-

Base annuity fee

(mortality, expense, and administration charges)- Fee

0.45%

Underlying investment expenses

- Fee

0.03% to 1.44%8

Optional SecurePay Life Guaranteed Lifetime Withdrawal Benefit (GLWB)

- Fee

1.10%9 for single and joint life (fee is a percentage of Benefit Base value). The GLWB fee maximum is 2.00% (2.20% if added after issue under the RightTime benefit).

Optional Return of Purchase Payments Death Benefit

- Fee

0.20%

- Fee

Guaranteed Lifetime Withdrawal Benefit

You are able to purchase income protection through SecurePay Life,5 an optional Guaranteed Lifetime Withdrawal Benefit (GLWB) for an additional cost. This rider provides an income guarantee for life plus potential growth through multiple investment options.5,6 Investment restrictions and allocation requirements apply.

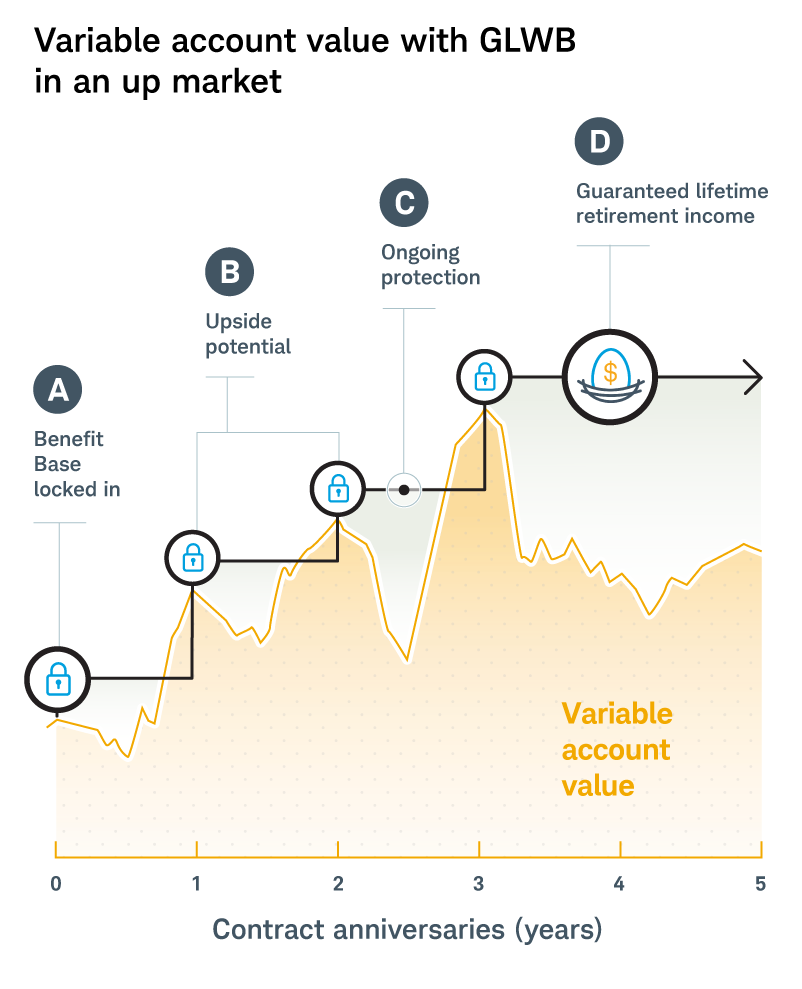

Your income can grow in up markets.

Key benefits

A. Lock in the base. Your Benefit Base, equal to your initial contribution, is locked in when you purchase SecurePaySM Life.

B. Upside potential. If your contract value is higher than your initial contribution on a contract anniversary, your Benefit Base6 is locked in at the higher value.

C. Ongoing protection. Your Benefit Base can continue to increase on future contract anniversaries, but it never steps back down due to market performance.

D. Guaranteed lifetime retirement income. You can activate SecurePaySM Life and start taking guaranteed annual withdrawals at any time after the younger covered person turns age 60.7 Your retirement income amount is determined by your age when you start taking withdrawals. Depending on your age and that of your spouse and whether you have elected a single or joint option, the maximum withdrawal rate can range from 3.50% to 6.75% (3.25% to 5.75% in NY) of your Benefit Base. Withdrawal amounts can increase if contract value rises and locks in a higher Benefit Base, but they won’t decrease if your contract value falls due to poor market performance.

*Withdrawals prior to age 59½ may be subject to a 10% federal tax penalty.

Withdrawals in excess of the guaranteed annual withdrawal amount or withdrawals prior to SecurePaySM Life benefit election may significantly and permanently reduce the benefit base.

You must submit a SecurePay Benefit Election Form to Protective Life in order to begin taking guaranteed annual withdrawals under SecurePaySM Life.

The Maximum Withdrawal Percentage(s) applicable to newly issued contracts may change at any time. Please consult the Rate Sheet Prospectus Supplement in effect at the time the contract is purchased.

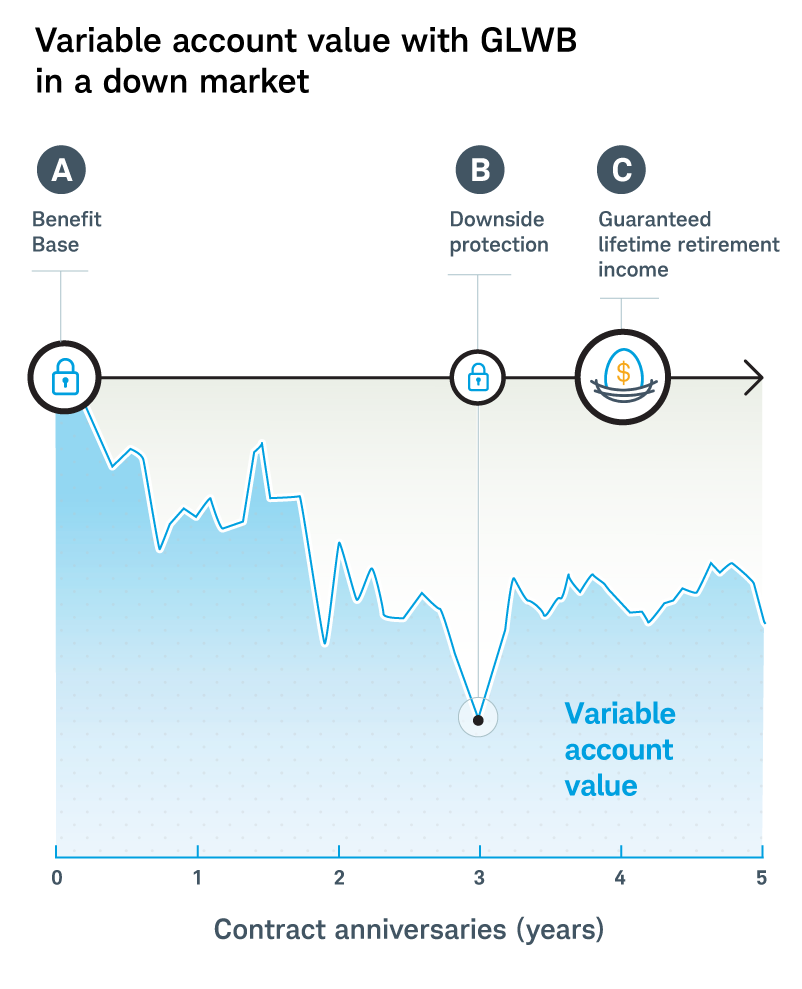

Your retirement income is protected in down markets.

Key benefits

A. Lock in the base. When you purchase SecurePay Life, your Benefit Base is established and locked against market downturns.

B. Downside protection. Because your Benefit Base locks in at the highest value your contract value reaches on any anniversary of your initial contribution, it is protected against market losses.

C. Guaranteed lifetime retirement income. When you begin taking guaranteed annual withdrawals, you can receive 3.50% to 6.75% (3.25% to 5.75% in NY)7 of your locked-in Benefit Base for life (the guaranteed annual withdrawal rate will depend on your age and single or joint election)—even if market volatility, guaranteed annual withdrawals, and annuity fees reduce your contract value to zero.

Note: The Benefit Base is not available for withdrawal like a cash value. Your actual value and death benefit will decrease with each withdrawal.

The maximum withdrawal percentage(s) applicable to newly issued contracts may change at any time. Please consult the Rate Sheet Supplement in effect at the time the contract is purchased.

Death benefits

The Schwab Genesis Variable Annuity offers two death benefit options to protect your beneficiaries:

- Option one: Your beneficiaries receive your account value, less any premium tax.

- Option two (for an additional 0.20% annually): The optional Return of Purchase Payment Death Benefit offers your beneficiaries the greater of your current account value or the amount of your investment (less adjustments for withdrawals and premium taxes), regardless of how the market performs.

.jpg)

Get started

-

Ready to get started with annuities?

If you're interested in annuities, contact an annuity specialist today at 866-663-5241.

Questions? We're ready to help.

-

Call

Call877-566-1032

-

Chat

Chat -

Visit

Visit